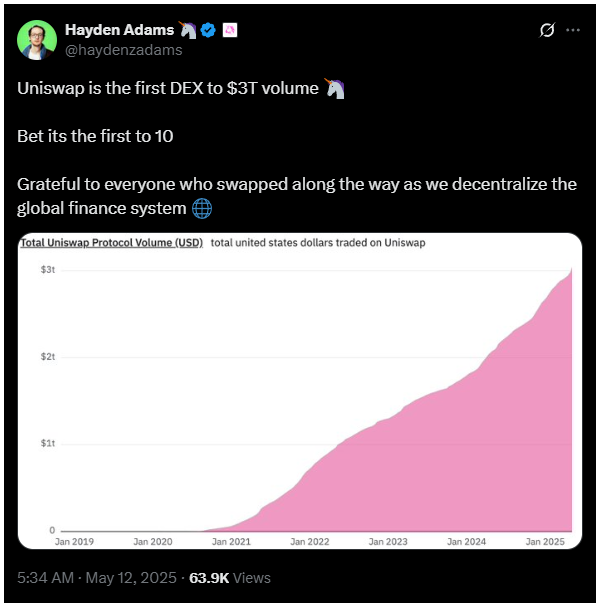

Uniswap just hit $3 trillion in all-time trading volume. The first DEX to ever cross that line.

Hayden Adams, the guy who built this beast, couldn’t help but brag a little on X, sharing a screenshot counting down to this epic milestone.

Milestone

Now, daily trading volume? Uniswap’s still flexing with around $3.3 billion moving through its virtual halls every single day.

That’s a hefty chunk of the market, about 23% of all DEX activity, revealed DeFillama’s experts.

Not far behind is PancakeSwap, holding 21% with $2.7 billion daily. So, Uniswap’s got some competition, but it’s still the top dog in the decentralized trading game.

But here’s where the story gets a little less glamorous, because the total value locked on Uniswap, the crypto stashed in its smart contracts is just under $5 billion now.

Sounds like a lot? Sure. But it’s only about half of what it was back in 2021 when the DeFi party was at its peak.

The whole DeFi sector’s TVL has shrunk to roughly half of its late-2021 peak, hovering around $124 to $132 billion, with Ethereum holding the lion’s share.

Up and down

And don’t get me started on Uniswap’s native token, UNI. While the platform’s volume is breaking records, UNI’s price is still limping along, down more than 84% from its $45 ATH in May 2021.

At the time of writing, it’s barely scraping $7, having lost 3.4% that day.

But Adams just dropped news that Uniswap is rolling out its own 7702 smart wallet, alongside support for other 7702 wallets.

we're rolling out our own 7702 wallet and supporting other 7702 wallets through EIP 5792

with the goal being 1 click swapping for all users

— Hayden Adams 🦄 (@haydenzadams) May 12, 2025

This is sounds like a boring tech jargon, but in reality it means one-click swapping is coming to your fingertips, making DeFi trading smoother and faster.

The 7702 upgrade, part of Ethereum’s recent Pectra update, beefs up security against future quantum computing threats and lets regular accounts act like smart contracts temporarily.

Trust Wallet already jumped on this bandwagon, now Uniswap’s joining the party.

Carry on

So, Uniswap’s volume milestone is a pretty big deal, no doubt about it. But the DeFi sector’s been through some rough patches, and the token price tells a different story.

Still, with innovations like the 7702 wallet, Uniswap’s aiming to make DeFi easier and more accessible for everyone. The grind never ends.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.