S&P Global Ratings cut Tether’s USDT stablecoin to the lowest score on its stablecoin stability scale.

The agency now labels the USDT dollar peg as “weak” and questions how firmly the token can hold 1 dollar in stress events.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The S&P Global Ratings scale measures how well a stablecoin keeps its peg to a reference currency. In this case, it looks at how USDT tracks the US dollar.

A weak score means S&P sees meaningful risk that the USDT dollar peg could face pressure if markets move sharply.

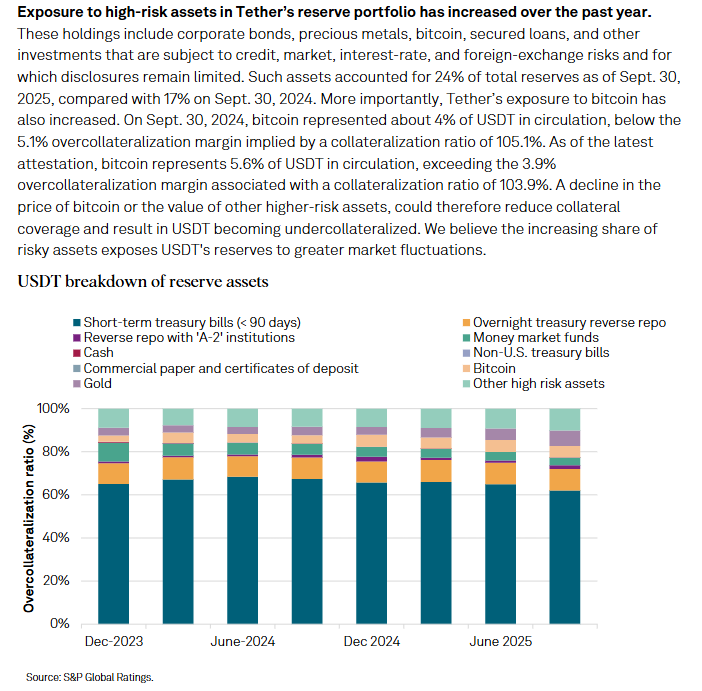

In the report, S&P Global Ratings said Tether reserves include US Treasurys, Bitcoin reserves, gold reserves, loans, and corporate bonds.

It described Bitcoin, gold, loans, and some bonds as “higher-risk” assets because their prices can change quickly and affect the value of the USDT stablecoin backing.

Bitcoin Reserves, Gold Reserves And US Treasurys In Tether USDT Backing

S&P focused on one number inside the Tether reserves. It said Bitcoin represents 5.6% of USDT in circulation, while the collateralization ratio stands at 103.9%, leaving a 3.9% overcollateralization margin.

The report stated:

“Bitcoin represents 5.6% of USDT in circulation, exceeding the 3.9% overcollateralization margin associated with a collateralization ratio of 103.9%. A decline in the price of bitcoin or the value of other higher-risk assets could therefore reduce collateral coverage.”

In simple terms, Tether holds about 3.9% more assets than the total value of USDT in circulation.

However, S&P Global Ratings warns that if Bitcoin reserves or other “higher-risk” assets fall in price, that extra margin could shrink.

The agency also pointed to gold reserves, loans, and corporate bonds inside the Tether reserves mix.

These instruments can be harder to sell fast or value smoothly in a stressed market. Because of this, S&P sees additional risk around how the USDT stablecoin might behave under strong market moves.

At the same time, S&P Global Ratings noted that about 75% of USDT backing comes from US Treasurys and other short-term financial instruments.

It described these US Treasurys and money-market assets as “low risk” compared with Bitcoin, gold, and loans.

Tether Rejects S&P Global Ratings USDT View

Tether is headquartered in El Salvador and regulated by the National Commission of Digital Assets (CNAD).

According to S&P Global Ratings, the CNAD regime has looser requirements for reserve assets than some other major financial centers.

The report also criticized the level of independent checks on Tether reserves. S&P pointed to a lack of full audits or detailed proof-of-reserves reports as a core reason for the weak USDT rating.

The agency said more frequent and deeper external reviews would reduce uncertainty around the backing of the USDT stablecoin.

In a statement to Cointelegraph, Tether called the S&P Global Ratings report “misleading.”

The company said it “strongly disagrees with the characterization presented in the report” and argued that the analysis “fails to capture the nature, scale, and macroeconomic importance of digitally native money and overlooks data that clearly demonstrate USDT’s resilience, transparency, and global utility.”

Stablecoin Regulation, USDT Scale And 300 Billion Dollar Market Cap

The S&P Global Ratings move comes during a crucial year for stablecoin regulation. In 2025, the United States passed new stablecoin regulation, and the administration of US President Donald Trump framed stablecoins as one way to support US dollar influence in global markets.

Over the same period, the combined stablecoin market cap climbed past 300 billion dollars. This growth increased attention on how each major stablecoin, including Tether’s USDT stablecoin, is backed and how stable each dollar peg really is during market stress.

Tether has also built gold reserves of 116 tons, held as part of the Tether reserves backing USDT. Those gold reserves place the company near smaller central banks and some nation-states when measured by reported gold holdings.

Because Tether holds large US Treasurys, significant gold reserves, and can mint and redeem the USDT stablecoin, some analysts describe its role in crypto markets as similar to a central banking function.

The new USDT rating from S&P Global Ratings now adds another reference point for how outside agencies see the stability of the USDT dollar peg and the structure of Tether reserves.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 27, 2025 • 🕓 Last updated: November 27, 2025