US investors poured more than $31.77 billion into US crypto ETFs in 2025, even as crypto prices softened near year end.

The flows covered multiple products, including spot Bitcoin ETFs and spot Ether ETFs, according to Farside Investors data cited in the report.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Spot Bitcoin ETFs took the largest share. They drew about $21.4 billion in net inflows during 2025, based on Farside Investors numbers. However, the report said 2024 saw $35.2 billion in net inflows, so the yearly total fell.

Spot Ether ETFs added about $9.6 billion in net inflows in 2025, according to the same dataset. Since Ethereum ETFs launched in July 2024, the report framed 2025 as the first full year of trading for spot Ether ETFs.

BlackRock IBIT widens the gap as other spot Bitcoin ETFs split

BlackRock IBIT dominated spot Bitcoin ETFs in 2025. BlackRock’s iShares Bitcoin Trust (IBIT) posted about $24.7 billion in inflows by year end, based on Farside Investors data cited in the report.

That total put BlackRock IBIT far ahead of rivals. The report said IBIT inflows ran about five times larger than Fidelity FBTC, the Fidelity Wise Origin Bitcoin Fund. As a result, US crypto ETFs growth depended heavily on BlackRock IBIT.

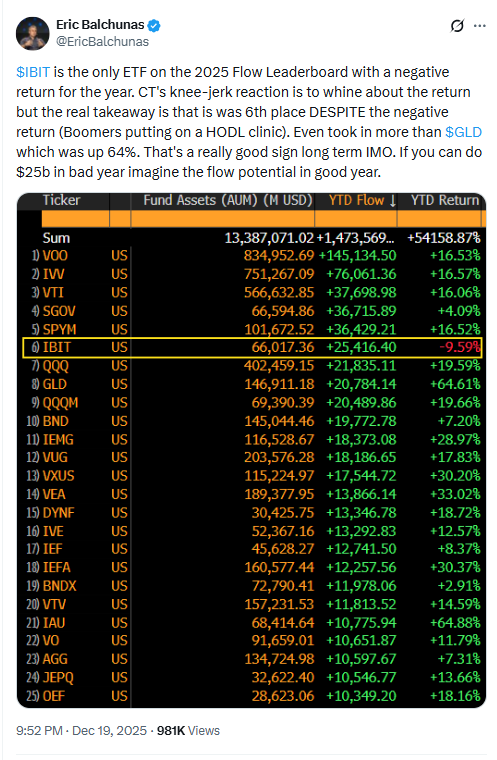

Bloomberg ETF analyst Eric Balchunas highlighted BlackRock IBIT in mid December. He said IBIT ranked sixth in net inflows among all ETFs, behind broad index funds and a treasury bond ETF.

“If you can do $25b in [a] bad year imagine the flow potential in [a] good year,” Balchunas said, while noting Bitcoin fell slightly from about $93,500 at the start of 2025.

Ethereum ETFs stay led by BlackRock ETHA as late year flows fade

Ethereum ETFs also showed concentration at the top. BlackRock ETHA, the iShares Ethereum Trust ETF, held almost $12.6 billion in inflows, according to the report.

Still, the report said BlackRock ETHA failed to post an inflow over the last 12 trading days in the period shown.

Other Ethereum ETFs trailed at a distance. The report listed Fidelity’s Ethereum Fund (FETH) at about $2.6 billion in inflows. It also put the Grayscale Ethereum Mini Trust ETF at about $1.5 billion.

The report also cited Glassnode data on demand. It said spot Bitcoin ETFs and Ethereum ETFs showed little to no renewed demand over the past month.

That data point described recent behavior rather than a wider trend.

Solana ETFs and new filings expand US crypto ETFs lineup

New products added to the US crypto ETFs lineup late in the year. The report said Solana ETFs totaled about $765 million since launching in late October 2025. It also said Litecoin, Solana, and XRP ETFs launched in the second half of the year.

The report linked faster approvals to leadership changes at the SEC during 2025. It said the agency accelerated approvals for new crypto products, which helped broaden the set of US crypto ETFs available to investors.

Analysts also discussed what could come next under the SEC’s “generic listing standards,” which the report said no longer require each application to be reviewed case by case. Bitwise said more than 100 crypto ETFs could launch in 2026.

Bloomberg analyst James Seyffart agreed more products could arrive, while adding, “We’re going to see a lot of liquidations in crypto ETP products,” and he placed the timing at late 2026 or by the end of 2027.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 1, 2026 • 🕓 Last updated: January 1, 2026