The spectacular implosion of the LIBRA memecoin, endorsed by Argentina’s President Milei literally sent shockwaves throught the crypto market.

The collapse has reignited the fiery debate, as who’s to blame for these memecoin messes, and who’s going to clean them up?

After all, buying isn’t mandatory

Nic Puckrin from Coin Bureau didn’t mince words, and points a finger squarely at the regulators.

He said that the blame for the LIBRA memecoin disaster, and other pump-and-dump schemes like it, lies on the shoulders of the regulators, and they are the only ones that can fix this.

Puckrin thinks that the lack of clear rules from the likes of the SEC has created a Wild West environment ripe for fraudulent celebrity and political memecoins.

Now, SEC crypto task force head Hester Peirce has said in the past that memecoin regulation isn’t really their jam, leaving it to Congress and other regulators like the CFTC. But Puckrin thinks that is not a good strategy at all.

He is clearly in favor of regulation in the memecoin space, stating that the crypto industry, particularly memecoins, needs clear regulation to ensure that token launches are conducted fairly. Somehow, tha answer is always more regulation.

Someone to blame

Puckrin even reminisced about the good old days of ICOs, before the SEC cracked down on them.

Puckrin thinks someone, whether it’s the Department of Justice or the CFTC, needs to step up and regulate memecoins, otherwise, the LIBRA fiasco will keep repeating itself.

“It doesn’t help that the SEC appears to be washing their hands of memecoins.”

And he’s not alone in his frustration, because Chainlink enthusiast Zach Rynes went on X to blast SEC for its historical failure and corruption.

Fraud

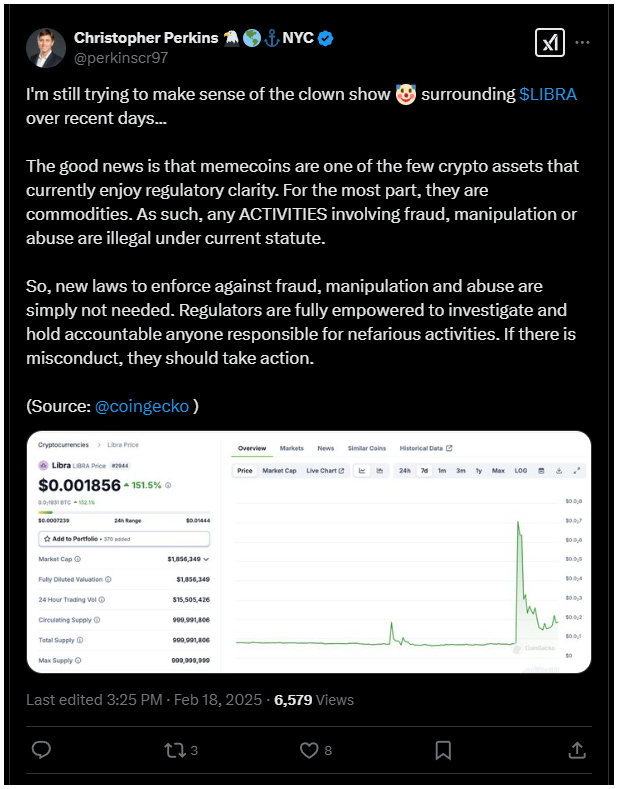

Not everyone agrees, of course. CoinFund president and former CFTC member Christopher Perkins thinks memecoins already have regulatory clarity because, for the most part, they are commodities, and any fraud or manipulation is already illegal.

So, what’s the solution? Puckrin suggests the US Department of Justice needs more resources to tackle wire fraud, money laundering, and market manipulation.

He also thinks the crypto community needs to kick these bad actors to the curb, and then the authorities should throw the book at them.

The LIBRA scandal might be a black eye for crypto, but maybe it’s also a wake-up call.

Regulations would definitely help, but the crypto industry needs to take the lead and fully ostracize these individuals.

Have you read it yet? Crypto wallets should rule over exchanges?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.