Bitcoin was bouncing within a narrow range for the past six months, but now analysts predict a price move soon.

Bitcoin’s stability bring uncertainty?

Over the weekend, Bitcoin and the crypto market experienced a small-ish dip, but overall, prices remained relatively stable.

At the start of the week, the popular analyst James Check noted that Bitcoin’s current phase of ’chopsolidation’, where price swings become more pronounced and sustained, could signal that the market is slowly becoming unstable.

He warned that this growing instability suggests a big price movement might be on the horizon, as the current price range is unlikely to hold much longer.

September rain

There is speculation that a major positive move in Bitcoin’s price could occur in September, especially with a potential adjustment in Federal Reserve interest rates on the horizon.

This sounds like hopium, as September is renowned its poor market performance, in case of Bitcoin too, it has traditionally been a challenging month for Bitcoin.

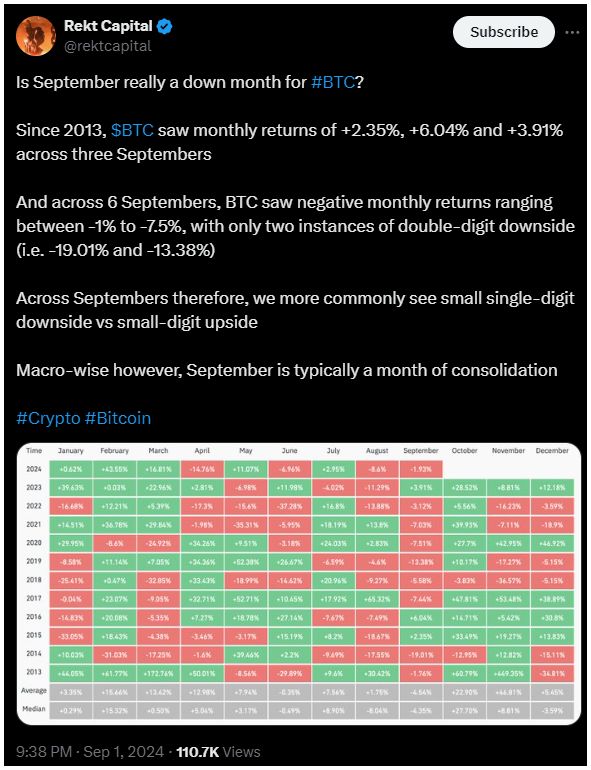

Since 2013, Bitcoin has seen positive returns in only three Septembers, with gains ranging from 2.35% to 6.04%.

In contrast, six other Septembers have recorded losses between 1% and 7.5%. So now, there is a higher likelihood of small losses rather than gains.

At the same time, analyst Willy Woo observed that Bitcoin is being gradually absorbed into the market, despite the influx from sources like the German and U.S. governments and Mt. Gox distributions.

He also mentioned that the decreasing leverage in crypto derivatives is a positive sign, moving the market sentiment from bearish to neutral.

Liquidity is coming

Another analyst examined Bitcoin’s liquidity using a 7-day liquidation heatmap, and the analysi pointed out an important cluster of liquidations around $57,000, close to the 50% level of a recent price wick at $56,600.

He suggested that Bitcoin might first move towards $61,300 as a run for liquidity before any other price action occurs.

Bitcoin experienced a few percent decline over the weekend, dropping to a support level around $57,000 and below.

By Monday morning during the Asian trading session it had slightly recovered to $57,500.

As Check shared, despite finishing August with an 8.6% total loss, only those who purchased Bitcoin in 2024 would currently be facing losses.