Arizona, land of desert sunsets and big ideas, was this close to making history. The state legislature had a plan, let’s stash some Bitcoin in the official reserves, maybe get ahead of the curve.

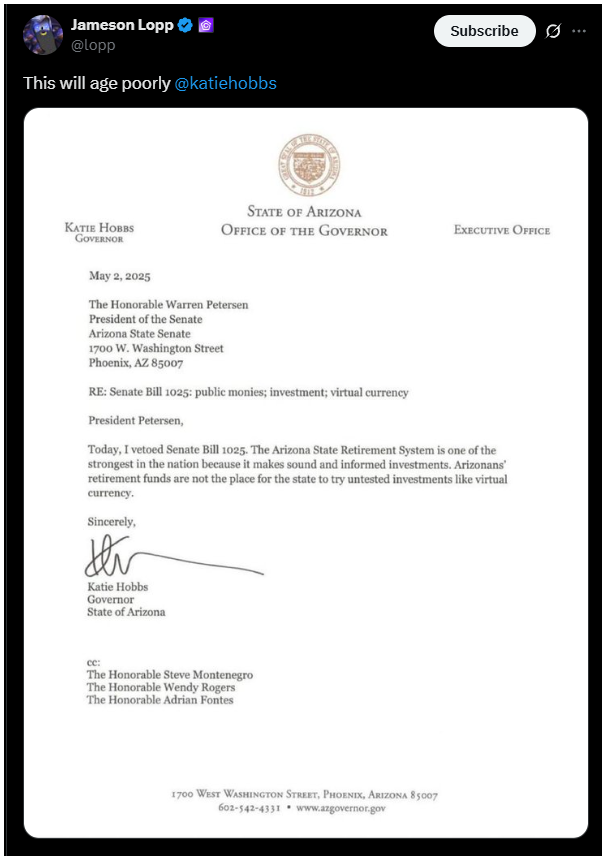

But then, Governor Katie Hobbs steps in, slams the brakes, and vetoes the whole thing.

You gotta ask yourself, who does that? Who turns down a shot at being first in line for the future?

Not on my watch

The bill, dubbed the Arizona Strategic Bitcoin Reserve Act, would’ve let the state invest seized funds into Bitcoin, with a reserve managed by officials.

Passed the House, 31 to 25. Not a landslide, but hey, enough to get the ball rolling. Then Hobbs, with a pen stroke, calls it quits. Her reason?

She says the Arizona State Retirement System is one of the strongest in the nation, and not by accident, but because it sticks to sound and informed investments.

In other words, she’s not about to gamble retirement money on what she calls untested digital assets.

Seeing red

Now, if you’re thinking the crypto community took this lying down, think again. Jameson Lopp, big name at Casa, says, this will age poorly.

Anthony Pompliano, never one to mince words, basically calls out Hobbs for thinking she’s smarter than the market.

If she can’t outperform Bitcoin, she must buy it, he quips. State Senator Wendy Rogers, who co-sponsored the bill, is fuming.

“Politicians don’t understand that Bitcoin doesn’t need Arizona. Arizona needs Bitcoin.”

But interestingly, Arizona’s retirement fund already holds shares in MicroStrategy, Michael Saylor’s outfit, which is basically a leveraged Bitcoin ETF, or at least, something like that.

Talk about mixed signals! Rogers promises the bill will be back, telling crypto fans to HODL and wait for round two.

Outlier

Not everyone’s crying over spilled milk, though. Peter Schiff, a known crypto skeptic, sides with Hobbs. He says governments shouldn’t be speculating with public money. Classic Schiff move.

If this bill had passed, Arizona would’ve been the first state in the U.S. to hold Bitcoin reserves.

Instead, they join a club with Oklahoma, Montana, South Dakota, and Wyoming-states where similar dreams fizzled out.

On the other hand, North Carolina is moving forward with its own crypto investment law, and even the feds are sniffing around the idea of a national Bitcoin reserve.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.