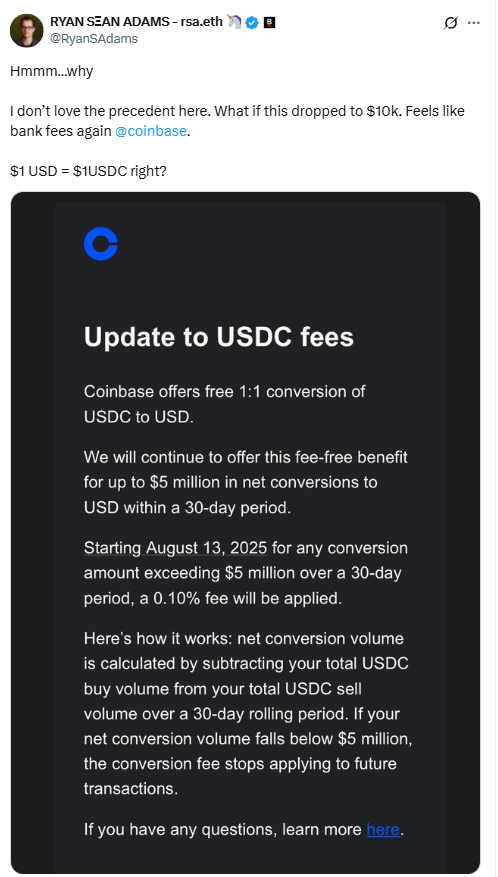

Coinbase will charge a 0.1% USDC to USD fee on stablecoin conversions above $5 million. The new policy will take effect on August 13 and applies over a 30-day rolling period.

Until now, Coinbase allowed up to $40 million in monthly fee-free stablecoin conversion.

Users converting more than that paid between 0.05% and 0.2%, depending on the amount. The updated threshold marks a steep reduction, now capped at $5 million for free conversions.

The fee applies to net conversions, meaning total USDC sales minus USDC purchases during the 30-day window.

This affects individuals and institutions using Coinbase for high-volume USDC to USD transactions.

Coinbase Revenue Falls Below Expectations

Coinbase reported $1.5 billion in Q2 revenue, missing analysts’ forecasts of $1.56 to $1.59 billion. Following the results, Coinbase shares dropped 8%.

Stablecoin-related revenue increased 12% year-over-year, reaching $332 million. Despite this, Coinbase failed to meet broader revenue targets. In Q1, the company also missed expectations. Revenue fell 10%, and net income dropped 95% due to unrealized crypto-related losses.

These continued misses on earnings explain the timing of the new USDC swap fee, as Coinbase looks to manage rising costs tied to stablecoin services.

Fee Structure Now Under Review

Bankless co-founder Ryan Sean Adams raised concerns about the policy. “What if this dropped to $10K?” he posted on X.

“Feels like bank fees again.”

In response, Coinbase stablecoins product manager Will McComb said the company was running an “experiment” to assess how fees affect USDC to USD off-ramping. He added that Coinbase is collecting user feedback to better understand the impact.

According to McComb, some competing platforms already charge more for fiat redemptions. The fee adjustment could reflect Coinbase’s operational costs in managing stablecoin conversions.

Tether Arbitrage May Have Driven Fee Change

Some observers pointed to user behavior around Tether (USDT) as a reason for the USDC to USD fee. Tether charges a 0.1% fee or $1,000 minimum for redemptions, with a $100,000 minimum redemption amount.

Users were reportedly swapping USDT for USDC and converting to dollars for free through Coinbase, bypassing Tether’s fee. This route became a cost-saving method for large holders.

Crypto figure Jordan Fish, known as Cobie, said,

“The cheapest practical route was to swap USDT to USDC and then off-ramp USDC to USD.” Coinbase CEO Brian Armstrong replied “Yep,”

confirming the behavior.

USDC Supply Grows Faster Than USDT

Data from DeFiLlama shows USDC’s market capitalization has increased 47% since January 2025. USDT’s supply rose by 20% in the same period.

The higher growth in USDC use may raise the cost of processing redemptions. Bloomberg ETF analyst James Seyffart said, “This feels similar to a create/redeem fee for an ETF.”

Seyffart added that if Coinbase must process one-way redemptions, the company likely incurs extra expenses.

He said the platform appears to be passing on these costs through the new USDC to USD fee.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 7, 2025 • 🕓 Last updated: August 7, 2025