Canary Capital just made history by filing the first-ever application for a Hedera spot ETF with the U.S. SEC, to give investors direct access to HBAR without the hassle of dealing with derivatives or futures contracts.

New player on the field

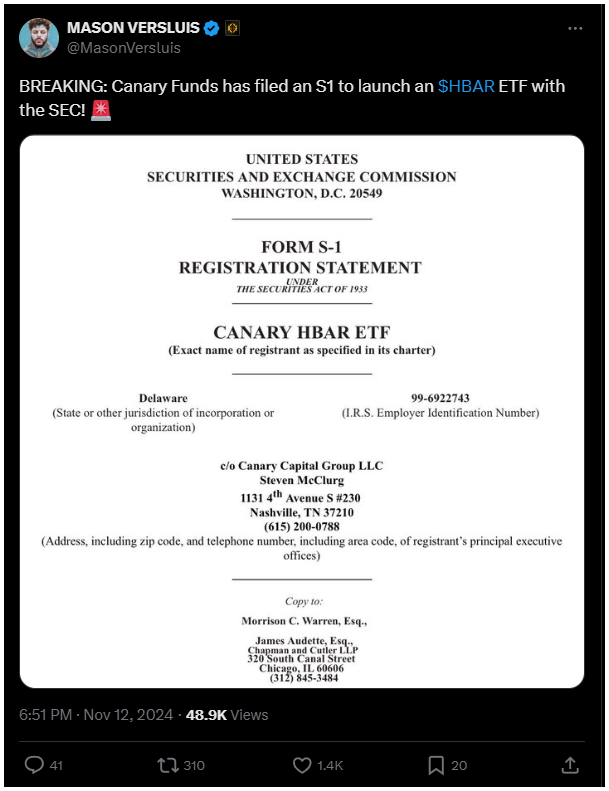

On November 12, Canary Capital submitted its application, and honestly, this is a huge step forward in the expansion of crypto-related ETFs beyond just Bitcoin and Ethereum.

If approved, this could easily set a precedent for other cryptocurrencies to follow suit.

The application includes an S-1 registration statement, which outlines how the HBAR ETF will provide investors with direct exposure to HBAR, the native token of the Hedera network.

Unlike some crypto funds that rely on derivatives or futures, this ETF will hold actual HBAR tokens, making it a more straightforward investment in Hedera.

On the other hand, there’s still some mystery surrounding the fund since the filing hasn’t specified who will be the custodian and administrator.

Those are pretty important details that investors will want to know. Right now Hedera is governed by a consortium of global organizations and enterprises, wanting to create a balanced and secure ecosystem.

HBAR plays a central role within this ecosystem, powering dApps, facilitating transactions, and supporting governance decisions.

Veteran warrior, new sword

Canary Capital isn’t new to pushing the envelope in the crypto ETF space. Founded by Steven McClurg, who also started Valkyrie Funds, they recently launched an HBAR ETF Trust for accredited investors and have filed for spot ETFs covering Litecoin, Solana, and XRP.

The announcement of the HBAR ETF filing has taken many experts by surprise, especially since Hedera isn’t exactly a household name among mainstream investors.

The platform is more recognized for its enterprise solutions in blockchain but has gained traction lately, especially after launching its AI-integrated Prove system in October.

According to Canary’s filing, the HBAR ETF will calculate its Net Asset Value based on HBAR’s price in U.S. dollars.

This follows their earlier pioneering efforts with a Litecoin ETF filing and reflects their aggressive approach toward crypto ETFs.

New winds

The news has already sparked a rally for HBAR, with its price jumping over 21% to hit $0.06764.

At one point, it even reached an intraday high of $0.074 from a previous low of $0.05317, definitely showing renewed interest in this asset amid a wider market upswing.

The SEC’s attitude toward spot crypto ETFs also seems to be shifting. After approving Bitcoin and Ethereum spot ETFs earlier this year, there’s speculation about how new political dynamics might influence future decisions.

With President-elect Donald Trump hinting at replacing SEC Chair Gary Gensler if he takes office, industry players are keeping a close eye on potential changes in leadership.