Ethereum just absorbed a heavy hit, and held its ground.

After a $540 million sell wave, Ether recovered 0.43% to around $1,980, outperforming Bitcoin and several major altcoins in the process.

At first glance, a 0.43% move sounds minor. In context, it matters.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The broader market had been under pressure. Volatility spiked. Positions were unwound. Oversold signals appeared across major assets.

In that environment, holding relative strength is not trivial.

What happened during the Ethereum selloff

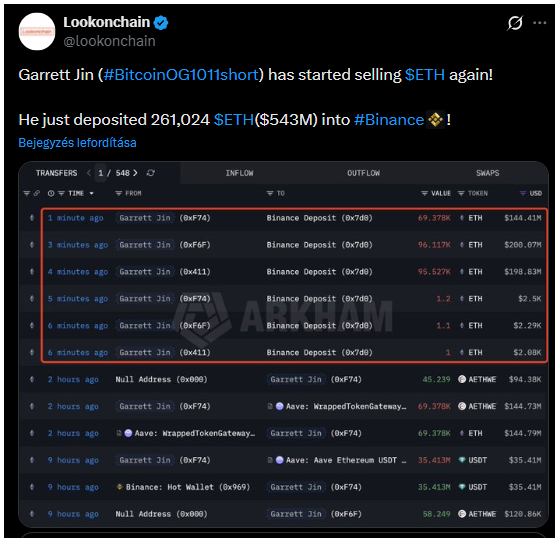

The $540 million sell-off was part of a broader liquidation phase across crypto markets. Large positions were closed. Leverage was reduced. Risk appetite cooled.

When markets move quickly, weaker assets tend to fall harder and recover slower, but Ethereum did the opposite. It stabilized faster than many peers. That relative performance is the key point.

Why relative strength matters

Crypto markets are increasingly driven by positioning rather than headlines.

Institutional traders monitor oversold conditions, funding rates, and liquidation data. When forced selling exhausts itself, capital rotates selectively.

Ethereum’s rebound suggests two things: the sell pressure was absorbed without structural damage, and buyers were willing to step in at lower levels.

This does not mean a new bull phase has started. It means Ethereum remains central in capital allocation decisions.

Infrastructure confidence plays a role

Ethereum is no longer viewed purely as a speculative asset. It functions as a settlement layer, a smart contract platform, a base layer for tokenized assets and stablecoins, and a staking network with yield characteristics.

These structural roles change how the asset trades. When markets reset, capital often returns first to assets with deep liquidity and infrastructure importance. Ethereum fits that description.

What retail should watch

Markets that fall sharply often experience technical rebounds. Oversold signals create conditions where short covering and tactical positioning can occur.

Ethereum’s recovery suggests the market treated the sell wave as excessive rather than systemic.

That distinction matters. Systemic weakness would imply fading network usage, declining developer activity, or capital flight. A positioning reset implies volatility within a functioning system.

If you are tracking Ethereum, focus less on daily percentage moves and more on liquidity depth, staking participation, network usage trends, and institutional custody expansion. The real signal.

Short-term volatility tests confidence, but infrastructure determines Ethereum resilience.

Price reacts to these layers over time. And in volatile markets, that distinction shapes where money flows first.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 18, 2026 • 🕓 Last updated: February 18, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.