Seventeen years ago, a mysterious figure named Satoshi Nakamoto tossed the Bitcoin white paper into the world like a digital Molotov cocktail.

Titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, it promised a revolutionary way to ditch banks and control money using a decentralized network.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

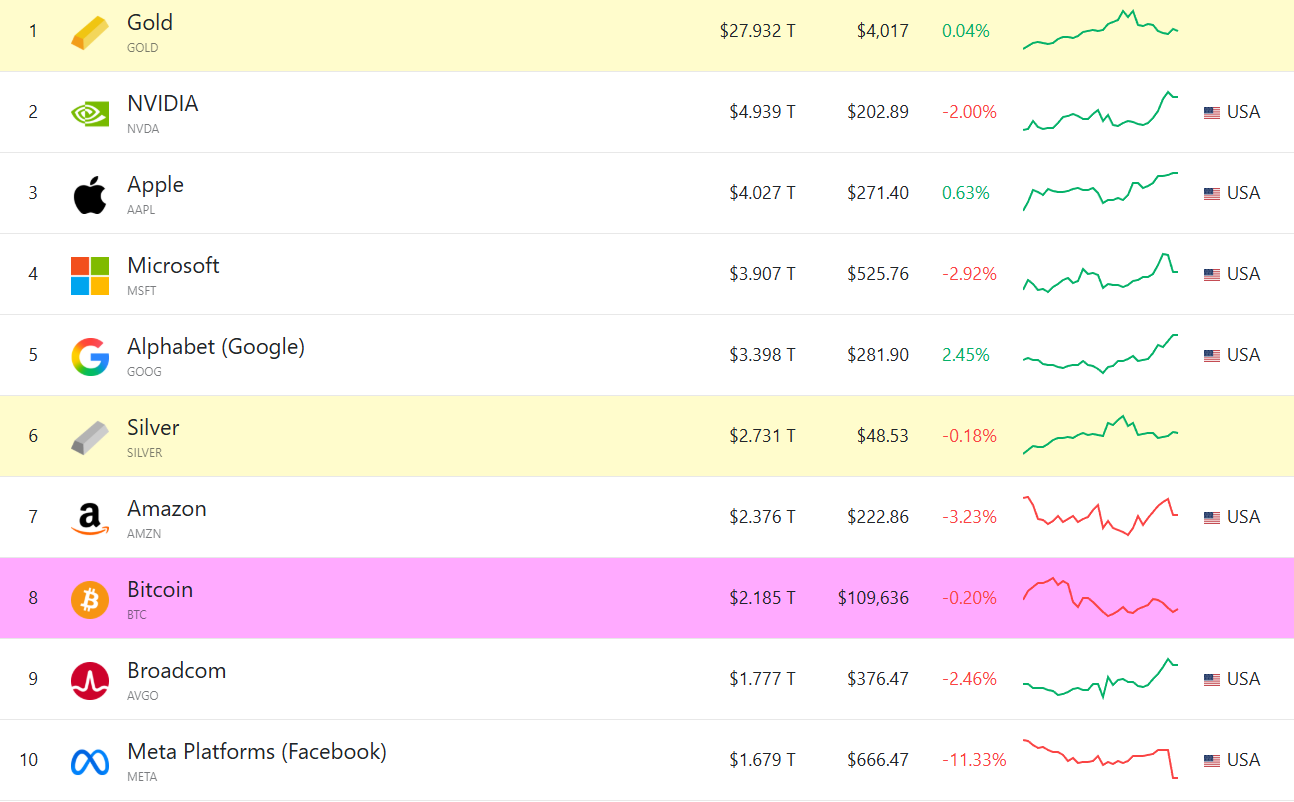

The world’s eighth-most-valuable asset

The first block, affectionately known as the “genesis block” was mined shortly after, minting 50 Bitcoin and setting off a financial revolution that now glows with a $2 trillion market cap. 17 years is relatively long time.

From modest origins, Bitcoin has grown to stand proudly as the world’s eighth-most-valuable asset, rubbing digital elbows with silver and Amazon.

Narek Gevorgyan, CEO of CoinStats, calls Bitcoin’s journey “more than market cap”, and he’s probably right.

Who knew that a white paper produced during the chaos of the 2008 financial crisis could shake the entire financial system?

Hold my beer

But the party mood is quite muted. October, famously known as “Uptober” for its habit of rewarding Bitcoin holders with sweet gains, is poised to turn red for the first time since 2018.

Analysts say that despite those lofty birthday vibes, Bitcoin’s price has dropped over 3.5% so far, breaking a six-year “Uptober” winning streak.

That’s the kind of party pooper news that sends traders scrambling.

Overleveraged gamblers

It’s a widely known fact that October has historically been Bitcoin’s second-best month with an average return of nearly 20%, so this dip feels like the market’s cold shower.

The dreadful day was October 10, which hosted a massive crash, eventually dragging Bitcoin down to a four-month low of $104,000.

Crypto analysts call this a “controlled deleveraging,” which is trader-speak for we needed to blow some steam and clear out the overleveraged gamblers.

Now experts say despite the monthly dip, this correction might be exactly what Bitcoin needed to set the stage for the next rally.

After all, great heroes don’t just rise, but they stumble, recalibrate, and conquer again.

💬 Editor’s Take:

Seventeen years — that’s a lifetime in crypto years. It’s wild to think that one white paper from an anonymous figure could spawn an entire financial universe.

Bitcoin isn’t just a currency anymore; it’s a statement — a living, breathing rebellion against the old system.

Sure, Uptober’s off to a gloomy start this year, but maybe this dip is just Bitcoin’s version of a midlife crisis before its next big leap.

Like any great hero, it’s not the fall that defines Bitcoin, but how fast it gets back up — and history says, it always does.

You may be interested in: The USD1 stablecoin listing on Binance.US caused political drama

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 1, 2025 • 🕓 Last updated: November 1, 2025

✉️ Contact: [email protected]