Listen up, Bitcoin is playing a dangerous game right now. It’s sitting comfy above $100,000, flirting with its all-time highs like a cat on a hot tin roof, but something’s off.

The market’s got this uneasy vibe, like a tense office meeting where everyone’s pretending everything’s fine, but you just know the storm’s brewing.

Let’s break down why Bitcoin’s throne might be shaking beneath it.

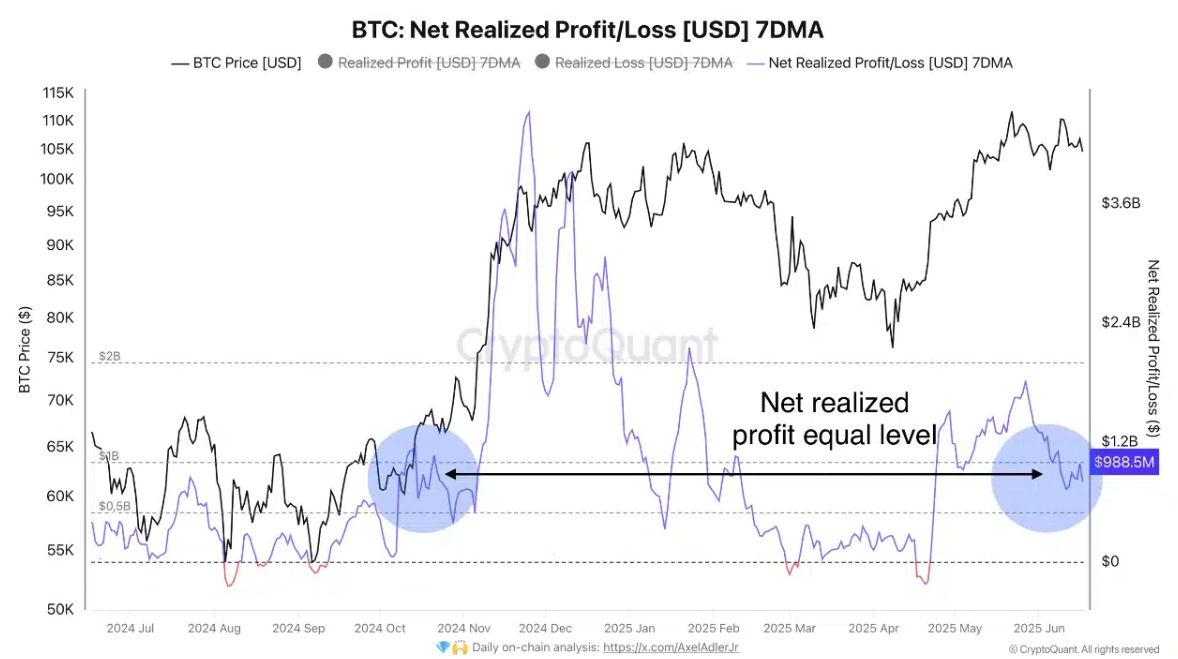

Where’s the profit?

First off, experts say profits are looking weak. Realized profits over the past week barely scrape $1 billion, a level we haven’t seen since late October. That’s like your star salesman suddenly not closing deals.

Odd, right? Despite hitting some local highs, traders aren’t cashing out much. This low profit-taking suggests hesitation, maybe even fear.

The big fish, the whales, are acting skittish. Over the last seven days, their net inflows plunged big time.

That’s like your top clients suddenly pulling back orders, leaving you wondering if the business is about to tank.

Tug-of-war

And the derivatives market? It’s flashing red too. Funding rates on platforms like dYdX are stubbornly negative, meaning traders are betting against Bitcoin’s rally.

Every time the bulls try to push forward, the bears snatch the momentum away. It’s like watching a tug-of-war where one team just won’t let go.

Unless these funding rates turn positive and stay there, Bitcoin’s buyers will struggle to take control, leaving the door wide open for sell-offs.

Now, about those unrealized profits, the cushion that usually softens the blow when prices dip.

The MVRV Z-score has dropped from 2.97 to 2.47 since early June. Analysts in disbelief. Think of it as your safety net getting thinner.

Without that buffer, short-term holders might bolt at the first sign of trouble, while long-term holders are stuck in a stalemate, neither buying nor selling, creating a deadlock with no clear direction. This is where we are now.

Bull-run delayed?

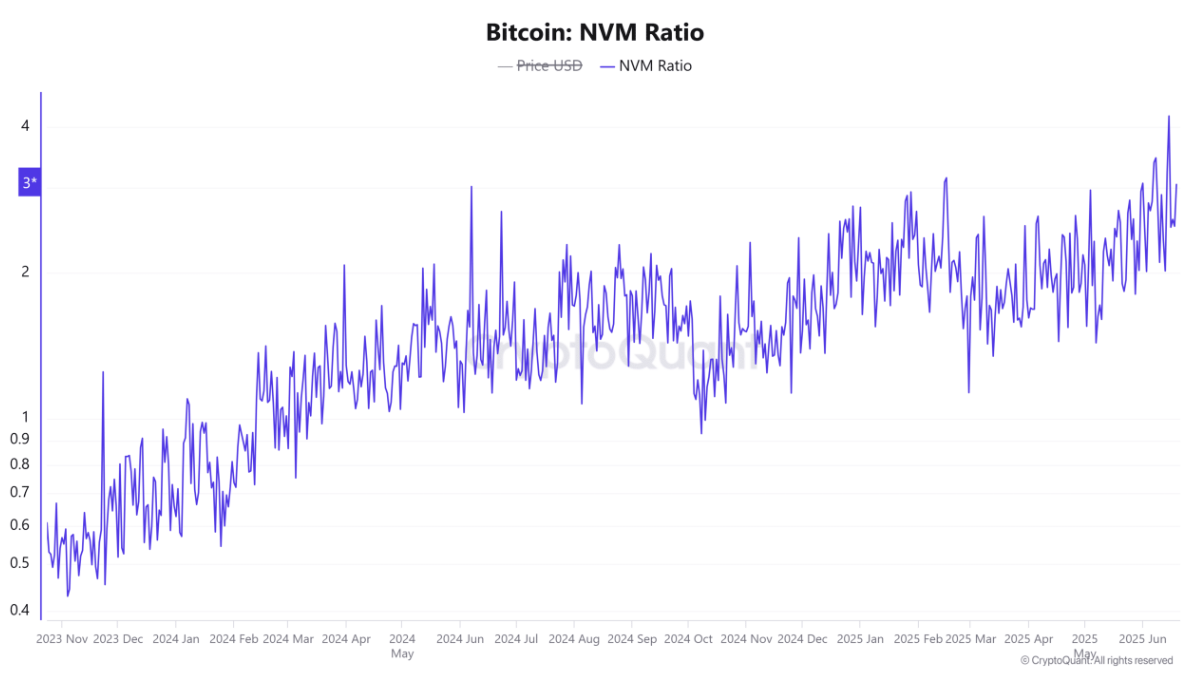

Then there’s the on-chain valuation metrics, waving warning flags like a referee calling fouls.

The NVT and NVM ratios have surged by 37% and 27%, respectively, signaling a growing disconnect between Bitcoin’s market cap and its actual network activity. It’s like a company boasting sky-high sales but with empty shelves.

I mean how? Historically, such gaps have led to nasty corrections or boring sideways moves.

The Stock-to-Flow ratio, a favorite among Bitcoin bulls, has dropped 16%, hinting that Bitcoin’s scarcity story might be losing steam.

Maybe more coins are flooding the market, or investors are just not as hungry as before. Either way, it’s a blow to the bullish narrative. Sh*t.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.