The FTX story just got a spicy new chapter, and it’s got more twists than a mob movie plot. Picture this, over 300 Chinese creditors, led by one Weiwei Ji, are throwing a wrench in the works of the FTX bankruptcy payout plan.

Why? Because they’re fed up with being lumped into the restricted jurisdictions group, which could block their rightful claims.

Give my money back

The twist in the story is this, Ji’s not even living in China! He’s a Singapore tax resident, but FTX tagged him as Chinese just because of his passport.

Talk about painting with a broad brush, huh? Now, Ji’s family holds four KYC-verified FTX accounts, with claims totaling $15 million.

That’s not chump change. He’s waving the flag, saying, they’ve played by the rules, followed every step, and now this plan threatens to snatch away our payouts in a way that’s just plain unfair.

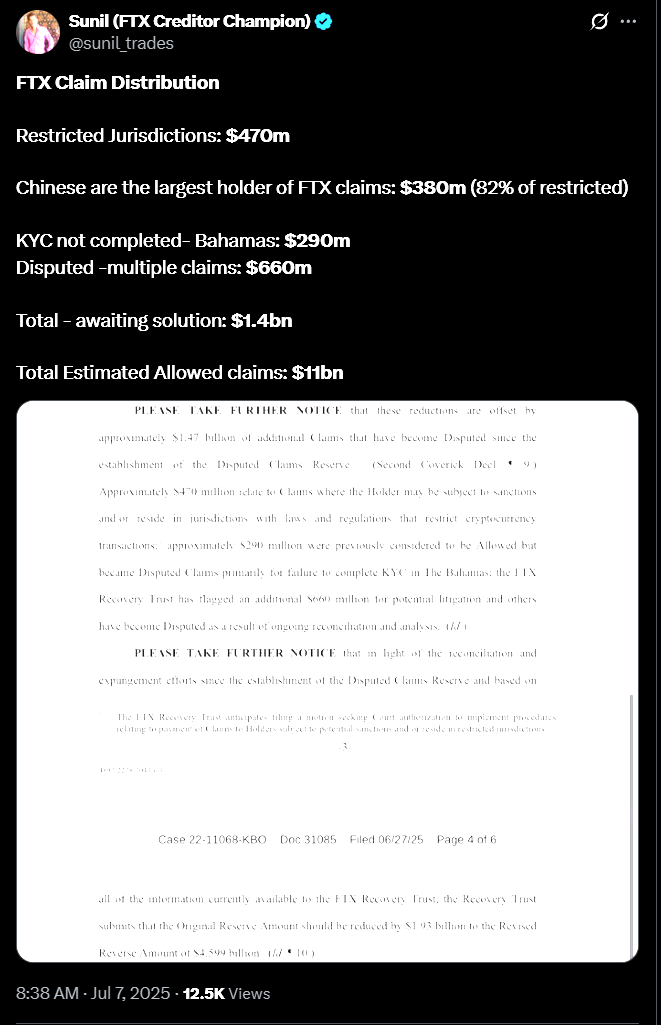

The FTX Recovery Trust wants to scrutinize claims from 49 potentially restricted countries, like China, Russia, Pakistan, you name it,with the idea of hiring local legal eagles to see if payouts can happen without breaking any laws.

If not, those claims get tossed back into the trust. And guess what? China’s claims make up 82% of the $800 million in question. That’s a lot of dough on the line.

Legal property

Ji argues that labeling China as a restricted zone doesn’t hold water legally or factually. He points to Hong Kong’s more crypto-friendly stance and references the Celsius Network case as a precedent.

Despite mainland China’s ban on crypto trading, crypto assets are still considered legal property. So, blocking payouts to Chinese creditors?

It’s a move that risks legal trouble for the trustee and flies in the face of bankruptcy rules. He’s urging the court to shoot down this motion and let the money flow.

The house doesn’t always win

Sam Bankman-Fried, the man who built and then saw his crypto empire crumble, is staring down a long stretch behind bars.

His release date? December 14, 2044. That’s right, less than 21 years into a 25-year sentence for fraud related to the FTX collapse.

Oh, and he’s been slapped with a fine north of $11 billion. He got shuffled not so long ago from New York to an Oklahoma transfer facility after nearly two years in the slammer.

The move came hot on the heels of him landing in solitary confinement for spilling the beans in an unauthorized interview. Talk about a fall from grace.

The FTX bankruptcy is like a legal chess game with billions on the table and lives changed forever.

Chinese creditors are fighting to protect their claims, challenging the idea that geography should dictate who gets paid.

And as for Bankman-Fried? His prison sentence is a reminder that in the crypto market, the house doesn’t always win.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.