Bitcoin four-year cycle rumors of death are greatly exaggerated. On-chain sleuth Willy Woo spots capital flows slowing just like old times, so he says price might strut steady, but the pulse beneath tells the real tale.

Bitcoin Four-Year Cycle Shows Capital Deceleration

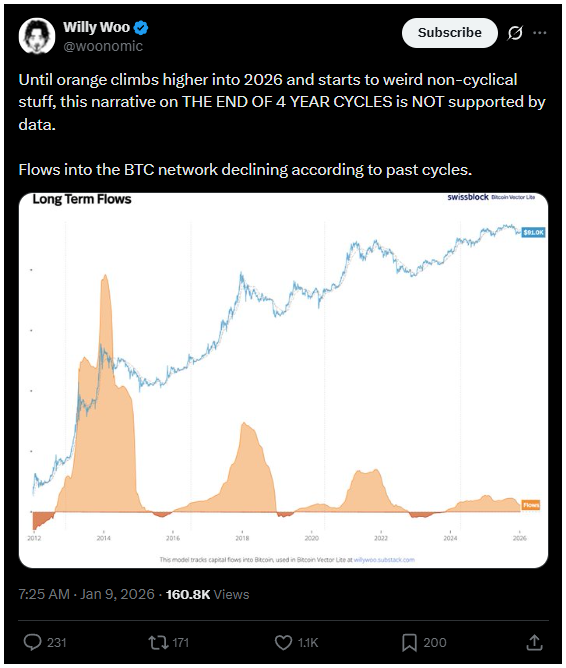

Willy Woo skips price charts for the good stuff, raw capital inflows and outflows pulsing through Bitcoin’s veins.

Fresh money’s tapering off, net inflows cooling fast, mirroring transitions from past cycles like clockwork.

Headlines scream bull, but on-chain whispers say hold your horses, enthusiasm’s simmering down under the hood.

This slowdown is actually classic, long-term holders offload to latecomers chasing the tail. Woo nails it, Bitcoin four-year cycle ain’t dead, just playing coy in a suit.

Think stock market panics of yore, like the legendary 1929’s Black Tuesday when inflows froze mid-roar before the crash, or dot-com ’01 where capital choked despite Nasdaq highs.

Human greed and fear stick to four-year-ish beats.

Bitcoin four-year cycle fits that mold, supply halvs every four, psychology loops, institutions just paint it fancier.

Narrative Claims Bitcoin Four-Year Cycle Vanished

People yap that spot ETFs, whale custody, and BTC-collateral loans killed the boom-bust, and it’s probably true. Partially.

Liquidity smooths bumps, stretches buys, turns BTC into macro darling over cycle pony. Volatility? Tamed. Accumulation? Endless, they swear.

Woo chuckles, surface sheen hides the beat. Institutions swap retail fireworks for boardroom drips, ETFs funnel slow cash, lending props floors. The rhythm bends, but never breaks.

Institutions Reshape, Don’t Kill Bitcoin Four-Year Cycle

ETFs cut forced sells, custody steels nerves, loans grease wheels.

No more retail FOMO spikes, now it’s committee nods and balance sheet shuffles. Capital creeps institutional-style, dampening volatile swings.

Yet Woo’s models catch the dip, inflows lag price, signaling distribution stealth-mode.

Each cycle gets called “done”, think 2018 bear, 2021 top, but on-chain ticks accumulation, markup, blow-off, trough. Same dance, classier shoes.

Why Bitcoin Four-Year Cycle Outlives the Hype

Markets morph, greed doesn’t. Bitcoin four-year cycle roots in halvings, risk waves, conviction tides, and ETFs just whisper the tune.

Woo’s peek under the kimono shows deceleration now, transition brewing. Too soon for obituaries.

Human nature loops every four-ish years, even suits can’t rewrite psychology. But Bitcoin isn’t human.

It keeps that heartbeat amid the noise, because it’s programmed in protocol-level.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: January 12, 2026 • 🕓 Last updated: January 12, 2026

✉️ Contact: [email protected]