Two major crypto names just locked in important regulatory wins in different parts of the world: OKX secured a European Payments Institution license in Malta, and Animoca Brands received a VASP license from Dubai’s VARA.

On the surface, these look like routine compliance steps. But zoom in, and you see a clear pattern: serious players are quietly building compliance moats across jurisdictions before the next wave of rules hits.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

OKX’s European payments license

OKX obtained a Payments Institution license in Malta, putting it in position to comply with MiCA and PSD2.

The license allows expanded stablecoin payment services via OKX Pay and broader crypto card offerings across the EEA.

This means OKX can now legally offer seamless fiat-to-crypto ramps and payments inside Europe without relying on third-party workarounds.

The LATAM license is secured, and now the European one too. For retail users, this could eventually mean faster, cheaper stablecoin transfers and cards that work like normal debit cards but with crypto backing.

For OKX, it’s a defensive play, because MiCA compliance is mandatory soon, and early movers get to shape the market instead of reacting to it.

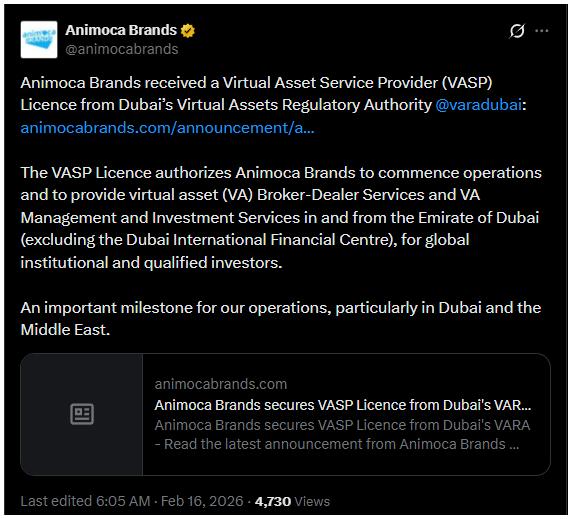

Animoca Brands’ Dubai VASP license, a strategic Middle East foothold

Animoca Brands cleared a major hurdle by securing a Virtual Asset Service Provider license from Dubai’s VARA.

The license authorizes broker-dealer and investment management services for institutional and qualified investors in the emirate.

This directly supports Animoca’s push into stablecoins and RWAs, giving them a regulated base in one of the fastest-growing crypto hubs.

Dubai has become a magnet for Web3 companies thanks to clear rules, tax advantages, and VARA’s pro-innovation stance.

For Animoca, this is building a compliant bridge to MENA institutional capital while keeping options open globally, not just expansion.

The race for compliance moats

These moves are not isolated. They’re part of a broader trend where serious crypto companies treat regulation as a competitive advantage.

OKX and Animoca are securing regulated footholds before MiCA fully kicks in and before VARA tightens further. Latecomers will face higher barriers.

For retail users, the impact is indirect but real, more regulated platforms usually mean better consumer protections, more fiat ramps, and eventually lower fees.

The bigger picture is simple: crypto is not escaping regulation anymore.

The smart players are racing to own pieces of the regulated future, and regulated footholds bring legitimacy, institutional inflows, and better infrastructure for everyday users.

The cost: it raises the barrier to entry for smaller projects and could centralize power in the hands of a few big players who can afford the compliance bills.

The race for licenses is the new way companies build lasting moats.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 17, 2026 • 🕓 Last updated: February 17, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.