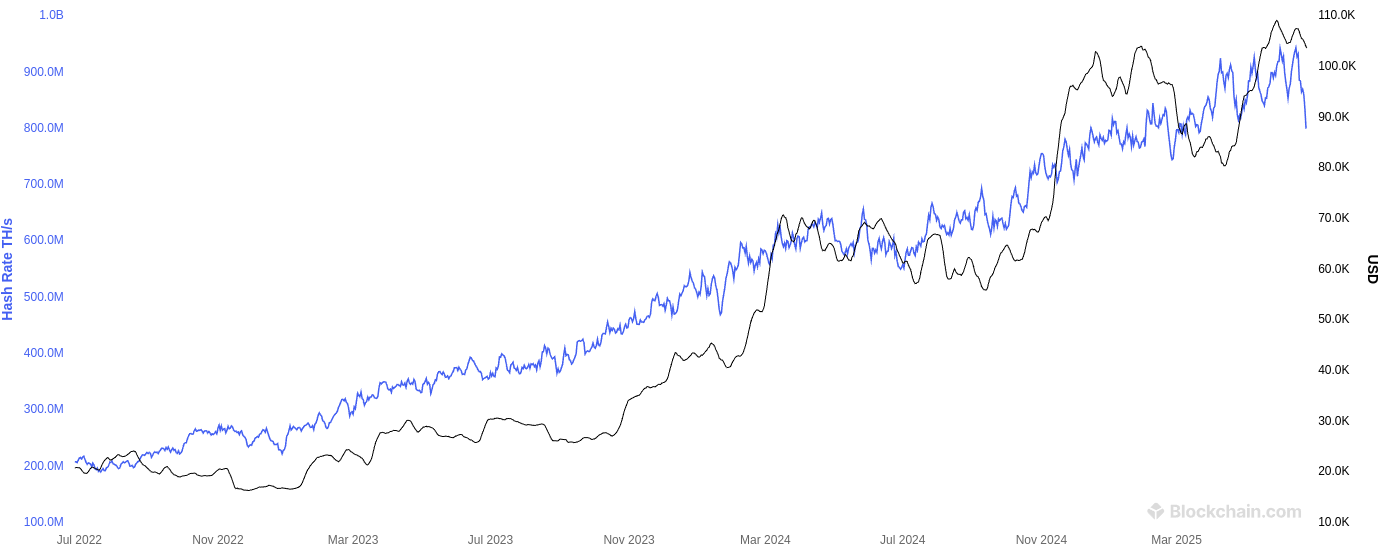

The raw muscle measuring the Bitcoin network’s mining power, just took a dip. We’re talking a drop of over 15% since June 15, the steepest plunge we’ve seen in three years.

From nearly 944 billion terahashes per second down to about 800 billion TH/s. That’s no small dip, guys.

Global power games causing issues?

Now, the crypto world’s buzzing, finger-pointing like a bunch of detectives in a sitcom.

The prime suspect? Iran. Known for running some serious Bitcoin mining rigs, the country’s been under the spotlight lately.

The National Council of Resistance of Iran threw some shade, blaming state-backed mining operations, especially those tied to the Islamic Revolutionary Guard Corps, for causing local power outages. Sounds plausible, right? But hold your horses.

The big picture

Dig a little deeper, and the story gets murkier. Iran slapped on a near-total internet blackout last Friday, aiming to shield itself from cyberattacks.

That blackout coincided with a 2.2% drop in global hashrate. Then came the US strike on Iranian nuclear sites Sunday, which reportedly knocked out parts of Iran’s electric grid.

That event matched a 1% dip in the network’s power. But these incidents only explain a tiny slice, about 3% of the total hashrate decline.

What’s more, the hashrate was already sliding before all this Iran drama started. From June 15 to the Thursday before the blackout, the network had already shed over 6% of its power. So, the Iran angle? Maybe a piece of the puzzle, but definitely not the whole picture.

Synergy

Other culprits are lurking in the shadows. Take the brutal heatwave scorching the US right now.

High temps mean AC costs more, mining rigs run less efficiently, and with electricity prices climbing, some miners, especially the smaller, less profitable ones, might just throw in the towel.

Bitcoin’s hashrate isn’t measured directly. It’s estimated based on how quickly blocks are mined and the current mining difficulty.

Since mining is a game of chance, this number’s always a bit fuzzy.

So the sudden hashrate drop is a cocktail of factors, geopolitical tension, environmental heat, and economic pressure all stirring the pot.

Like a messy office politics meeting where nobody’s quite sure who’s to blame, but everyone feels the heat.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.