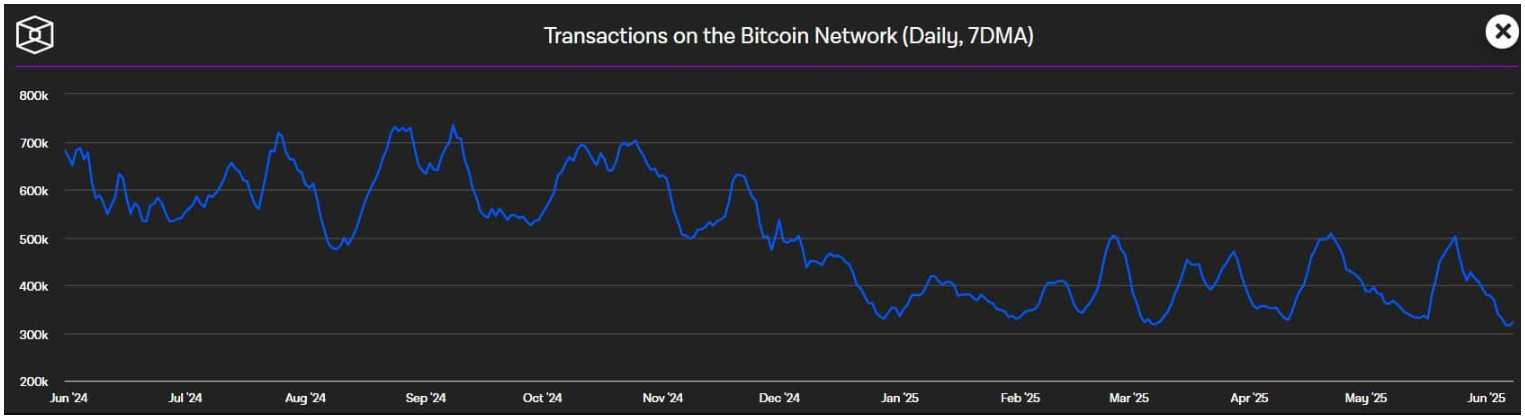

Bitcoin’s price is shooting through the roof, hovering near $100,000 like it owns the place. But the actual activity on the Bitcoin network?

It’s dropping faster than your office’s Wi-Fi when everyone’s on a Zoom call.

We’re talking the lowest transaction levels since October 2023. While everyone’s cheering the price, the real-world use is ghosting us.

Super-cheap transactions on the Bitcoin network

As of June 6th, the seven-day average of daily Bitcoin transactions is sitting at a mere 317,000. To put that in perspective, back in late 2024, it was over 700,000.

That’s the real dip. So what’s going on? Is Bitcoin just being hoarded like that one guy in your office who never shares snacks? Or has the action moved somewhere else, off-chain?

Transaction fees have dropped to practically pocket change. There was a 0.1 sat/vB transaction, costing just 11 satoshis, roughly a penny, that finally got confirmed after sitting in limbo for almost a month.

MARA, a mining outfit, slipped this tiny fee transaction through their Slipstream pipeline, which accepts these non-standard, dirt-cheap transactions. Miners are clearly feeling the chill, lowering their standards to keep the network humming.

a few days ago Mara finally mined this 0.1 sat/vB transaction that I started broadcasting via the public p2p relay network a month ago.

it only cost 11 sats!https://t.co/mVPxJRFjwv

— mononaut (@mononautical) June 8, 2025

Bitcoin is for everyone?

But this low activity is sparking a heated debate in the Bitcoin community.

Thirty-one Bitcoin Core developers fired off an open letter defending these low-fee, non-standard transactions.

Their argument? This flexibility is vital to Bitcoin’s core promise, censorship resistance. They say Bitcoin has to serve all kinds of use cases, even if some people don’t like it.

Of course, not everyone’s buying it. Samson Mow from Jan3 calls it out for what it is, a drift from Bitcoin’s original monetary purpose.

Bitcoin Core devs have been changing the network gradually to enable spam and now seem focused on also removing barriers for spammers. It’s disingenuous to just say “it is what it is now, too bad.”

This statement itself is also inappropriate. Feels like an NYA from Core devs. https://t.co/ACIqyvK12f

— Samson Mow (@Excellion) June 7, 2025

He accuses the developers of basically rolling out the welcome mat for spammers, diluting Bitcoin’s value as a serious transactional network.

Digital gold?

So it looks like Bitcoin’s caught in an identity crisis. Institutional investors love calling it digital gold, a store of value. But the everyday use?

It’s drying up. The gap between price hype and actual usage is widening like the break room fridge after a long weekend, empty and neglected.

If this trend continues, Bitcoin risks becoming a shiny, expensive collectible that only a few miners and whales really use.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.