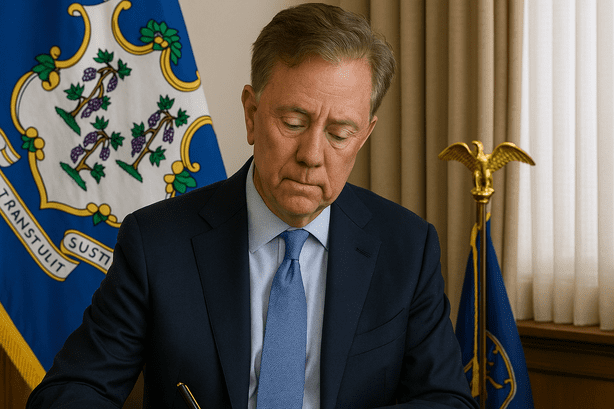

Connecticut Governor Ned Lamont has signed House Bill 7082, a new law that bans the use of digital assets in government.

The bill prohibits state agencies from accepting cryptocurrency payments or holding a Connecticut cryptocurrency reserve.

It also blocks the creation of any crypto investment or reserve program.

The new Connecticut crypto ban takes effect on October 1, 2025. The law applies to all state departments and prevents them from requiring or allowing payments in crypto. It also restricts the state from buying, storing, or investing in digital assets.

The legislation received wide support in both chambers of the Connecticut General Assembly. It was introduced in February 2025 by Representative Jason Doucette.

Jason Doucette Bill Introduced Crypto License Requirements

In addition to banning crypto use in government, House Bill 7082 sets rules for digital asset service providers.

It outlines new crypto license requirements for money transmission businesses operating in Connecticut.

These requirements affect companies that transfer, hold, or exchange crypto on behalf of users in the state. According to the June 30 draft published on LegiScan, the Department of Banking will oversee the implementation.

The bill does not allow any state agency to invest in or hold a Connecticut cryptocurrency reserve.

It also does not allow payment for taxes or services using Bitcoin or other digital currencies.

Cointelegraph contacted Jason Doucette for comment, but no reply was received by publication time.

Ned Lamont Crypto Law Contrasts With Other State Approaches

While the Ned Lamont crypto law moves Connecticut away from crypto adoption, other U.S. states are going in the opposite direction. Some have proposed or passed laws to establish their own cryptocurrency reserves.

Texas Governor Greg Abbott approved a bill in June 2025 to create a Texas crypto reserve.

In May 2025, New Hampshire Governor Kelly Ayotte signed a similar New Hampshire crypto bill. Both laws enable their states to hold Bitcoin or other digital assets for future use.

Other efforts did not succeed. In South Dakota, Montana, and Pennsylvania, lawmakers proposed crypto reserve laws in 2025, but those did not pass.

These developments show a divided approach at the state level on whether to embrace or reject government-held digital assets.

Strategic Bitcoin Reserve Adds Federal Context

At the federal level, former President Donald Trump signed an executive order in March 2025 creating the Strategic Bitcoin Reserve and Digital Asset Stockpile.

The plan aims to build up federal crypto holdings, mainly from assets seized in Justice Department cases.

The federal government’s action provides context for state-level moves like the Connecticut crypto ban. While some states aim to align with the Strategic Bitcoin Reserve model, others are blocking similar efforts locally.

Aaron Brogan, founder of Brogan Law, spoke to Cointelegraph about the bill. He said the measure shows that Connecticut does not support the path taken by pro-crypto states. Brogan added,

“This is signaling that Connecticut is symbolically opposed to cryptocurrency, and to all the states that have established Bitcoin reserves.”

The Ned Lamont crypto law prevents Connecticut from storing, investing in, or transacting in cryptocurrency through state agencies.

The law also sets conditions for crypto companies operating in the state. These restrictions begin on October 1, 2025.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.