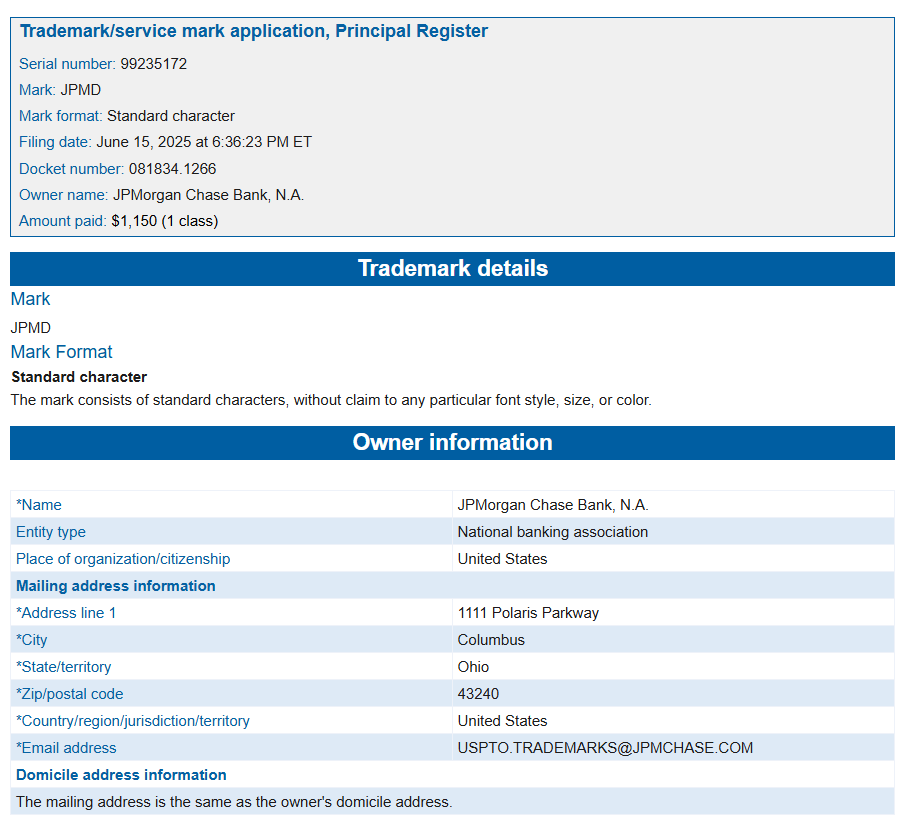

On June 16, JPMorgan Chase submitted a trademark application for “JPMD” to the U.S. Patent and Trademark Office.

The filing outlines multiple crypto payment services, including digital asset trading, transfer, clearing, exchange, and blockchain-based payment processing.

The application comes as JPMorgan expands its blockchain activities. It lists digital currency services under several categories, suggesting preparation for offering broader blockchain-based financial tools.

The trademark filing, submitted under number 98566161, names JPMorgan Chase Bank, N.A. as the applicant.

The application text includes “digital currency payment processing,” “virtual currency exchange transaction services,” and similar terms under Class 036 and 042 of the USPTO categories.

JPMorgan Stablecoin Project Could Link to JPMD Filing

On May 22, The Wall Street Journal reported that JPMorgan, along with Wells Fargo and Bank of America, is exploring a joint stablecoin initiative.

Although JPMorgan’s JPMD trademark filing does not mention stablecoins directly, it appeared shortly after the WSJ report, raising attention.

The WSJ said these banks aim to compete with private stablecoin issuers and use bank-issued digital currencies for faster settlement and cross-border payments.

The goal is to support transactions across institutional networks without using crypto-native assets.

The report did not confirm any launch timeline. However, the proximity of the report and the trademark application raised questions about JPMorgan’s next steps.

The trademark protects the name “JPMD” for a wide range of crypto payment services, which could include a bank-backed digital token.

JPMorgan’s Kinexy and JPM Coin Process $1.5 Trillion in Blockchain Payments

JPMorgan already runs an internal blockchain platform called Kinexy, previously known as Onyx. This platform supports JPM Coin, a tokenized payment solution used for interbank transfers.

JPM Coin is a private stablecoin pegged to fiat currencies, including the U.S. dollar, euro, and British pound. It operates on a permissioned blockchain and is limited to institutional clients of JPMorgan.

As of June 2025, Kinexy has processed over $1.5 trillion in transactions using JPM Coin.

The platform facilitates real-time payments, replacing traditional bank settlement systems with blockchain. JPM Coin remains active despite criticism of Bitcoin from JPMorgan CEO Jamie Dimon.

Stablecoin Regulation Advances in the U.S. with GENIUS Act

JPMorgan’s JPMD trademark filing came days after the U.S. Senate advanced the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act.

The Senate voted 68–30 to invoke cloture, allowing full debate and setting up a floor vote.

The bill includes regulatory standards for stablecoin issuers, including banks. If passed, it would move to the House of Representatives. From there, it would go to President Donald Trump’s desk for final approval.

The GENIUS Act outlines how financial institutions can issue and manage stablecoins. It sets requirements on reserves, cybersecurity, and compliance for stablecoin projects in the U.S.

Stablecoin Market Reaches $251.7 Billion Led by USDT and USDC

DefiLlama data shows the current stablecoin market cap at $251.7 billion. Tether (USDT) holds the largest share at $156.3 billion, while Circle’s USDC stands at $61.3 billion.

These two tokens dominate global stablecoin activity. They are widely used in crypto trading, remittances, and decentralized finance platforms. U.S. banks entering the space with compliant digital currencies may offer regulated alternatives.

JPMorgan’s JPMD trademark does not include specific launch details. However, the application aligns with rising regulatory clarity and growing adoption of blockchain payment infrastructure.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.