US Representative Warren Davidson said the GENIUS Act could weaken financial privacy and expand government oversight of payments.

He warned that Digital ID rules and a CBDC path could push the US toward a permissioned system.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

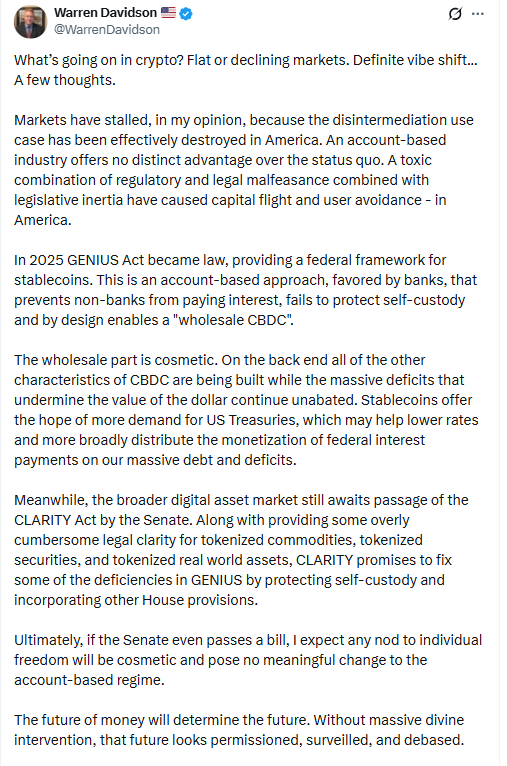

In a post on X on Wednesday, Warren Davidson criticized the stablecoin focused GENIUS Act. He said it could enable a wholesale US dollar CBDC used for “surveillance, coercion, and control.”

Davidson also said a Digital ID system could follow. He said that approach could force people to get government permission to use their own money, which he linked to financial privacy and self custody concerns.

GENIUS Act Debate Centers on Digital ID, CBDC, and Financial Privacy

Warren Davidson framed the GENIUS Act as more than a stablecoin bill. He argued the structure could still support a CBDC style system, even if it starts with stablecoin rules.

He wrote,

“Do not be deceived,” while pushing back on claims that the bill protects freedom by default. He also said policymakers should “reject this globalist surveillance state and return to first principles.”

Davidson connected those “first principles” to permissionless money. He told his followers that Bitcoin began as a peer to peer payment idea, and he said the goal was permissionless use rather than heavy gatekeeping.

Warren Davidson Record Highlights Self Custody and CBDC Resistance

Warren Davidson has backed self custody and financial privacy in Congress since he began representing Ohio in 2016. The report described him as a frequent supporter of privacy and permissionless access.

It also said Davidson has introduced legislation aimed at restricting state control over crypto. The report added that he has supported efforts that would criminalize CBDCs.

In addition, the report referenced a bill connected to leadership at the Securities and Exchange Commission.

It said one measure sought to remove then SEC chair Gary Gensler, which the report tied to Davidson’s broader crypto policy push.

Marjorie Taylor Greene Joins Digital ID and CBDC Warnings on GENIUS Act

Representative Marjorie Taylor Greene said she voted no on the GENIUS Act. She argued the bill hands power to banks and opens a “back door” to a CBDC.

Greene echoed the same Digital ID and self custody themes. She wrote, “The real danger lies in Digital ID, CBDC, and no self custody,” while aligning her message with Davidson’s focus on financial control.

Both lawmakers pointed to the CLARITY Act as a better option than the GENIUS Act. The report said the CLARITY Act is awaiting passage in the Senate and is expected to be marked up in early 2026.

CLARITY Act Focuses on Self Custody, While GENIUS Act Remains in Effect

Warren Davidson said the CLARITY Act could address gaps he sees in the GENIUS Act. He said, “CLARITY promises to fix some of the deficiencies in GENIUS by protecting self custody and incorporating other House provisions.”

However, Davidson also questioned how much the CLARITY Act can change after GENIUS Act implementation. He said that with the GENIUS Act in effect, changes tied to individual freedom would be “largely cosmetic.”

He also used broader language about where money systems can lead. Davidson wrote,

“The future of money will determine the future. Without massive divine intervention, that future looks permissioned, surveilled, and debased,”

while keeping the focus on Digital ID, CBDC risk, and financial privacy.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 1, 2026 • 🕓 Last updated: January 1, 2026