Even with Bitcoin’s impressive 113% return this year, many mining stocks are having a tough time keeping up.

The numbers tell the story

Bitcoin has been on a roll, but that hasn’t translated into big gains for most mining companies.

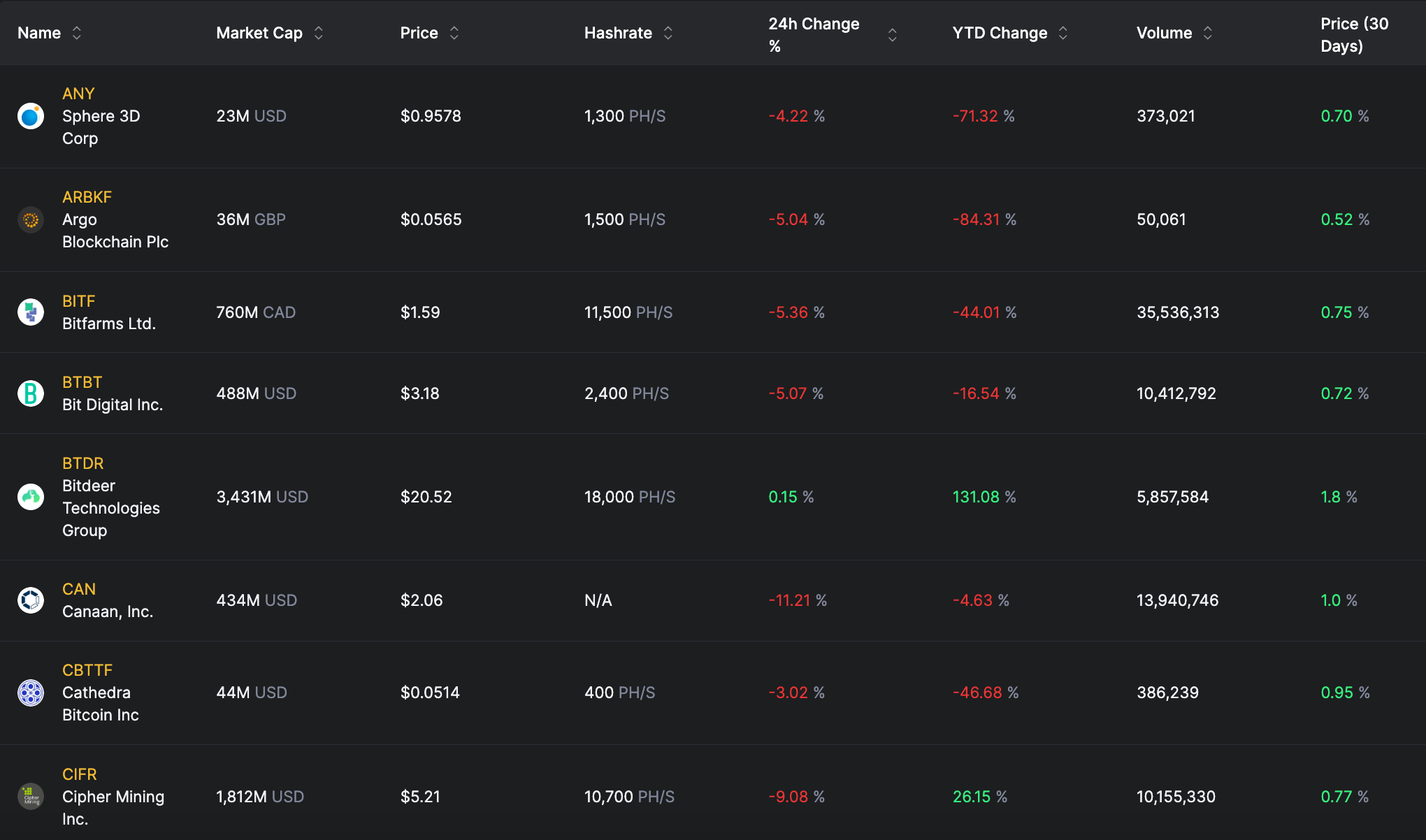

Hashrate Index and Google Finance shared that many publicly traded miners are ending 2024 with significant losses—some down as much as 84%. Out of 25 listed miners, only seven are showing positive returns.

Bitcoin is up, why stocks aren’t

This year has been all about adapting for Bitcoin mining companies, as they’ve faced reduced rewards and rising costs while trying to find new ways to keep their operations afloat.

Since Bitcoin’s inception, miners have earned over $71 billion, but every four years, their rewards for mining new blocks get cut in half during the halving event.

The latest halving in April slashed rewards from 6.25 BTC to just 3.125 BTC.

As of December 22, miners’ revenue was sitting at around $42 million, down from over $100 million in April.

To make matters worse, the difficulty of mining new blocks has doubled since last year, increasing operational costs big time.

Rising costs and new strategies

For example, BitFuFu reported a 168% rise in mining costs, hitting $51,887 per BTC, so it’s not a big surprise that to stay afloat financially, many publicly traded miners turned to capital markets for support.

In the second quarter alone, nine out of thirteen U.S.-listed Bitcoin mining firms raised about $1.25 billion through stock offerings.

Some companies are also diversifying their operations. Core Scientific, which traditionally focused on Bitcoin mining, has ventured into AI by partnering with CoreWeave to host Nvidia GPUs—aiming to tap into the booming demand for AI computing power.