Backpack said it plans to launch a 1 billion supply Backpack token in the future. The exchange tied its release schedule to a planned Backpack IPO in the United States.

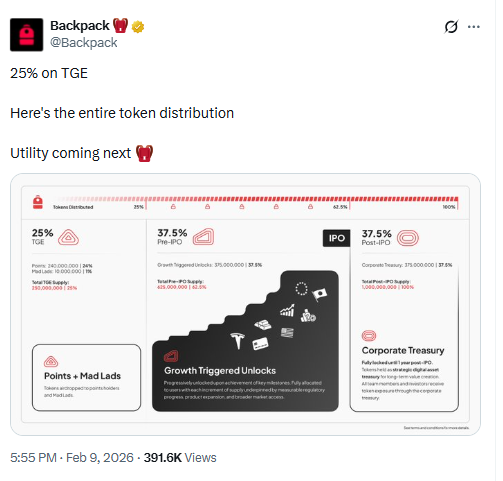

The company said the launch begins with 25% of supply. That equals 250 million tokens. Backpack has not shared the launch date.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Backpack also published a tokenomics framework that links later releases to specific conditions.

As a result, most of the Backpack exchange token supply would stay off the market at first.

Token unlocks split into pre IPO and post IPO tranches

After the initial 250 million, Backpack said another 37.5% of supply sits in a pre IPO tranche. That tranche totals 375 million tokens.

Armani Ferrante, Backpack’s co founder and CEO, said the pre IPO token unlocks depend on “key milestones.” He listed examples such as opening in a new region or launching a new product.

The remaining 37.5%, another 375 million tokens, would be post IPO supply.

Backpack said it would lock those tokens until one year after the company goes public. It also said it would hold them in a corporate treasury.

Armani Ferrante says insiders get no direct Backpack token allocation

In a separate X post, Armani Ferrante said the “guiding principle” was clear. He wrote that insiders “dumping on retail” should be impossible.

Ferrante said no founders, executives, team members, or venture investors received a direct Backpack token allocation. Instead, he said the team owns equity in the company.

He also described when insiders could benefit financially. Ferrante wrote,

“It’s not until the company goes public (or has some other type of equity exit event), that the team can earn any wealth from the project.”

Axios report links Backpack IPO talk to a $50 million funding round

The Backpack IPO push surfaced as Axios reported that Backpack is discussing a new raise. The report said the company is in talks to raise $50 million at a $1 billion pre money valuation. It added that the round could end up larger.

Axios also described Backpack as a centralized trading firm built by former FTX and Alameda Research leaders. The report framed the talks as a step that could make Backpack a crypto “unicorn” by valuation.

Separately, Ferrante addressed timing risk in his post. He wrote,

“Going public might happen quickly, it might happen not so quickly, and in fact, it might not happen at all.”

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 10, 2026 • 🕓 Last updated: February 10, 2026