Franklin Templeton thinks Solana’s DeFi scene is undervalued. It’s a bold claim from one of the biggest players in traditional finance.

This trillion-dollar asset manager thinks Solana’s got some hidden gems that investors are sleeping on.

And let me tell you, they’re not just talking the talk; they’ve got the numbers to back it up.

The numbers don’t lie, and they’re quite nice

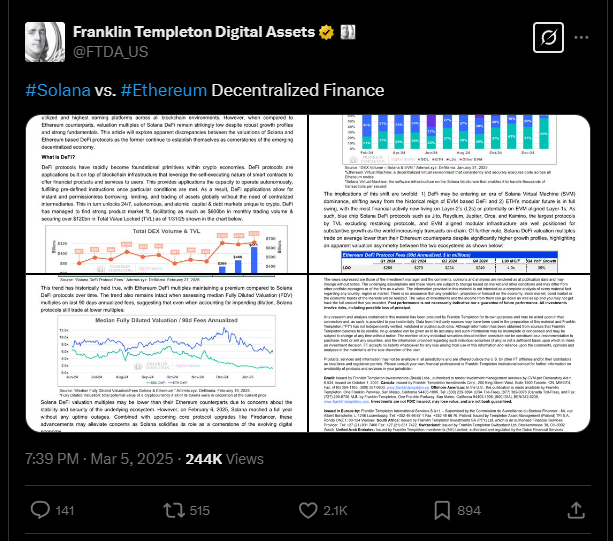

Solana’s been crushing it in on-chain metrics, so the fundamentals looks strong. Its DEX volume has been dominating the market, even surpassing Ethereum and its Layer-2s.

In January, Solana took a 53% of the market share, making it the leader in on-chain trading.

And while it dipped slightly in February, it’s still on top. But here’s the thing, despite this success, Solana DeFi tokens are valued lower than their Ethereum counterparts.

That’s what Franklin Templeton calls a distinct asymmetry.

The growth story

Protocols like Jito, Jupiter, and Raydium on Solana have seen astronomical growth, far outpacing their Ethereum rivals.

Yet, Solana DeFi tokens trade at lower multiples despite their higher growth potential. It’s like they’re saying, “Hey, we’re the underdog, but we’re about to blow up!”

Franklin Templeton argues that Solana DeFi is better positioned for more, and more importantly, sustainable growth, but investors are still hesitant because they see Ethereum as safer.

The safety net

Now, you might be thinking, isn’t Ethereum more stable? Well, Franklin Templeton says not so fast. Solana’s had a year of uninterrupted uptime, and its upcoming Firedancer client is set to boost network security even more.

So, what’s holding investors back? Maybe it’s time to give Solana the recognition it deserves. After all, as people always say, “You gotta take risks to make gains.”

Have you read it yet? Bitcoin’s big comeback on the horizon, new ATH by June?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.