Brazil just got hit with one of the nastiest cyber heists in its history. We’re talkin’ about a cool $140 million gone in the blink of an eye.

How? Some slick hackers broke into C&M Software, the company that links Brazil’s Central Bank to other banks.

And get this, the whole mess started with a measly $2,700 bribe. Quite a ROI, right?

Sitting ducks

So, an employee at C&M Software sold their corporate login credentials for just a couple grand.

That’s like selling the keys to the vault for the price of a fancy dinner.

Once those hackers had the keys, they waltzed right into the software managing reserve accounts for six major financial institutions tied to the Central Bank.

Then, bam, they started moving millions around like it was Monopoly money.

This hack screams one thing loud and clear, centralized systems are a sitting duck.

When you put all your eggs, and your money in one basket, you better hope no one sells you out or cracks the code. Because once inside, the hackers had free rein.

Low-hanging fruit

And where’d the loot go? A big chunk, between $30 million and $40 million, got flipped into crypto, Bitcoin, Ethereum, USDT.

According to crypto expert ZachXBT, the stolen funds zipped through Latin American exchanges and over-the-counter platforms faster than you can say money laundering.

This is the dark side of blockchain’s magic, great for freedom, but also a playground for criminals who want to move cash with little trace.

Look, centralized systems in crypto? They’re like the office gossip, one weak link, and everything falls apart.

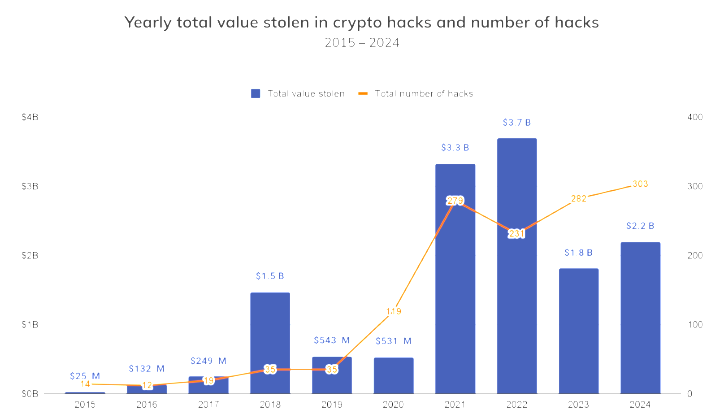

Last year, hacks on centralized exchanges exploded, especially in the latter half. Chainalysis data shows these systems have single points of failure, login creds, access keys, that hackers drool over. They’re the low-hanging fruit, ripe for the picking.

Two sides of the coin

And don’t think this is just about tech. The human factor? It’s a ticking time bomb. Insider bribery is the new weapon in the hacker’s arsenal.

Coinbase had a similar nightmare when support agents spilled secrets, affecting nearly 69,000 users.

Companies pour millions into firewalls but forget the guy with the password sitting right there.

Ironically, this hack hit just months after Brazil started cozying up to crypto with new investment proposals.

The Central Bank lost fiat cash, but the hackers used crypto to clean their hands. Blockchain’s a double-edged sword, a tool for empowerment and a door for abuse.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.