Willy Woo says Strategy would need “one hell of a sustained bear market” to face Bitcoin liquidation.

He posted the comment on X on Wednesday. The statement targets the recurring claim that Strategy could be forced to sell.

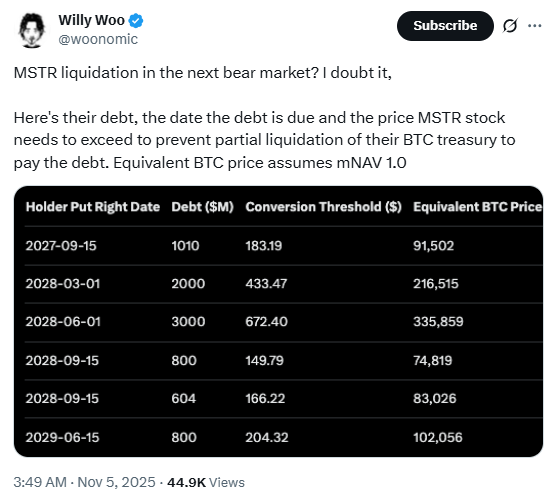

Woo focuses on thresholds, not narratives. He links equity prices and Bitcoin prices to a specific debt date. The frame keeps the Bitcoin liquidation debate tied to numbers.

Another analyst reinforced the view. The Bitcoin Therapist said “Bitcoin would have to perform horribly” for selling to start. The remark keeps the discussion on triggers and not headlines.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Strategy debt and convertible notes: $1.01B due in 2027

Strategy carries mainly convertible senior notes. As they mature, the firm can settle in cash, stock, or a combination. That structure can limit forced Bitcoin sales during stress.

The key line item is $1.01 billion due on September 15, 2027. Woo highlights an equity threshold for MSTR that addresses that bill. He says MSTR must trade above $183.19 to avoid selling Bitcoin for repayment.

Woo ties that stock level to Bitcoin ~$91,502, assuming mNAV = 1. In this context, mNAV treats MSTR’s market value as equal to the net asset value of its Bitcoin and other assets.

If Bitcoin trades near that band by 2027, the MSTR threshold looks attainable.

Bitcoin price and MSTR price now: context for the liquidation math

At the cited time, Bitcoin trades near $101,377, down 9.92% over seven days, per CoinMarketCap. 3

The figure frames Woo’s Bitcoin liquidation thresholds. It shows how far current price sits from the $91,502 stress line.

MSTR closed Tuesday at $246.99, down 6.7% and at a seven-month low. Even so, MSTR $246.99 remains above Woo’s $183.19 line. The spread can change quickly in volatile Bitcoin markets.

Strategy holds about 641,205 BTC, worth roughly $64 billion at the cited time, per Saylor Tracker.

The size of that Bitcoin stash defines the discussion. Any Bitcoin liquidation would impact liquidity and market tone.

Partial liquidation scenario: 2028 bull market timing risk for Bitcoin and MSTR

Woo does not expect Bitcoin liquidation in the next bear market. However, he notes a different risk window.

He sees a “chance of a partial liquidation” if Bitcoin fails to climb fast enough during an assumed 2028 bull market.

That risk centers on timing. Convertible notes, MSTR equity levels, and Bitcoin trajectory may not align. If Bitcoin appreciation lags, optionality narrows and pressure can rise.

Forecasts from industry figures remain wide. Cathie Wood and Brian Armstrong have cited Bitcoin $1 million by 2030.

Woo’s thread does not rely on long-range targets. It focuses on near-term Bitcoin and MSTR thresholds linked to Strategy debt.

Bitcoin liquidation checkpoints: MSTR $183.19, Bitcoin $91,502, and mNAV

Woo’s framework rests on clear checkpoints. MSTR $183.19 matters for the $1.01B due in 2027. Bitcoin ~$91,502 with mNAV = 1 links the equity line to the coin price. These markers allow tracking without speculation.

Reactions from analysts add context. The Bitcoin Therapist repeated that Bitcoin must perform very poorly for selling to start. The emphasis returns the Bitcoin liquidation topic to sustained price damage, not brief shocks.

Convertible notes give Strategy choices: cash, stock, or a mix. That design can reduce pressure to sell Bitcoin at weak prices.

It does not erase risk. It changes how any Bitcoin liquidation could unfold.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 5, 2025 • 🕓 Last updated: November 5, 2025