Nasdaq just filed a 19b-4 form with the SEC to bring the 21Shares SUI ETF into the US spotlight.

This move is pretty much a power play to launch one of the first altcoin-based ETFs in the States after Ethereum.

And it’s happening while the Sui ecosystem is clawing its way back from some recent rough patches.

The money is there, but where to spend?

Now, this filing is no small potatoes. It kicks off the official review process for the spot SUI ETF, a product that’s been buzzing in crypto circles.

The Sui Foundation itself hailed this as the formal start of the SEC’s review, marking a big step toward institutional acceptance of Sui. Remember, 21Shares already filed an S-1 back in April, so this is building momentum.

Here’s where it gets interesting, because globally, over $300 million is already parked in SUI-based exchange-traded products, mostly in European markets like Euronext Paris and Amsterdam.

The appetite for a regulated US version? Growing like a weed. Investors want in, and Nasdaq’s making sure they get their chance.

Nasdaq just filed to list the 21Shares SUI ETF — a spot ETF backed by the SUI token.

From $300M+ in global ETP inflows to a potential U.S. listing, institutional momentum for Sui is very real.

Next stop: institutional adoption. pic.twitter.com/5AGtmXimHs

— Sui (@SuiNetwork) June 10, 2025

The big gun

What’s driving this growth? Sui’s tech is no joke. Its object-oriented programming and scalable infrastructure make it a playground for everything from DeFi and gaming to real-world asset tokenization.

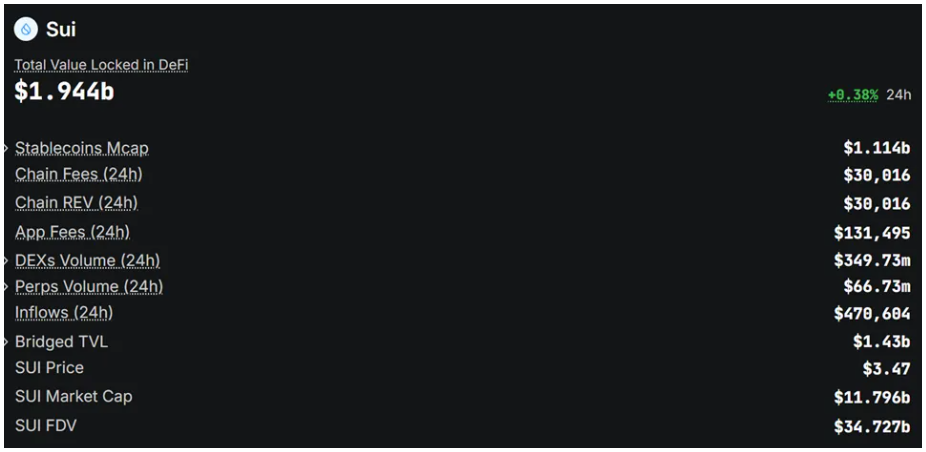

And most importantly, the numbers back it up, DeFiLlama ranks Sui eighth in total value locked, boasting nearly $2 billion locked across its platforms.

The stablecoin market cap on Sui shot up over 190% this year, now topping $1.1 billion. May alone saw stablecoin transfers north of $110 billion.

Kevin Boon, Mysten Labs’ president, put it straight, and said Sui’s become the go-to spot for serious builders and institutions.

The Nasdaq filing? A milestone that signals Sui’s march toward mainstream investor access.

Selection

But Bloomberg’s Eric Balchunas throws a little cold water on the hype, and he said not all altcoin ETFs will see Bitcoin-level demand.

The further you stray from BTC, the thinner the crowd gets. Still, with Osprey pushing a Solana ETF, the SEC might just speed things up for altcoin ETFs overall.

Either way, the 21Shares SUI ETF filing is a big deal for Layer-1 altcoins trying to break into the big leagues. Will Sui become the next hot asset class? The million dollar question.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.