The University of Austin is stepping into the world of Bitcoin, and putting its money where its mouth is, launching a brand-new Bitcoin investment fund worth a cool $5 million.

Next step: hodl!

This isn’t just some flash-in-the-pan experiment, either, because the university’s endowment fund is planning to HODL, or hold its Bitcoin for at least five years. Why? Because they believe in its long-term potential.

Chun Lai, the foundation’s chief investment officer, pretty much said they don’t want to be the last ones to the party when crypto’s potential blows everyone’s minds. Game theory at its finest.

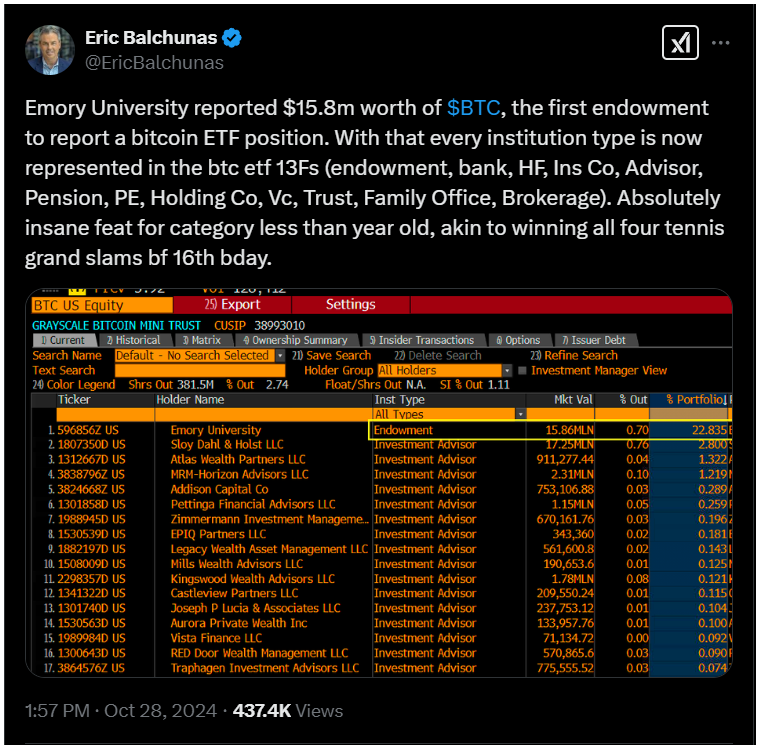

This news comes hot on the heels of Emory University revealing they’d purchased over $15 million in Bitcoin through Grayscale’s spot Bitcoin ETF.

It was the first time a U.S. university endowment publicly admitted to holding Bitcoin ETFs.

Market demand

More and more institutions warming up to Bitcoin ETFs could seriously pump up its price.

After all, these guys have serious cash that can move markets. Institutional adoption is key if Bitcoin wants to reach new all-time highs.

Chad Thevenot, a bigwig at the University of Austin, thinks Bitcoin has long-term value, just like stocks or real estate.

And it’s not just universities getting in on the crypto action. Even retirement funds are starting to pay attention, especially among the younger crowd.

The future is here

A new Bitget Research report says up to 20% of Gen Z and Alpha would be cool with getting their pensions in cryptocurrency, plus 78% of them trust alternative retirement savings options more than traditional pensions.

It seems the kids want decentralized finance and blockchain-based solutions.

Bitget CEO Gracy Chen shared that this should be a wake-up call for the financial industry, because young people want more control, flexibility, and transparency.

As of January 2025, 40% of these youngsters had already invested in cryptocurrency.