Things are getting wild in the world of state-level Bitcoin adoption, and it seems like every day, more and more states are thinking about hoarding Bitcoin like it’s the new gold.

VanEck’s prediction: a $23 billion Bitcoin party

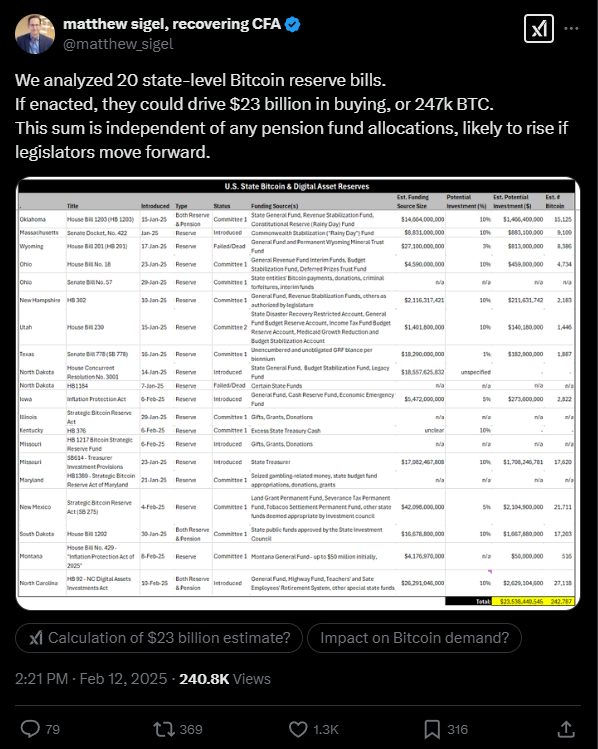

Matthew Sigel, VanEck’s head of digital assets research shared that if all the proposed strategic Bitcoin reserve bills actually pass, we could see states buying up a nice $23 billion worth of BTC in the first round.

That’s like 247,000 Bitcoin, and he thinks that’s actually a lowball estimate, since we don’t have all the details yet.

States eyeing the Bitcoin prize

VanEck crunched the numbers on proposed legislation in 20 U.S. states to figure out how much Bitcoin they could buy if the bills get approved.

Ohio, Illinois, Missouri, and Maryland are still playing coy, but North Dakota said a big no to the Bitcoin dream. And there are 30 other states without proposal.

Just to put things in perspective, if all the states actually bought Bitcoin per their bills, they’d collectively have more than the U.S. government’s stash of 198,100 BTC.

Is this a Bitcoin buying frenzy?

Bitwise, another investment firm, pointed out that if companies and governments start buying Bitcoin, they’ll have to pry it from the hands of us regular investors willing to sell.

Right now, 19 states have crypto reserve bills in the works, and Arizona and Utah are leading the charge, having already moved their legislation past the House committee level.

Even North Carolina wants to get in on the action, proposing to invest in Bitcoin ETFs.

And now, the Lone Star State is joining the party too, as republican Senator Charles Schwertner filed the “Texas Strategic Bitcoin Reserve and Investment Act”, which would let Texas invest and trade in Bitcoin and other popular cryptos in an investment fund.