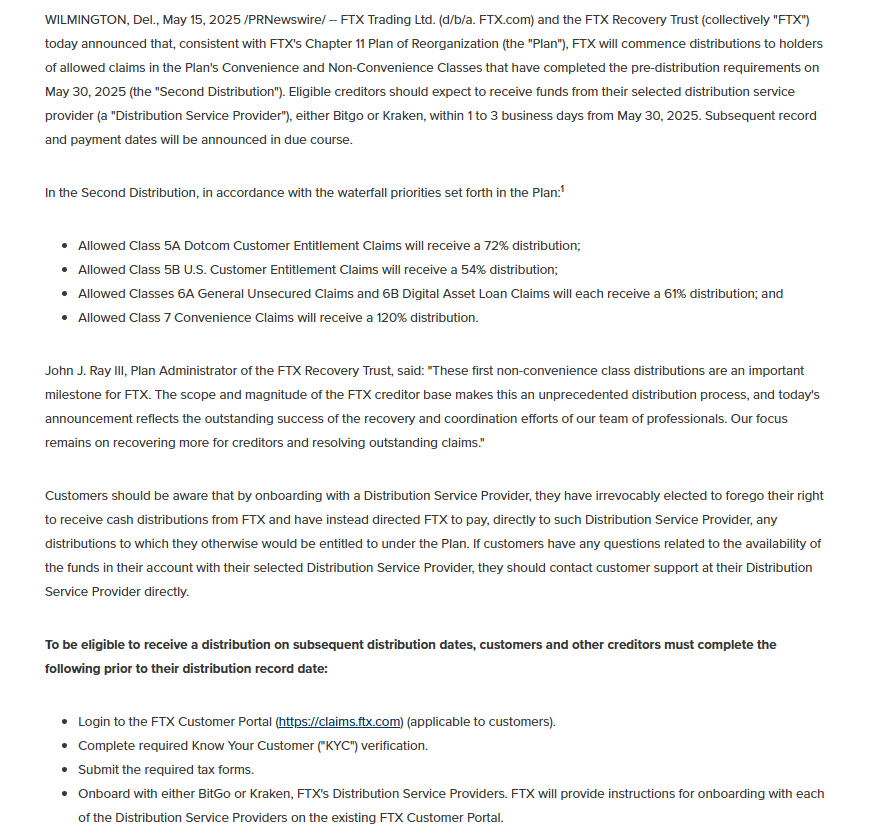

FTX Recovery Trust will release more than $5 billion in a second round of FTX payout starting May 30.

The trust said on May 15 that it will distribute funds within one to three business days after that date.

The FTX distribution will go through BitGo and Kraken, both handling crypto asset transfers under the court-approved process.

This follows the first FTX payout on February 18, which was worth around $1.2 billion.

Not all FTX creditors are included in this round. The estate confirmed that future payments will be shared “in due course.”

Five Classes to Receive Between 54% and 120% in FTX Distribution

Under the FTX reorganization plan, creditors fall into five “convenience classes.” These groups will receive payouts ranging between 54% and 120% of their allowed claims.

The total expected FTX payout could reach up to $16 billion if all claims are submitted and verified.

The plan’s structure uses fixed U.S. dollar values based on the date of the exchange’s bankruptcy in November 2022.

FTX Recovery Trust continues to follow this framework. The full disbursement process will take place in multiple stages depending on claim verification, available funds, and legal approval.

Creditors Question Price Lock Date in FTX Reorganization Plan

The FTX reorganization plan calculates claims using cryptocurrency prices from November 2022. On that date, Bitcoin traded near $20,000. In May 2025, Bitcoin exceeds $100,000.

This method caused criticism from FTX creditors, who argue they are not receiving the current value of their assets. The plan, however, only considers U.S. dollar values at the time of bankruptcy.

Despite price increases, FTX Recovery Trust said 98% of creditors will receive at least 118% of their original claim value. This includes interest and other adjustments approved by the bankruptcy court.

Breakdown of FTX Bankruptcy and FTX Fraud Sentences

FTX filed for bankruptcy in November 2022 after revealing major financial gaps. Since then, the estate has worked through asset recovery and legal processes involving former leadership.

Former FTX CEO Sam Bankman-Fried was sentenced to 25 years in prison for FTX fraud. The court found him guilty of misusing customer funds and misleading investors.

Caroline Ellison, former CEO of Alameda Research, received a 7-year sentence after pleading guilty. Ryan Salame, former co-CEO of FTX Digital Markets, was sentenced to 7.5 years.

FTX co-founder Gary Wang and director of engineering Nishad Singh also pleaded guilty. Both received time-served sentences for cooperating with investigators.

Other Legal Actions Related to FTX Bankruptcy

Michelle Bond, partner of Ryan Salame, still faces campaign finance charges in New York. Authorities have not confirmed whether her case is tied directly to FTX fraud.

The FTX Recovery Trust continues managing remaining estate assets and creditor payments.

It confirmed more rounds of FTX distribution are planned. Dates will be announced later.

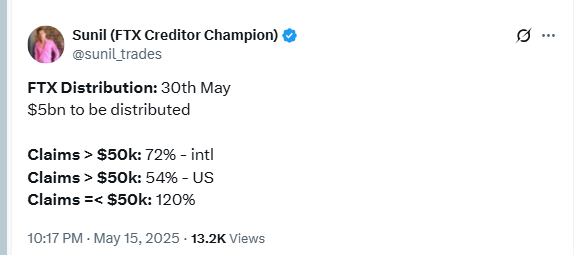

Sunil Kavuri, one of the most vocal FTX creditors, shared a breakdown of this second FTX payout round on X. The chart shows disbursement categories, claim types, and expected payment ratios.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.