November was an epic month for Bitcoin ETFs, with U.S. investors pouring in $6.46 billion as Bitcoin jumped by 45%, reaching the historic price of $99,000.

A month of gains

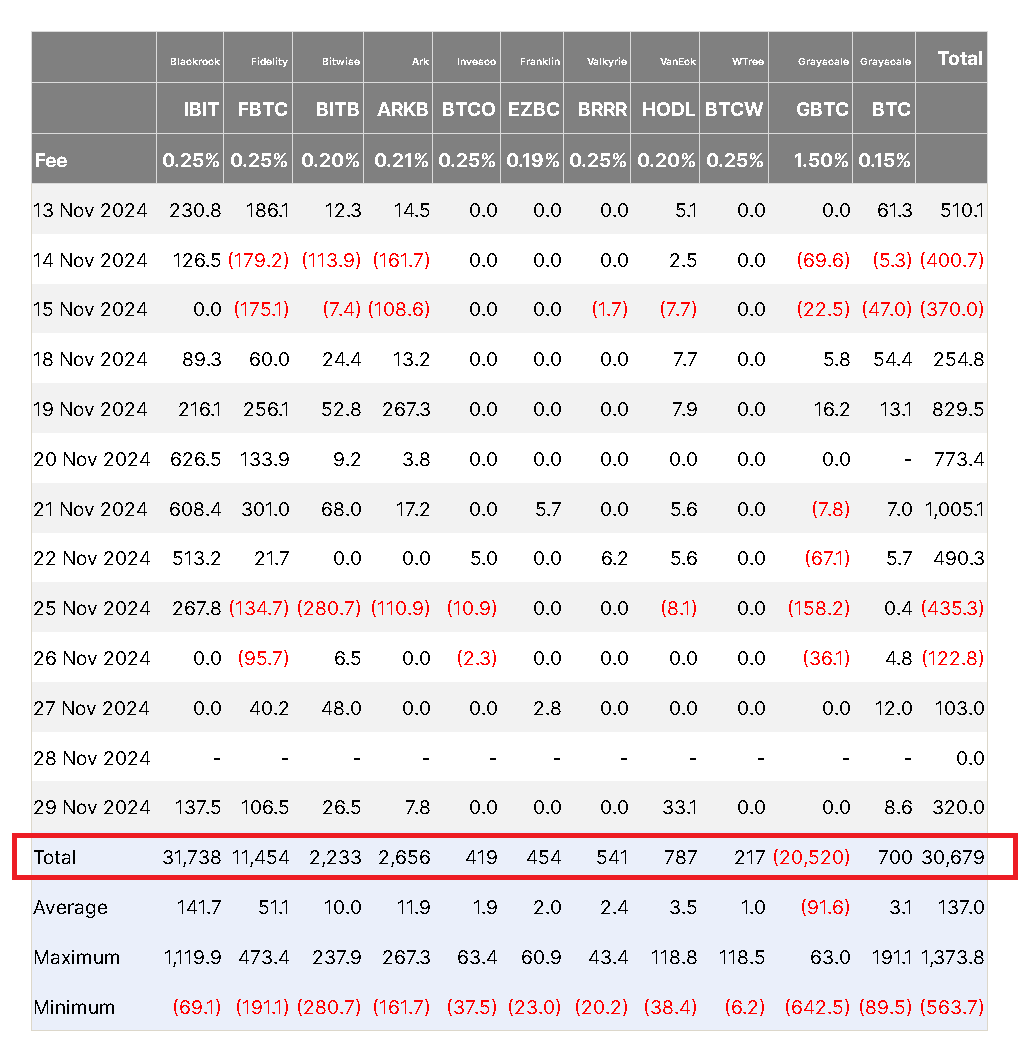

This month-long bull run saw Bitcoin prices jump from around $68,000 to $99,000. Overall, spot Bitcoin ETFs brought in a total of $6.87 billion, even after accounting for $411 million in outflows.

BlackRock’s iShares Bitcoin Trust ETF led the charge, attracting $5.6 billion, and that’s nearly 87% of the total inflows for the month.

Investor confidence on the rise

Other notable players in the ETF game included Fidelity’s Wise Origin Bitcoin Fund, which brought in $962 million, Grayscale’s Bitcoin Mini Trust ETF at $211.5 million, and VanEck’s Bitcoin ETF with $71.2 million.

The continued influx of funds from both institutional and private investors is expected to keep the momentum going for Bitcoin, with traders predicting insane long opportunities as Bitcoin enters a new price discovery phase.

Of course, not all ETFs were riding high, because three funds contributed to that $411 million outflow.

The Grayscale Bitcoin Trust ETF saw $364 million leave, while Bitwise and Valkyrie recorded outflows of $40.4 million and $6.8 million.

Bull run

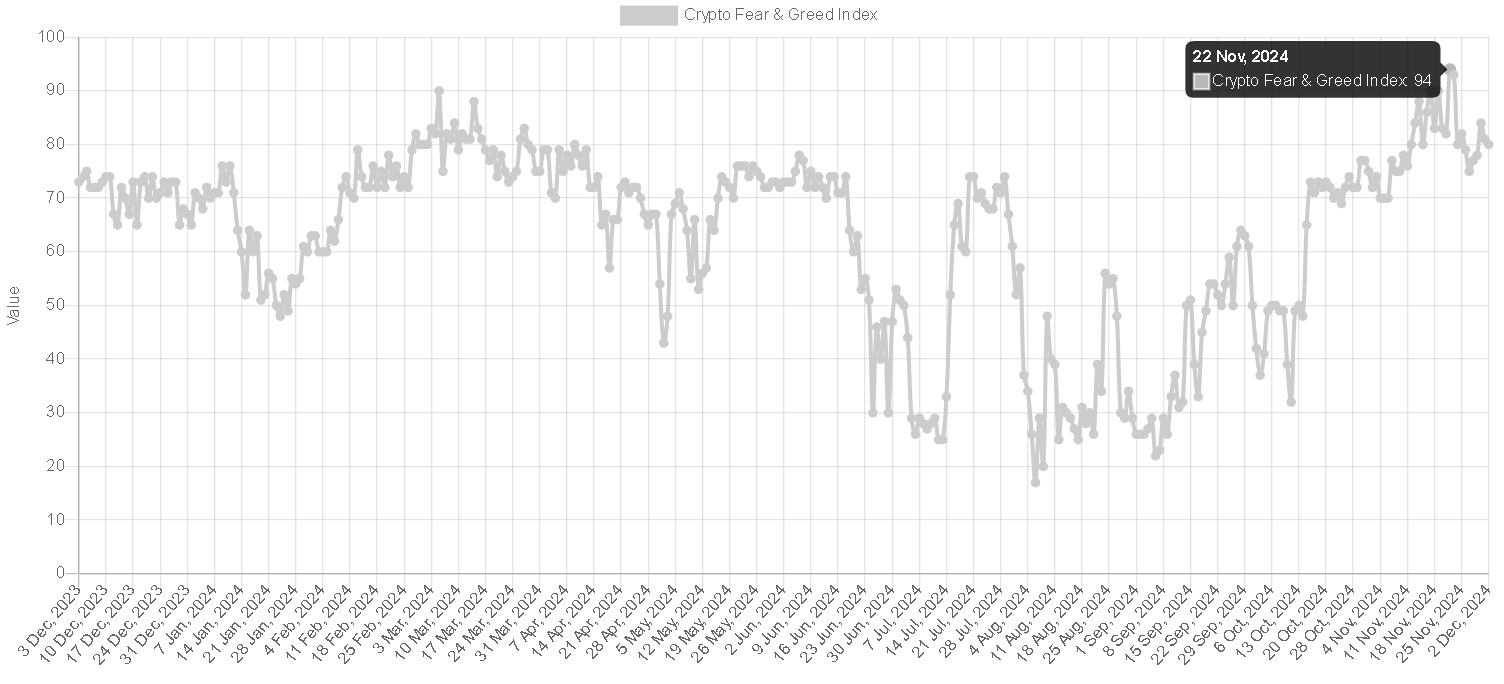

The Crypto Fear & Greed Index also reflected strong bullish feelings throughout November, and on November 22, it hit a yearly high of 92, signaling robust, maybe too much optimism among investors.

As we rolled into December, the index dipped slightly but still indicated extremely positive sentiment.

With such impressive inflows and a rallying Bitcoin price, it seems like the crypto market is gearing up for more excitement, and hopefully, more gains ahead.