Arthur Hayes has a prediction. And when Hayes makes predictions, markets listen.

The BitMEX co-founder is calling for a major Bitcoin rally, but his reasoning isn’t what you’d expect.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

He’s not pointing to ETF flows, institutional adoption, or halving cycles. He’s looking at something far more macro: a $572 billion liquidity injection from the US Treasury.

Hayes’ monetary morphine thesis

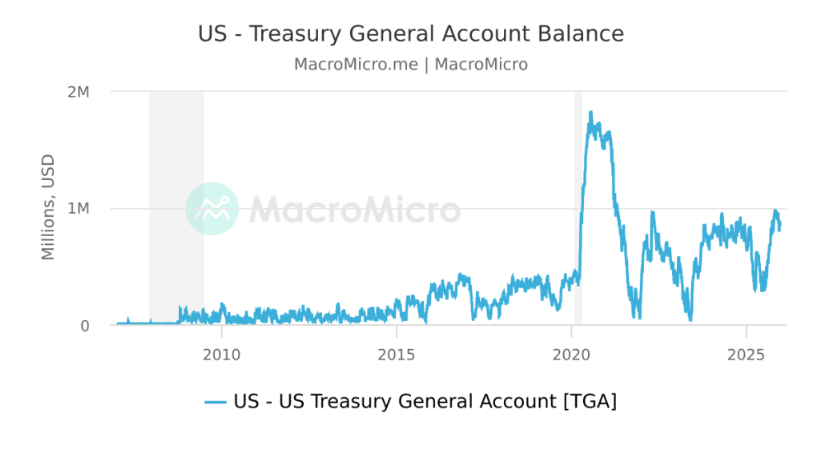

Hayes calls it “monetary morphine.” The mechanism involves a synchronized drawdown of the Treasury General Account (TGA) combined with heavier debt buybacks.

In simple terms, the Treasury is about to flood the financial system with cash. The numbers are striking.

Hayes calculates roughly $572 billion in net liquidity hitting markets before year-end.

For context, that’s larger than the entire market capitalization of many major asset classes. If his thesis holds, this isn’t just a tailwind for Bitcoin. It’s a hurricane.

How the TGA mechanism works

The TGA mechanism works like this. When the Treasury spends down its cash balance at the Federal Reserve, that money enters the banking system. It becomes deposits. It becomes lendable reserves.

It becomes, in Hayes’ words, “dry powder” looking for a home. Historical precedents support the thesis. Previous TGA drawdowns have coincided with strong risk asset performance.

The logic is straightforward: more liquidity in the system means more capital available to chase returns. And Bitcoin, as the ultimate risk-on asset, tends to benefit disproportionately.

The catch in Hayes’ thesis

But there’s a catch. Hayes’ thesis assumes the Treasury follows through. It assumes the Fed doesn’t offset the liquidity with quantitative tightening.

It assumes geopolitical events don’t derail the plan.

The timeline matters too. Hayes suggests this injection creates a high-probability environment for a Bitcoin surge starting now. Not next quarter. Not next year. Now.

The trader’s dilemma

For traders, this presents a dilemma. Do you position for the liquidity wave, knowing it might not materialize?

Or do you wait for confirmation, potentially missing the move? Hayes isn’t known for conservative calls.

His track record includes both spectacular wins and notable misses. But his macro framework has consistently identified the liquidity conditions that drive crypto markets.

The broader context

The broader context supports his view. The Fed has already pivoted toward a more accommodative stance. Rate cuts are on the table. The dollar has shown signs of weakness.

All of these factors create a favorable environment for Bitcoin. The $572 billion figure deserves scrutiny. It’s a large number, even by Treasury standards.

If accurate, it represents one of the largest liquidity injections in recent history. The impact on markets could be profound.

Hayes’ bold call

Hayes’ call is bold. It’s also specific. He’s not saying Bitcoin might go up. He’s saying a $572 billion liquidity wave is coming, and Bitcoin will rally as a result.

The next few months will test the thesis. Either Hayes will be vindicated, or he’ll join the long list of analysts who called the move too early.

But one thing is certain: when Arthur Hayes talks about liquidity, smart money pays attention.

The rally, if it comes, won’t be because of any single factor. It will be because liquidity drives markets. And right now, Hayes sees a flood coming.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 20, 2026 • 🕓 Last updated: February 20, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.