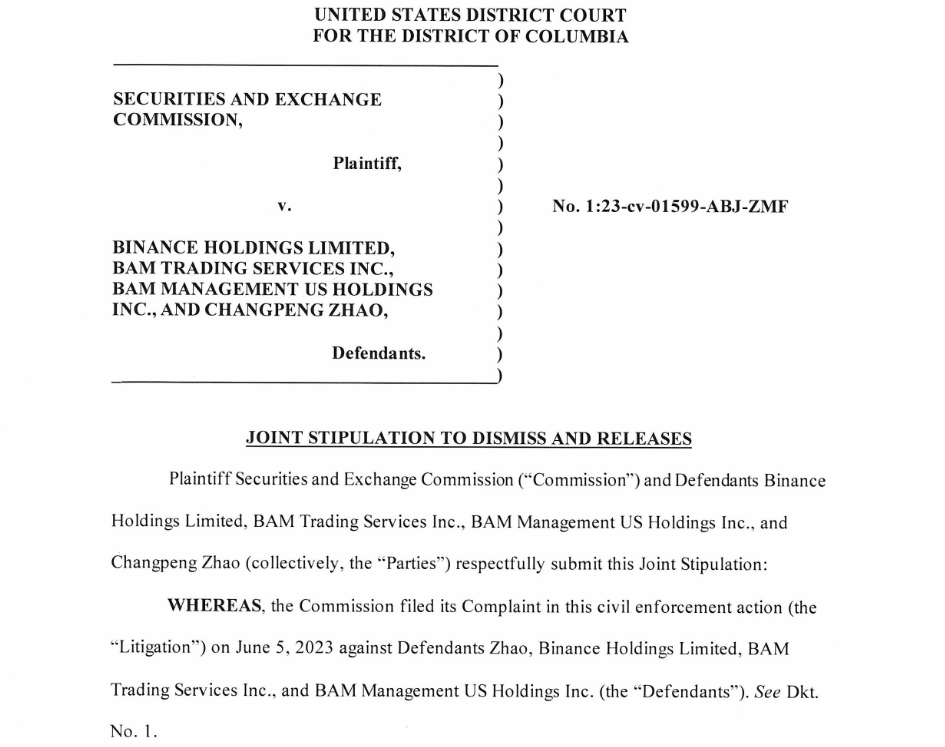

On May 29, 2025, the SEC Binance lawsuit came to an official end after a joint motion was filed by the U.S. Securities and Exchange Commission, Binance, and Changpeng Zhao.

The motion, submitted to a federal court in Washington, DC, requested that the Binance SEC case be dismissed with prejudice.

This prevents the agency from reopening the same case in the future.

The SEC said the decision was based on its own discretion and current policy direction.

The motion also mentioned that the SEC’s Crypto Task Force could influence the case resolution and that continuing the action was no longer necessary.

The lawsuit began in June 2023, when the SEC sued Binance, Zhao, and its U.S. arm BAM Trading.

The agency accused them of violating securities laws, misusing customer funds, and misleading investors.

The case had already been paused twice—in February and April 2025—before this final withdrawal.

Binance SEC Case Follows DOJ Settlement and Criminal Charges

Before the dismissal of the SEC Binance lawsuit, Binance and Zhao settled a separate case with the Department of Justice in November 2023.

They admitted to several violations, including operating as an unlicensed money transmitter, violating international sanctions, and failing to implement Anti-Money Laundering systems.

As part of that settlement, Binance paid a $4.3 billion fine. Changpeng Zhao stepped down as Binance CEO and pleaded guilty to money laundering violations. In April 2024, he received a four-month prison sentence.

Although the SEC lawsuit was independent, it involved overlapping issues with the DOJ case. Both agencies had targeted Binance’s regulatory practices and management failures during the same period.

Binance Responds After SEC Withdrawal, Mentions Trump and Atkins

After the motion was filed, Binance posted on X, calling the outcome a “huge win for crypto” and expressing support for President Donald Trump and SEC Chair Paul Atkins.

The post thanked both for opposing regulatory enforcement through lawsuits.

The company wrote:

“Thanks to President Trump and SEC Chair Paul Atkins for pushing back against regulation by enforcement.”

Paul Atkins, appointed by Trump, previously worked as a crypto lobbyist.

His leadership marks a clear departure from the SEC’s earlier enforcement approach during the Biden administration. Under Atkins, the SEC has started shifting away from court-led actions.

SEC Drops More Crypto Lawsuits After Binance Case Ends

The Binance SEC case dismissal is one of several steps taken by the agency since early 2025.

Under Paul Atkins, the SEC has dropped or settled enforcement cases against major crypto firms including Coinbase, Consensys, and Kraken.

The agency also closed investigations into Circle, Immutable, and OpenSea without filing charges.

These changes reflect a broader strategy shift under new leadership, emphasizing policy discussions over enforcement.

To support this shift, the SEC announced industry roundtables aimed at creating a regulatory framework for digital assets. These events involve participants from crypto firms, legal experts, and policymakers.

The SEC’s withdrawal from the Binance lawsuit highlights a growing trend in how it handles crypto-related issues.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.