When the crypto seas get rough, whales start splashing around, and October served up some splashes worthy of a Hollywood showdown.

The latest data from on-chain sleuths reveals Ethereum’s biggest players are shuffling their cards, repositioning their massive ETH stacks like it’s a high-stakes poker game on the blockchain.

Buy the dip?

After a brutal couple of weeks where whales offloaded 1.36 million ETH in early October, it looks like the tide is turning.

In the week leading up to October 25th, those same mega-holders, wallets usually clutching between 100 and 10,000 ETH, began snapping up around 218,470 ETH again, roughly $870 million worth at current prices.

Some call it a classic “buy-the-dip” move, but others say it’s a full-scale confidence rally.

Betting on the comeback

Specific wallets took the spotlight. One fresh whale spent $32 million on 8,491 ETH in a matter of hours, an aggressive re-entry after the bloodbath.

Another notable whale withdrew 12,000 ETH, valued at around $46 million, from Binance, causing big social media chatter, and suggesting these giants are scooping coins off exchanges to stash in their secret fortresses.

The game? Reduce sell pressure and keep coins off the market, hinting at a bullish undercurrent.

And it’s not just the big buys. Some whales are pulling back or even shifting strategy.

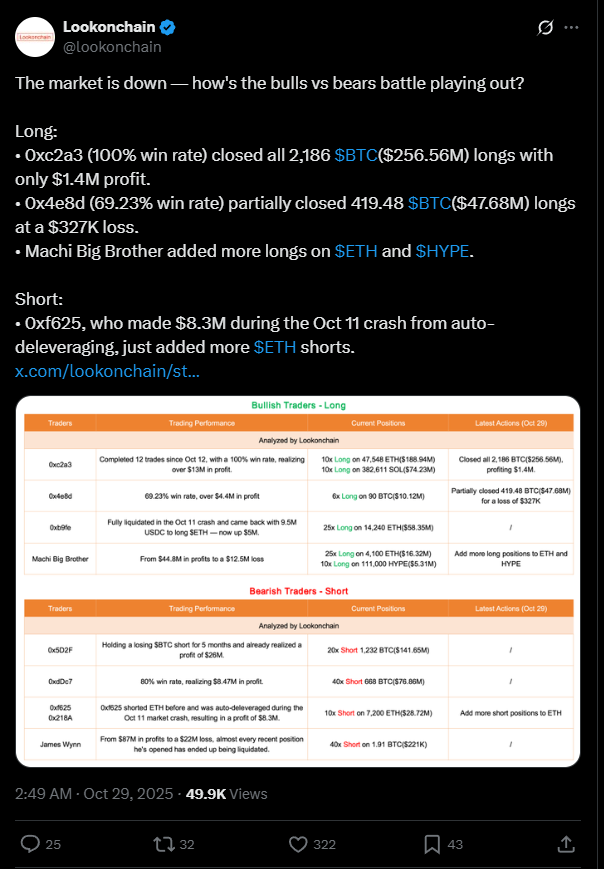

One famous or infamous “perfect win rate” trader closed over 2,000 BTC longs and scaled back ETH and Solana positions, making a modest $1.4 million from an exposure of $256 million.

Others have doubled down on new ETH longs despite losses, betting on the comeback. Steel nerves, diamond hands.

Part accumulation, part retreat?

This whale hustle coincides with Bitcoin bouncing back past $115,000 earlier in this week, wiping out $370 million in shorts and pumping the overall market cap beyond $4 trillion.

It’s a mixed chessboard, part accumulation, part tactical retreat.

Analysts watching these moves see more of a reset than a breakdown. The prolonged altcoin downtrend might be nearing its end, with whales setting buy walls near critical supports.

The battle between the bullish HODLers and skittish sellers is fierce, but signs of conviction among whales could herald a bigger bounce.

So in short, Ethereum’s whale drama is far from over, but the giants are playing for keeps, hinting the next crypto rally could be just over the horizon.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

You may be interested in: Venezuela forradalmat indít: bankokban érkezik a Bitcoin és a stablecoin

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 31, 2025 • 🕓 Last updated: October 31, 2025

✉️ Contact: [email protected]