Polygon founder Sandeep Nailwal noted the increasing interest in Real World Assets on the Ethereum Layer 2 network.

His comments came after the European Central Bank’s recent bond issuance trial on the platform.

This is the real world

Nailwal stated that many RWAs are launching on Polygon, and he claimed Polygon POS network is second only to Ethereum mainnet in terms of RWA value.

He’s proud, we get it, but data from RWA.xyz indicated that Polygon is only the fifth-largest network by total market cap, especially in the US tokenized securities market.

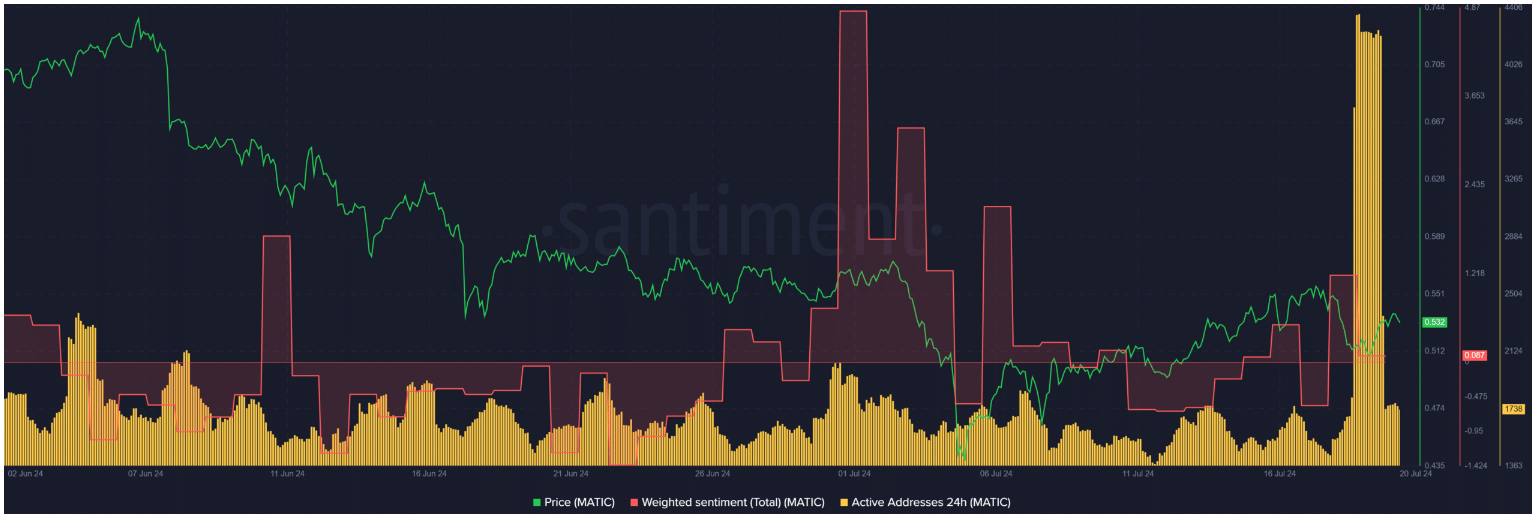

The increased interest in RWAs had some positive effects on the network, MATIC’s daily active addresses are in rise.

The news about the ECB trial with the Italian bonds also boosted MATIC’s weighted sentiment to positive, though it later dropped to a neutral level.

What does the chart say?

At the time of writing, the number of daily active addresses slightly decreased, which could stop further price increases as fewer users engage with the altcoin. Thus, demand is dropping.

MATIC’s price grew by 3% following Nailwal’s comments, but its overall recovery in July stalled above $0.55 and retraced to $0.51. Key price chart indicators showed mixed signals, causing traders to be cautious.

The Relative Strength Index recovered but remained below the average level of 50, which means there is not enough buying pressure for a stronger upside.

The Chaikin Money Flow was above average but near the equilibrium level, suggesting inflows increased but then stagnated.

Support and resistance

The indicators suggested MATIC might struggle to break the resistance level.

It doesn’t called resistance by coincidence. $0.55 is such a strong psychological number for some reasons. The $0.51 level was also important.

A bounce at $0.51 was marked by about $26 million in buy orders in the derivatives market on Binance, but in the same time, demand also surged in the MATIC spot market, with over $500,000 in bids at this level.