Andrew Bailey, governor of the Bank of England, warned that private stablecoins could threaten financial stability.

In an interview with The Sunday Times, he said that banks should focus on tokenized deposits, not issuing their own digital tokens.

Bailey explained that stablecoins could expose banks to fast outflows. Since blockchain transactions settle within seconds, he said that redemptions would happen too quickly for banks to manage.

He stated that private stablecoins might force governments to lose control over their monetary systems.

“We cannot wait for stress to show us the cracks,”

Bailey said.

Bank of England Governor Heads Global Risk Body

Bailey now chairs the Financial Stability Board (FSB), an international regulator that sets standards to reduce systemic risks. His new position allows him to push for coordinated policies across countries.

The FSB previously released guidelines for stablecoins in 2023. Bailey said the group would now focus on detailed enforcement standards. This could include stricter rules on reserves, audits, and redemption procedures.

He also made it clear that the Bank of England should not issue a CBDC (central bank digital currency) for now. He said the country should first improve tokenized versions of existing bank deposits.

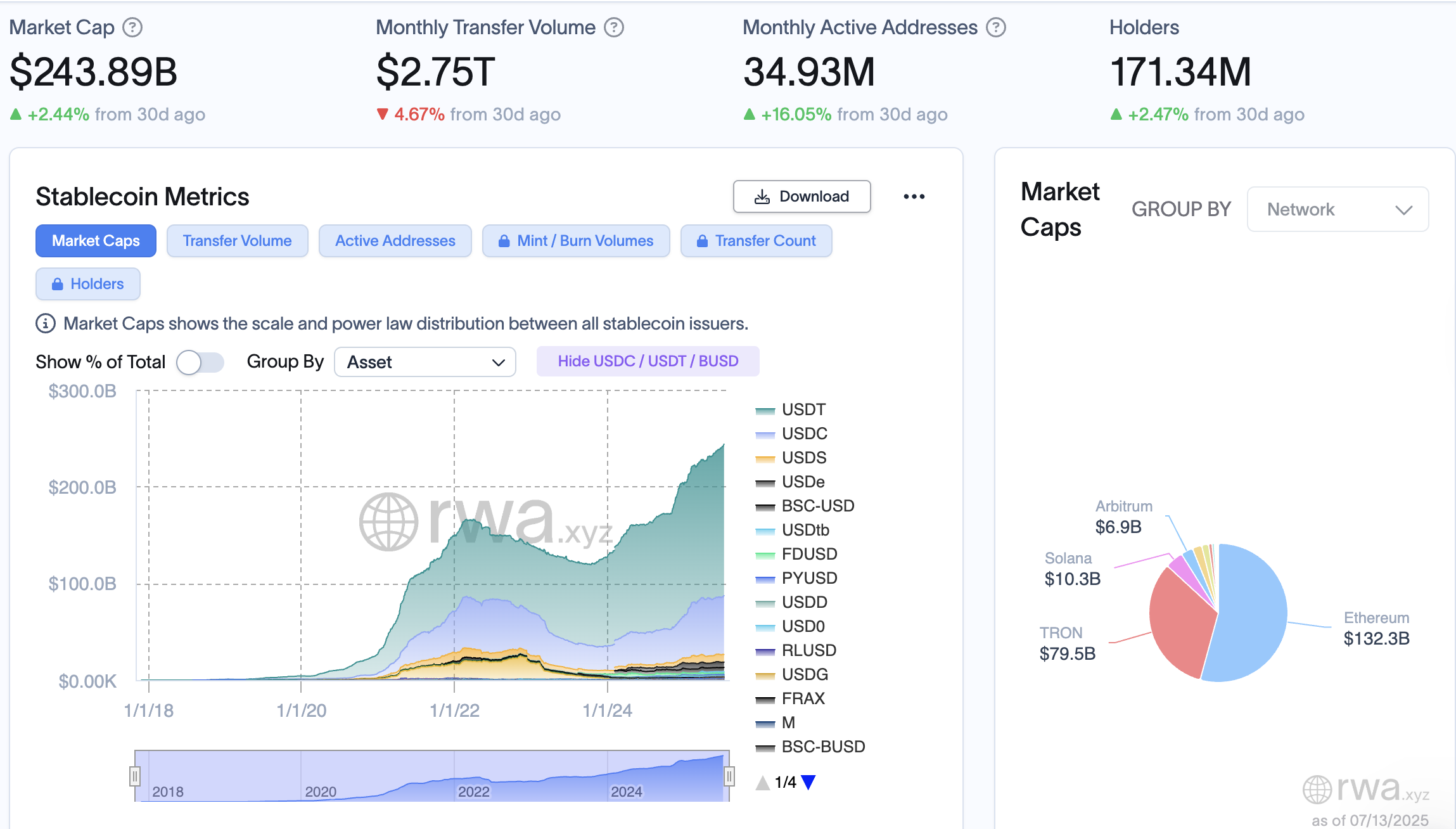

US Dollar Stablecoins Dominate the Market

Data from RWA.XYZ shows that US dollar stablecoins lead the global market. Tokens like USDT and USDC move large volumes daily, while euro-based stablecoins remain small.

Bailey warned that dollar-based tokens could spread across borders and affect other countries’ financial systems. He said such tokens allow users to avoid traditional banking systems.

As more people use stablecoins for payments, local currencies might lose relevance. Bailey said this shift could reduce central banks’ ability to manage inflation or interest rates.

Trump Administration Backs Stablecoin Regulation

Under the Trump administration, U.S. officials have pushed for strong stablecoin regulations.

In March, Treasury Secretary Scott Bessent said stablecoins would help keep the US dollar as the global reserve currency.

The administration supports overcollateralized stablecoins, backed by U.S. Treasury bills and cash held in banks.

These issuers can offer tokens to users around the world through smartphones and crypto wallets.

Federal Reserve chair Jerome Powell also supported this approach. He called for clear national rules to regulate how these tokens are created and backed.

European Officials Warn About Euro Displacement

Officials in the European Union raised concerns about US dollar stablecoins replacing the euro in daily transactions. They said that businesses could begin to prefer stablecoins over local currencies for speed and convenience.

They also stressed the need for strong oversight. European policymakers want issuers to show proof of reserves and allow regulators to monitor their operations in real time.

The European Central Bank is also working on a digital euro project. But private stablecoin growth could reduce the impact of that initiative if dollar tokens spread faster.

Tokenized Deposits Gain Attention in the UK

Banks like HSBC and Barclays are testing tokenized deposits. These projects use blockchain for speed but still keep funds under existing legal protections.

Bailey said these trials could be a safer option than private stablecoins. They let banks update payment systems without creating new liabilities.

He stated that the Bank of England would continue studying tokenized deposits. For now, stablecoin companies and financial regulators await further guidance from the FSB.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.