A whale just deposited 282,365 ENS tokens, valued at $9.15 million, into Binance through an intermediary wallet.

This strategic move has everyone loosing their mind, especially since it generated a profit of $4.36 million for the owner.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

What’s going on with ENS, there’s something we should know?

The tokens came from the ENS DAO’s Community Reward Funds wallet, where they were originally valued at $4.78 million.

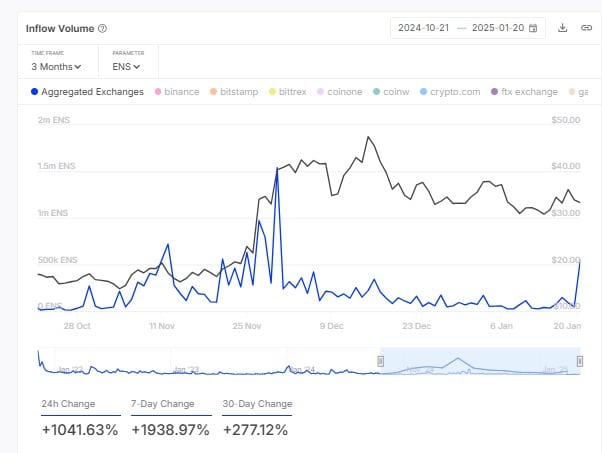

This deposit coincided with a 1041% spike in 24-hour inflow volume, signaling that the market is heating up, something is brewing for sure.

Since the whale’s transaction, ENS has experienced some serious price action. Currently trading at around $34.41, it’s bouncing back nicely from a last week low of $28.00.

After the whale’s deposit, buying activity on Binance also jumped, which helped offset any selling pressure.

Price predictions and market trends

The Relative Strength Index for ENS is sitting at 50.86, pretty neutral with potential for movement in either direction.

If ENS can hold above $32.00, we might see it test resistance near $38.00, but if sell-offs increase, prices could dip back toward $30.

The increase in on-chain inflow volume reflects heightened interest in ENS, often driven by profit-taking and speculative buying.

If this trend continues, we could see some short-term price volatility, but if inflows stabilize, ENS might just consolidate within its current range.

Network fundamentals, the driving factors behind the growth?

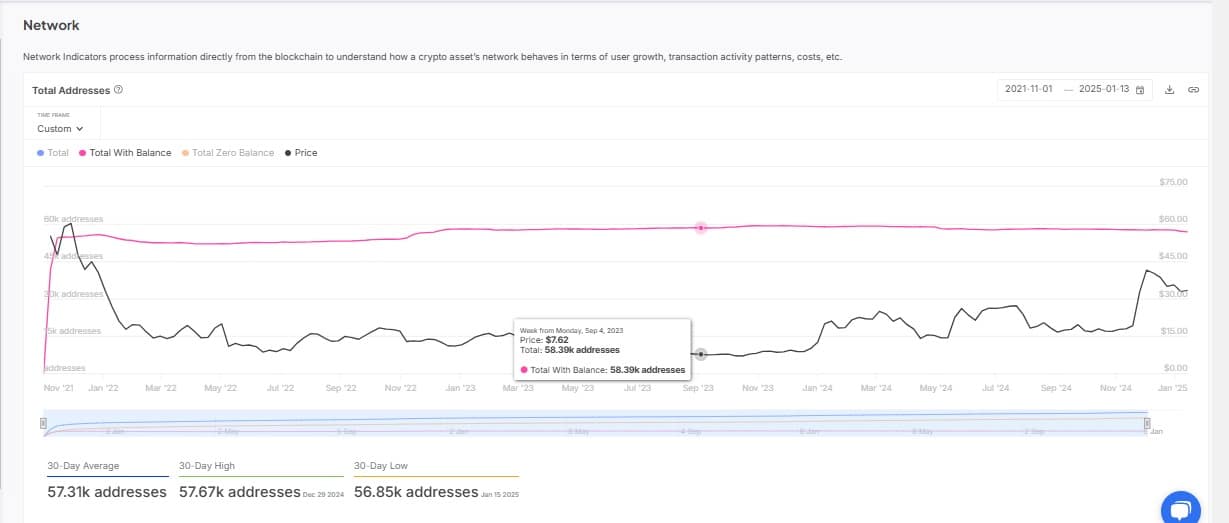

Right now there are about 58,390 ENS addresses holding non-zero balances, showing steady growth despite market fluctuations.

Over the past month, the average number of addresses was around 57,310, and this consistency suggests that holders are confident even when the market gets bumpy.

Interestingly, despite the whale activity and inflow spikes, the overall balance trend hasn’t been significantly disrupted, indicating stable participation from the broader market, as interest in ENS is clearly growing.

The whale’s profit highlights how important timing can be in these markets.