The Bitcoin story now? It’s like your favorite star player suddenly pulling a disappearing act right before the playoffs.

The crowd’s still buzzing, but the key players? They’re hitting the bench, scratching their heads, thinking, what’s the heck’s going on here?

Slowing inflows

Bitcoin had itself a slow week. The biggest news? Bitcoin ETF inflows plunged by 80% compared to the week before.

Yeah, that’s a full-on meltdown of interest. Institutions, the big fish with serious cash, hitting pause.

Glassnode’s new reports put this sudden chill in the spotlight, calling it the sharpest ETF inflow drop in months. It’s like your boss suddenly telling you hold your fire right when you’re ready to make the big move.

#Bitcoin ETF inflows dropped 80% last week.

But derivatives positioning remains elevated and on-chain data shows nearly all $BTC supply is still in profit.

This week’s Market Pulse unpacks the shifting balance of conviction across market participants: https://t.co/4LBrKjNh0f pic.twitter.com/NavS6wo7nI

— glassnode (@glassnode) July 29, 2025

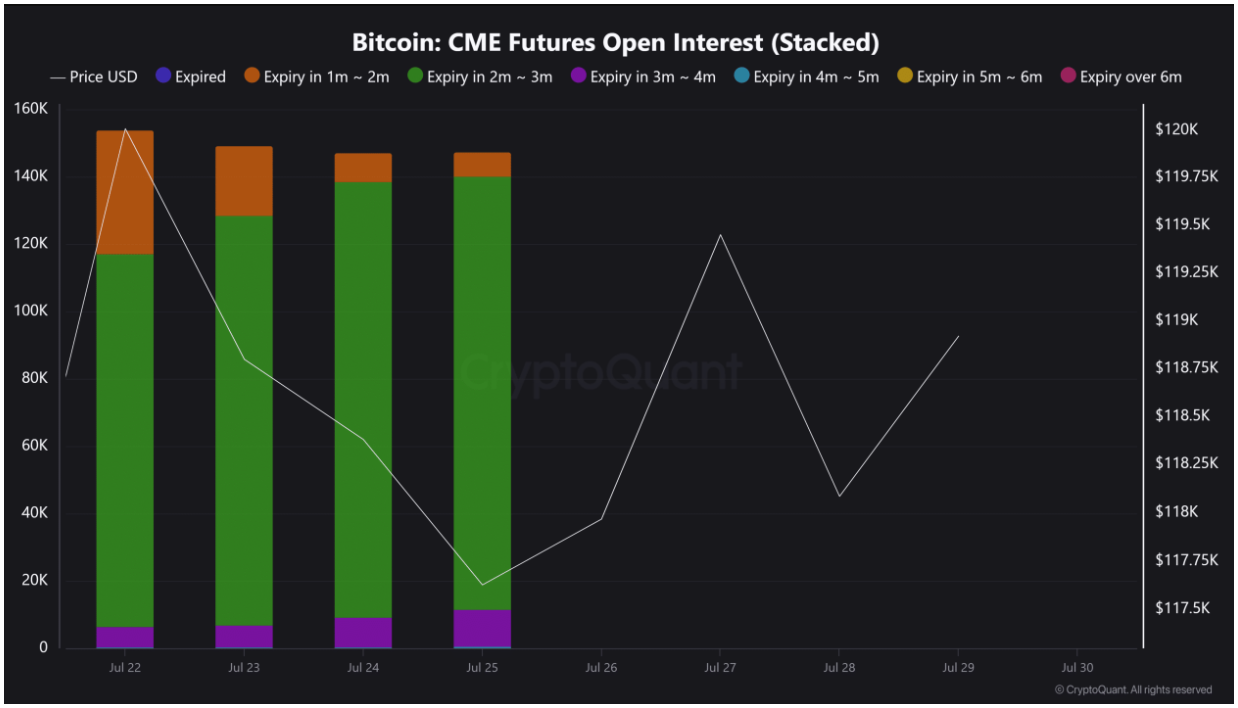

But don’t get too comfy thinking the party’s over. Behind the scenes, the derivatives markets are still buzzing. CME Futures open interest is high.

That’s a fancy way of saying traders, especially the speculators, are still gearing up for a possible breakout. It’s like everyone’s got skin in the game, just hoping this pause is the calm before a big storm, or glory, if you’re the optimistic type.

Profits soar, but danger lurks

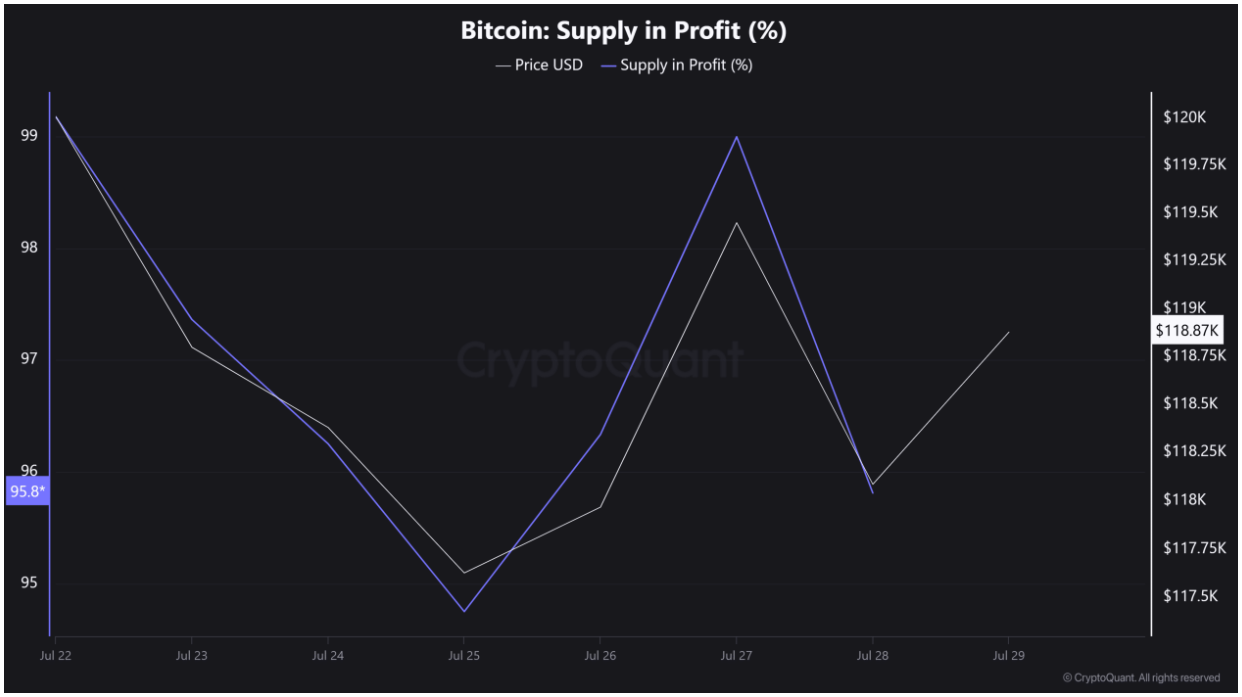

Here’s where it gets interesting, because 95.8% of Bitcoin’s supply is currently in profit. Sounds like a sweet deal, right?

Except, when nearly all holders are sitting on gains, the temptation to cash out grows like a late Friday craving for pizza.

If the momentum stalls, those paper profits could turn into a selling frenzy faster than you can say office budget cuts.

That means short-term holders might panic, and suddenly the bulls could find themselves running for cover.

Active addresses, basically the players moving coins around, have fallen since early July’s peak.

That’s the crypto version of your teammates standing by the water cooler, neither making a play nor throwing in the towel.

Large wallet holders seem stuck in a wait-and-watch mode. Nobody’s throwing the holy Bitcoin bomb yet, they’re just sizing up the scene.

Frequently Asked Questions (FAQ)

Why did Bitcoin ETF inflows drop by 80%?

The sharp decline is likely due to seasonal slowdowns and short-term profit-taking by institutional investors. It doesn’t necessarily indicate long-term bearish sentiment.

Is this inflow collapse a warning sign for Bitcoin’s price?

Not directly. Despite the drop in ETF inflows, derivatives data and on-chain metrics suggest that institutional interest remains active.

What could happen next if inflows remain weak?

Bitcoin may face increased volatility or short-term correction, but long-term trends depend on broader market sentiment and macroeconomic factors.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: July 31, 2025 • 🕓 Last updated: August 2, 2025

✉️ Contact: [email protected]