MicroStrategy is making headlines again with its ambitious plan to ramp up its Bitcoin acquisition strategy.

The company recently announced the “21/21 Plan,” wanting to raise $42 billion over the next three years.

Half of this will come from equity, while the other half will be sourced from fixed-income issuances, all to scoop up more Bitcoin.

A major shift in strategy

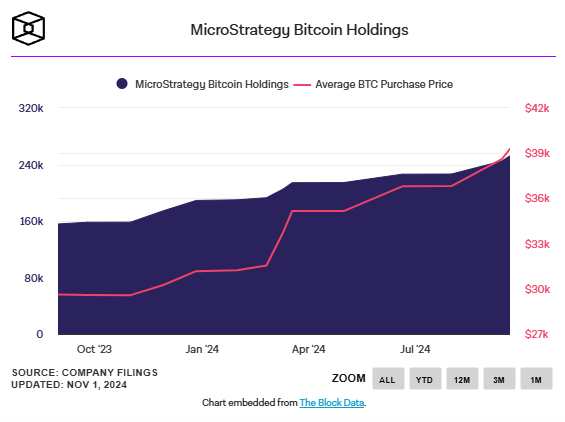

This new plan is a huge leap from MicroStrategy’s previous efforts, during which it has already accumulated over 252,000 Bitcoins since 2020.

Thanks to this aggressive strategy, the company’s stock soared about 290% this year, far outpacing Bitcoin’s own rise of around 64%.

In its latest quarterly report, MicroStrategy revealed sales of $116 million, which fell short of the expected $122.66 million by about 5%.

Despite this miss, the company reported a year-to-date yield of 17.8%, a figure they use to gauge the success of their Bitcoin strategy.

New plan: buy it all!

Management raised its target for Bitcoin yield, now projecting it to reach between 6% and 10% annually thanks to the new plan.

They want to accumulate a total of 412,220 Bitcoins by the end of 2025, with expectations that Bitcoin could be priced at around $175,000 by then.

Alexander Blume, CEO of Two Prime Digital Assets, pointed out that the term “BTC Yield” is somewhat misleading. It’s more about aligning the company’s net asset value with its market cap, currently around $50 billion, rather than generating actual yield.

Blume noted that it’s a clever way to turn a negative situation, where Bitcoin’s value is lower than the share price, into a perceived positive.

Benchmark analyst Mark Palmer credits MicroStrategy’s high stock valuation, currently at 2.7 times its net asset value, to its unique strategy that combines Bitcoin with traditional finance tools.

With institutional interest in Bitcoin growing and a potentially favorable regulatory environment in the U.S., there’s room for further stock gains.

Palmer highlighted that MicroStrategy’s ability to generate compounding yields on its Bitcoin holdings sets it apart from other ways to gain Bitcoin exposure, like spot ETFs.

Cautionary notes

While many see this as a win-win situation, Blume also cautioned that if Bitcoin prices take a nosedive and stay low for too long, MicroStrategy could find itself buried under unmanageable debt. It’s unlikely, but possible.

Palmer also raised his price target for MicroStrategy’s stock from $245 to $300 while maintaining a “buy” rating.

At publication time, shares were trading around $245, while Bitcoin was priced at approximately $70,370 after dipping 2% in the past day.