Bloomberg analyst Eric Balchunas has updated his prediction for the anticipated launch of spot Ethereum ETFs in the USA, moving the date to July 2.

Problems solved

Balchunas has revised his forecast for the launch of spot Ethereum ETFs in the USA, setting the new date to July 2, few days before the previously expected date of July 4.

He shared that the United States Securities and Exchange Commission, the SEC staff have provided comments on the S-1 filings to the ETF issuers, which were minimal and required a response within a week.

This means there isn’t any big problem with the filings, so that the SEC may declare the ETFs effective the following week, complete the process before the holiday.

Green light soon?

The new prediction by Bloomberg is based on feedback from the SEC staff to the issuers of the Ethereum spot ETFs.

The light nature of the SEC’s comments could means a high possibility that the approval process will be finalized quickly, as there is no issue left.

A successful launch finally could pave the way for greater acceptance and integration of Ethereum into traditional financial markets.

The last brush-strokes

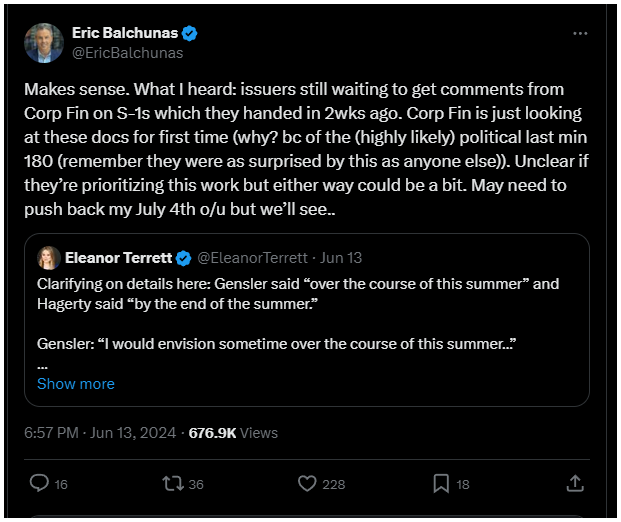

Just a day before this update, Balchunas had shared a different prediction. The issuers had not yet received a response from the SEC, leading him to predict a launch date of July 4.

Eleanor Terrett from FOX Business also provided opinions, mentioning statements from SEC Chairman Gary Gensler and Senator Bill Hagerty, who hinted at a possible launch during this summer or by the end of this summer.

The SEC had approved eight spot Ethereum ETF listings on various US exchanges on May 23.

Despite this, the actual launch on the stock exchange can only happen after the approval of the so-called S-1 registration statements, what isn’t happend yet.