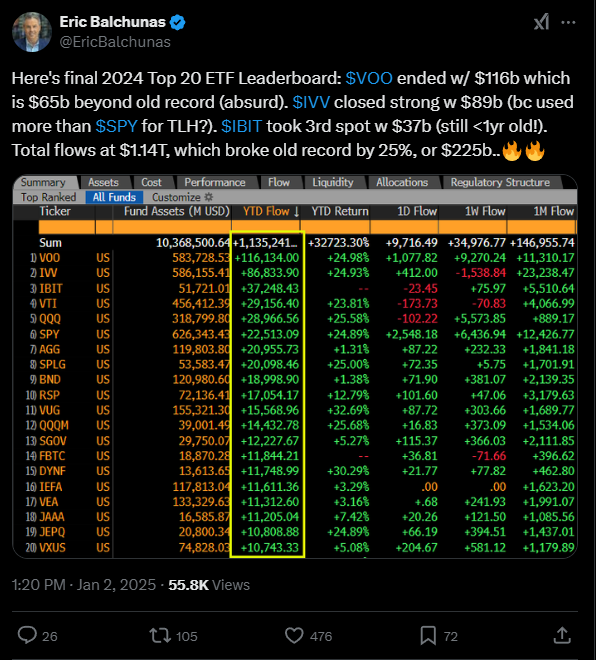

BlackRock’s spot Bitcoin ETF, aka IBIT has made quite the splash by securing the third spot in the global ETF rankings for the last year.

Eric Balchunas, Bloomberg’s senior ETF analyst shared that IBIT pulled in $37 billion in inflows.

Record

In this competition, the Vanguard S&P 500 ETF took the crown with a quite impressive $116 billion in inflows, an increase of $65 billion from its previous record.

Following closely behind was the iShares Core S&P 500 ETF, raking in $86 billion. And despite being a newbie on the block, BlackRock’s IBIT has shown it means business.

The $37 billion it attracted indicates a really strong appetite from investors looking to dive into digital assets.

The only other spot Bitcoin ETF to make the top 20 was Fidelity’s FBTC, which got the 14th position with $11 billion.

A booming market

Overall, ETFs have had a stellar year, pulling in $1.14 trillionin total, an increase of $225 billion or 25% over previous records.

This jump reflects growing investor interest in ETFs, likely fueled by heavyweights like BlackRock leading the charge.

Farside Investors’ data shows that BlackRock and Fidelity are dominating inflows this year, often experiencing streaks of positive cash flow that keep the Bitcoin ETF market in uptrend.

IBIT had a phenomenal October, landing in the top five global ETF list after seeing massive inflows of $1.5 billion in just six trading days.

The name of the game

Analysts are calling BlackRock’s performance nothing short of record-breaking since IBIT was only launched on January 11, 2024.

This rapid growth showcases how much interest there is in digital products within the ETF space.

With BlackRock’s impressive track record and its ability to attract substantial investments so quickly, it’s clear that the Bitcoin ETF market is just heating up.

As more investors turn their eyes toward cryptocurrency and digital assets, IBIT is poised to be a major player moving forward.