The corporate world is catching a serious case of Bitcoin fever, and it’s spreading fast.

Just this week, five public companies decided to step into the Bitcoin market, some making their first steps, others doubling down like there’s no tomorrow.

Game theory

Leading the charge is Addentax, which just pumped up its Bitcoin buy from a planned $800 million to $1.3 billion.

Yeah, they’re dropping serious cash on up to 12,000 BTC, ditching their previous plan to mix it up with TRUMP tokens.

It’s a full-on Bitcoin maximalist move now, no distractions, just pure BTC love. This shift isn’t happening in a vacuum tho, it mirrors a growing trend where companies are putting their chips squarely on Bitcoin.

MicroStrategy, remember them? They caught lightning in a bottle by becoming a Bitcoin whale early on.

Now, a wave of corporate players is following suit. Public companies are buying more Bitcoin than ETF issuers, who themselves are scooping up more than miners can produce globally. That’s how intense this buying spree is.

Risk business

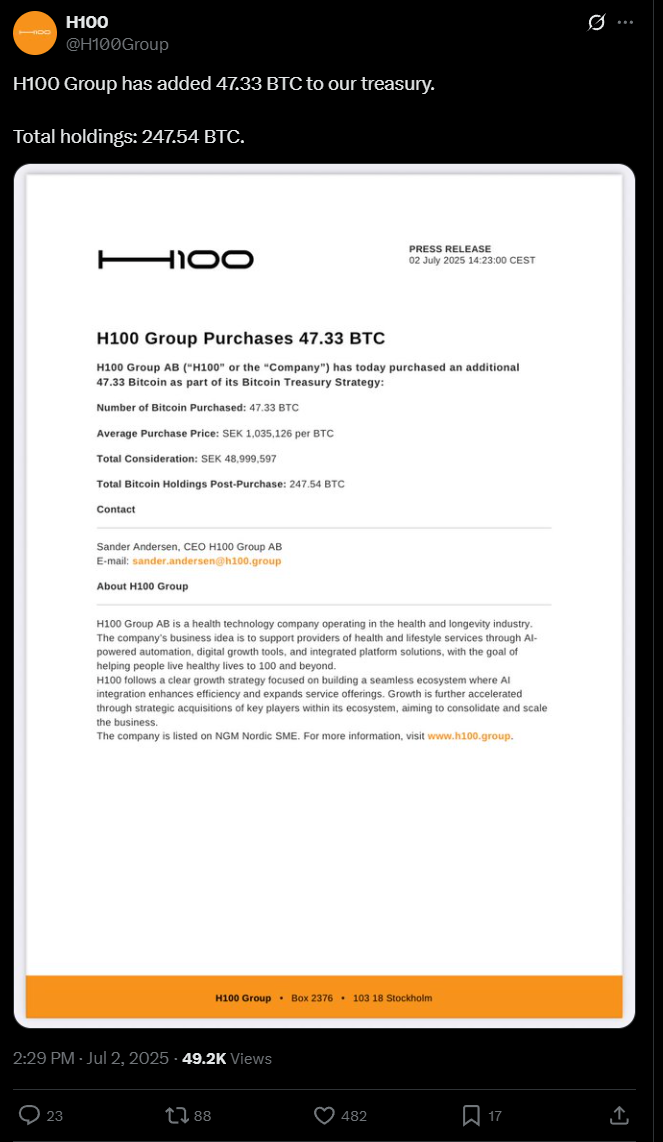

Besides Addentax, we’ve got H100 spending over $5 million on BTC at today’s $109,000 price.

Canadian lender Mogo is authorized to buy up to $50 million, while Singapore’s Genius Group grabbed $2.1 million worth.

Even Sweden’s K33 chipped in with 10 BTC, small in number but still a significant commitment.

But hey, not everything’s rosy in this Bitcoin party. Some people are waving red flags about a bubble forming.

Corporate buyers are piling in, but many of these companies are struggling in their core businesses and turning to Bitcoin as a lifeline.

It’s like betting the farm on a long shot horse because the regular races aren’t paying off anymore.

Double-edged sword

And the problem is if Bitcoin’s price takes a bigger-ish dip, these companies could face serious pain.

Unrealized losses and forced liquidations could ripple through the market, hitting the crypto ecosystem hard.

DeFi projects might find retail investors priced out of the game, threatening the whole decentralized finance dream.

So, corporate Bitcoin buying is booming, no doubt. But it’s a double-edged sword, exciting for Bitcoin’s future, yet risky for the companies and the market.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.