I’ve seen a lot of crazy things in my day, but what’s happening with Bitcoin right now? It’s like déjà vu with a side of heartburn.

You remember 2022? That year was a meat grinder for anyone holding Bitcoin short-term.

And guess what? The experts say the stage is set for another round if things go south from here.

Past mistakes

Bitcoin’s short-term holder, or STH cost basis, the average price paid by recent buyers, sits at a sky-high $93,460.

Unfortunately, that number isn’t just some fancy stat, it’s the line in the sand. If Bitcoin drops below it, you can bet your last cannoli the panic will be contagious.

Back in 2022, every time Bitcoin slipped under that STH cost basis, it was like someone yelled fire in a crowded theater.

May, June, September, each dip triggered a stampede for the exits, prices tanked, and weak hands got wiped out faster than you can say margin call.

Cracks

Now, don’t get me wrong, Bitcoin’s got a reputation for making fools outta anyone who bets against it.

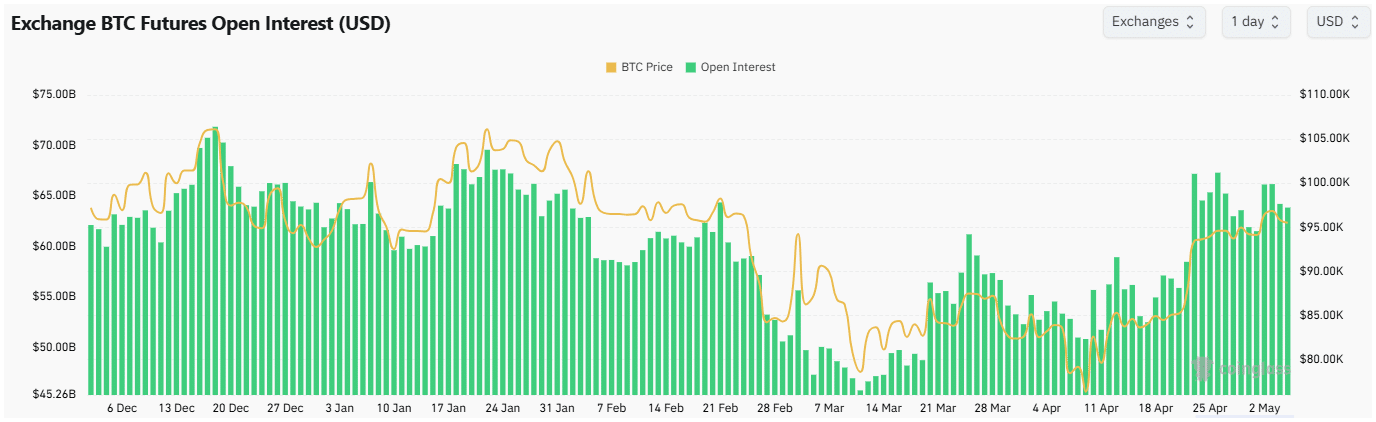

But Open Interest in the futures market is through the roof, $38.6 billion and climbing. That means there’s a lot of leverage, a lot of bets, and a whole lotta people who think they’re smarter than the market.

And usually they aren’t. Problem is, when prices start to fall, all those positions can turn into a liquidation avalanche.

It’s like stacking dominoes and then sneezing, everything comes crashing down, fast.

And let’s not forget, the market’s already showing cracks. Short-term holders are sitting on losses, and some are starting to bail out to cut their pain short.

Selling pressure is building, even if it hasn’t hit the panic levels of past bear markets yet.

But with the Fear and Greed Index stuck in fear, and resistance levels getting rejected left and right, the mood’s about as cheerful as a rainy funeral.

Key level

Right now, analysts and experts say if Bitcoin drops below that $93k level, brace yourself.

We could see a replay of 2022’s chaos, sharp sell-offs, mass liquidations, and a feedback loop of fear that turns a bad day into a full-blown disaster.

Maybe you’re thinking, nah, Bitcoin always bounces back. Sure, maybe. But this market?

It doesn’t care about your feelings. It chews up the careless and spits out the rest.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.