Fidelity’s Director of Global Macro, Jurrien Timmer, recently weighed in on the ongoing debate between Bitcoin and gold as reliable stores of value.

He discussed when each asset might effectively hedge against inflation, depending on the economic environment.

Government makes inflation

Timmer’s analysis centers on fiscal dominance, a situation where the government increases the money supply, thus decreasing the currency’s purchasing power.

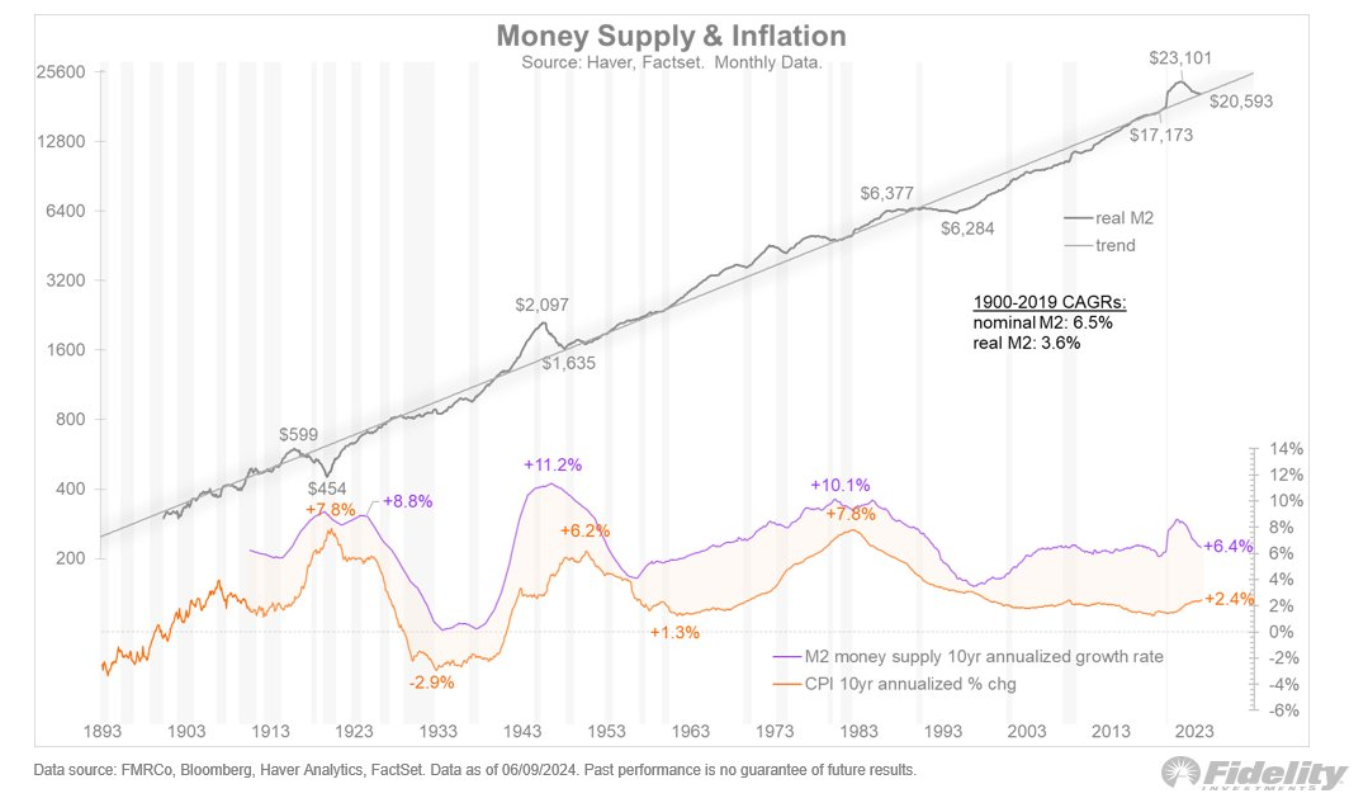

He references the historical relationship between the M2 money supply and the Consumer Price Index, also known as inflation, to highlight this point.

While Bitcoin and gold are considered strong inflation-resistant assets, Timmer believes that the full inflationary environment has not yet materialized, despite the Federal Reserve’s recent actions.

He notes that Bitcoin, often called digital gold or gold 2.0, combines the properties of traditional gold with new internet technology.

For Bitcoin to match gold’s status, the money supply would need to grow in a big way, above current trends.

Small inflation is still inflation

During the pandemic, there was a temporary spike in the M2 money supply growing rate, but the Federal Reserve’s tightening policies partially curtailed it, slowing it down, and this means that now both gold and Bitcoin might still be premature as absolute stores of value.

Bitcoin’s price recently surged following a CPI report that showed slowing inflation, suggesting its growing role as a store of value, and gold’s price too saw a small increase.

Bitcoin is not correlating with traditional assets?

Recent data from Barchart shows that Bitcoin’s price has lost its correlation with the 10-year U.S. Treasury bond yield, dropping to its lowest level in 14 years, at -53.

Many expert thinks that Bitcoin is now moving independently of traditional financial instruments like Treasury bond yields, which measure investor returns on government securities.

This decoupling suggests that Bitcoin is becoming less and less tied to traditional financial systems, strenghtening its position as a unique asset class.

If Bitcoin continues to separate from these financial metrics, it could prove its case as a superior non-traditional hedge against fiscal instability.