Lead: Brian Schwalb, the DC attorney general, sued Athena Bitcoin over alleged hidden fees and weak crypto ATM fraud controls.

His office said 93% of Athena deposits in its first five months in DC were tied to scams. The complaint also cited a no-refund policy that left victims unable to recover funds or fees.

Athena Bitcoin Lawsuit: DC Attorney General Alleges Hidden Fees

The Athena Bitcoin lawsuit focuses on undisclosed fees at crypto ATM kiosks across Washington, DC.

The filing covers operations from May to September 2024. Investigators said victims paid up to 26% per transaction.

According to the complaint, Athena Bitcoin avoided the word “fee” in its Terms of Service. Instead, it used “Transaction Service Margin.”

The DC attorney general argues this language hid true costs at the point of use.

The filing includes a direct quote:

“Athena knows that its machines are being used primarily by scammers yet chooses to look the other way so that it can continue to pocket sizable hidden transaction fees.”

The office said Athena did not immediately respond to a request for comment.

Crypto ATM Fraud Data: FBI Complaints and State Limits

The Athena Bitcoin lawsuit lands amid wider concern over crypto ATM fraud. The FBI recorded nearly 11,000 complaints tied to kiosks in 2024. Reported losses exceeded $246 million.

States responded with crypto ATM transaction limits. At least 13 jurisdictions, including Arizona, Colorado, and Michigan, moved to reduce large transfers. Officials said limits could lessen scam losses at the machine level.

The DC attorney general cited this national picture to frame the Athena Bitcoin case. The office said consumer disclosures and anti-fraud checks at crypto ATM terminals remain central to reducing harm.

Athena Bitcoin Oversight Claims: Elderly Victims and Losses

The complaint says Athena Bitcoin “pocketed hundreds of thousands of dollars” in undisclosed fees from scam victims during its first five months in DC.

The median age of victims was 71. The median loss per transaction reached $8,000.

One resident allegedly lost $98,000 through an Athena Bitcoin kiosk. The DC attorney general said the company’s no-refund policy prevented recovery of fees and funds. The filing argues that victims often deposited under pressure.

Another quote in the lawsuit states:

“Athena has permitted and profited from transactions in which victims are coerced, misled, and manipulated into depositing their life savings into Athena’s machines under fraudulent pretenses.”

The office described Athena’s compliance as “ineffective oversight.”

Legal Counts and Fee Language: Undisclosed Costs at Crypto ATMs

Prosecutors charged Athena Bitcoin with deceptive and unfair trade practices. The complaint also alleges violations of DC laws protecting vulnerable adults and the elderly from financial exploitation. The Athena Bitcoin lawsuit centers on the clarity of fee disclosures.

The DC attorney general said Athena Bitcoin charged up to 26% while not clearly labeling the cost as a fee.

The term “Transaction Service Margin” appeared in policies, not on-screen in plain language at the crypto ATM.

The filing argues that users reasonably expected straightforward fee information before sending funds. It adds that undisclosed fees at crypto ATM kiosks contributed to higher losses when scams occurred.

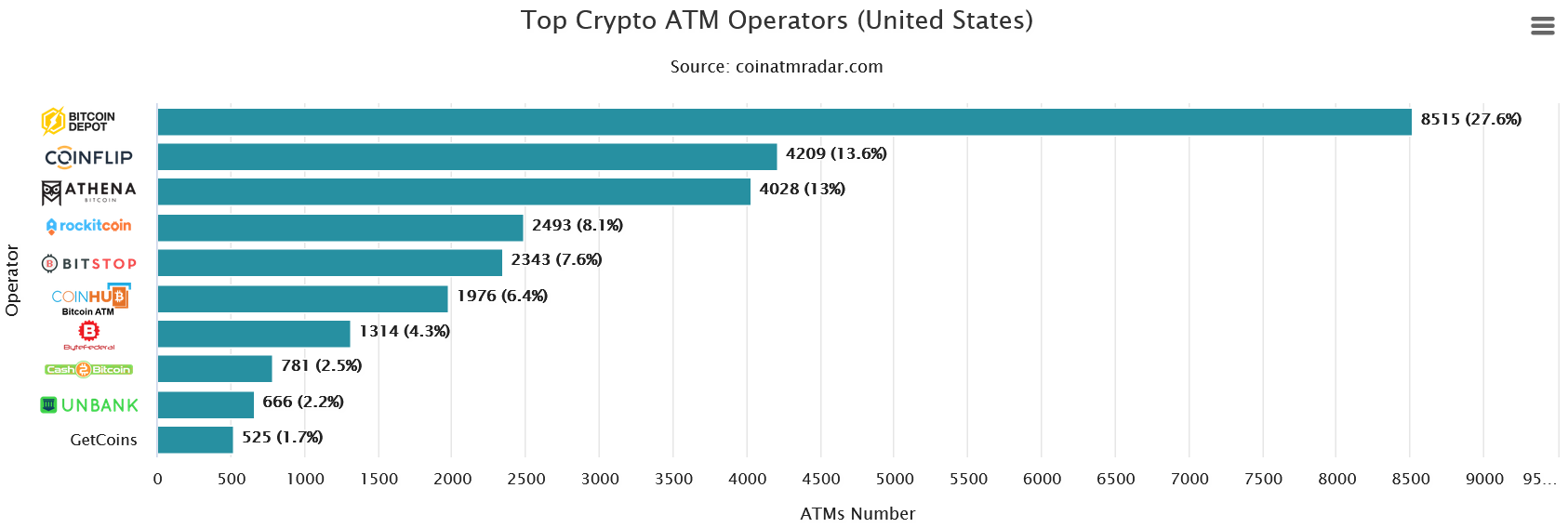

Crypto ATM Market Share: CoinATMRadar and Athena Bitcoin Position

There are 26,850 crypto ATMs in the United States, per CoinATMRadar. Bitcoin Depot operates 27.6% of machines. CoinFlip holds 13.6%. Athena Bitcoin has 13%.

This market share places Athena Bitcoin among the largest crypto ATM operators.

Therefore, the Athena Bitcoin lawsuit could affect how large providers present hidden fees and safeguards.

The DC attorney general will push the case through court. The record includes the 93% scam-linked deposit figure, the 26% alleged fee rate, and the $98,000 top loss example.

The filing maintains that undisclosed fees and ineffective oversight harmed DC residents using Athena Bitcoin crypto ATMs.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 10, 2025 • 🕓 Last updated: September 10, 2025