October usually brings crypto lovers a feast, a rising tide lifting Bitcoin and altcoins alike.

They call it “Uptober” for a reason. But 2025 pulled a fast one, turning that party into a hangover nobody wanted.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Free-fall

The month kicked off with fireworks, crypto’s total market capitalization hit a sky-high $4.27 trillion, everyone’s eyeballs gleaming with greed.

But then, the whole circus crashed on October 10th, an event now infamous as the “10/10 crash.”

Imagine a crypto bloodbath where leveraged positions worth $19 billion vaporized and over 1.6 million traders threw in the towel.

And as analysts highlighted, spot markets didn’t get off easy either, losing nearly $888 billion. That kind of free-fall is the stuff nightmares are made of.

The carnage also crushed the momentum Uptober had built, leaving crypto investors nursing wounds and watching their dreams evaporate.

So far, a faint $362 billion trickled back into the market, but investors are acting like my aunt at a rollercoaster, cautious and hesitant.

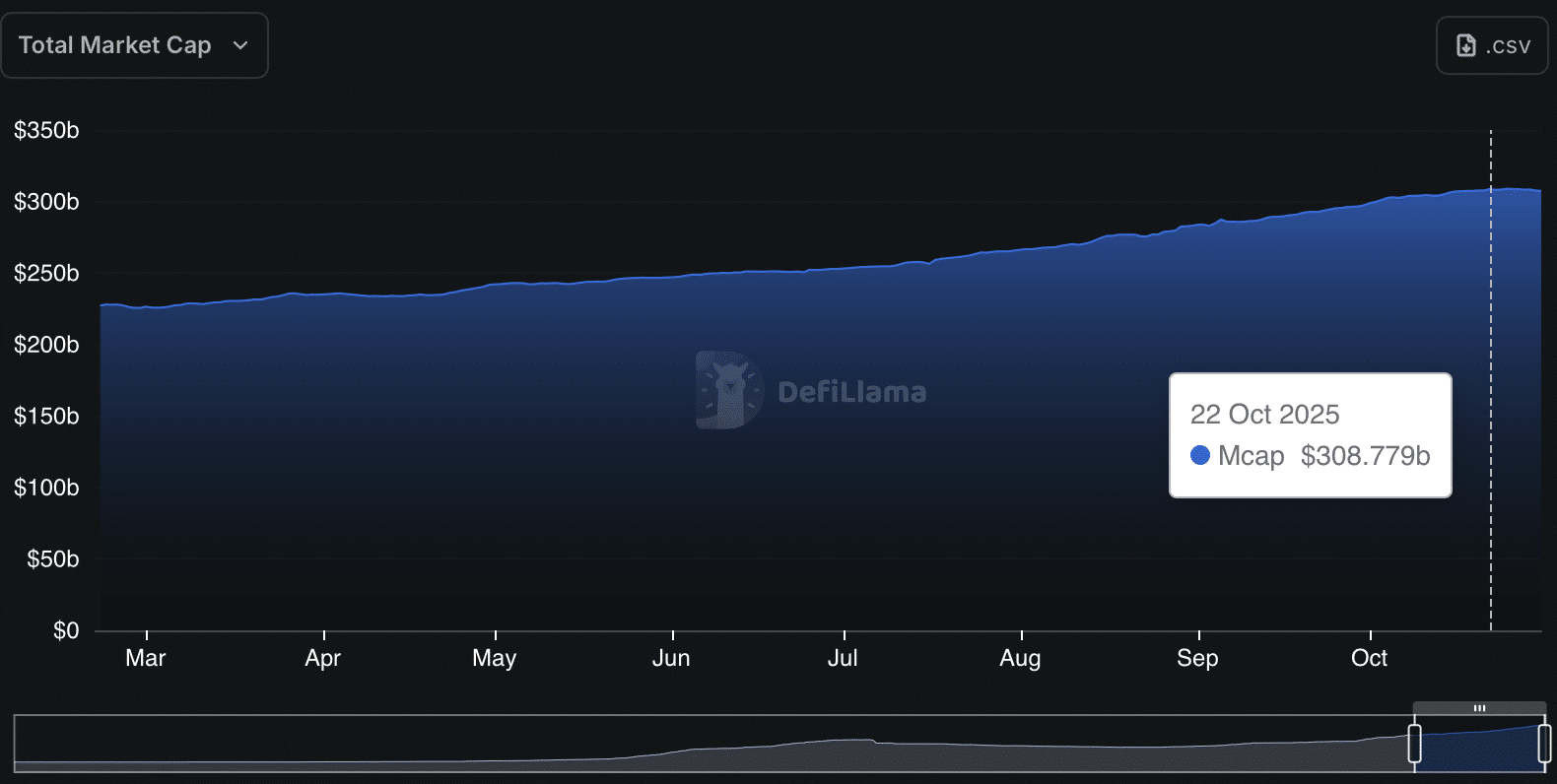

Experts say the numbers aren’t nice at all, outflows sit at $526 billion, accompanied by a humongous stablecoin stash of $308 billion, which screams “Let’s wait and see.”

No more rate cuts?

Now, it’s not just crypto’s own drama keeping traders on edge. Global economics decided to play spoiler too.

The U.S. and China’s trade war escalated with a bonkers 100% tariff slapped on all Chinese imports on the very day of the crash.

It’s as if Uncle Sam declared war on the Chinese goods supply chain, and the markets took the hit directly.

And just when everyone thought the Federal Reserve might ease off the brakes with a small 25-basis-point rate cut, Fed Chair Powell dropped a truth bomb, don’t count on more cuts soon. This half-hearted signal did nothing to kindle any risk-on enthusiasm.

HODL

Uptober is called Uptober because it has been a tradition of gains. 2022 was a party pooper with a 24.9% drop.

This year’s 24.19% decline stings but remember, the market still hit an ATH earlier in the month. There’s stubborn bullish fire hiding underneath the ashes.

Looking forward, Young predicts BTC will meander between $110,000 and $115,000 early November, bracing for turbulence if geopolitical drama worsens.

Mid-November might finally bring some gains again, but until that, we hodl.

💬 Editor’s Take (human, conversational tone)

Every October, the crypto world chants “Uptober” like a lucky spell — and usually, it works.

But this time? October pulled the rug out from under everyone. The 10/10 crash felt like the universe reminding traders that leverage cuts both ways.

Still, here’s the thing about this market — it never truly dies. Even in chaos, there’s resilience.

Bitcoin has survived bigger blows and uglier headlines. Maybe this Uptober hangover is just the pause before another wave.

One thing’s certain: those still holding on aren’t just traders — they’re battle-hardened veterans of the world’s wildest financial ride.

Frequently Asked Questions

What is the 10/10 crypto crash?

The 10/10 crash refers to the massive crypto market sell-off on October 10, 2025, when over $19 billion in leveraged positions were liquidated, wiping out around $888 billion from the market.

Why did crypto markets crash in October 2025?

The crash was triggered by heavy leverage unwinds, a U.S.–China trade war escalation with 100% tariffs, and the Federal Reserve signaling no further rate cuts soon.

How much did Bitcoin fall during the crash?

Bitcoin dropped to a four-month low of around $104,000, losing more than 3.5% in October — breaking a six-year “Uptober” streak of monthly gains.

Will Uptober recover before November?

Analysts expect Bitcoin to stabilize between $110,000–$115,000 through early November, with potential upside mid-month if geopolitical tensions ease.

You may be interested in: Did $184M ETH ETF Outflows Just Set Up a 61% Ethereum Breakout to $6,200?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: November 1, 2025 • 🕓 Last updated: November 1, 2025

✉️ Contact: [email protected]