BlackRock CEO Larry Fink recently addressed global economic leaders, emphasizing a major shift in the financial system and the growing importance of capital markets.

Who took the bank’s lunch?

Speaking to the G7 leaders, Fink pointed out a visible change in the global financial system, noted that capital markets are now the primary source of private-sector financing.

This shift indicates a need for new strategies to unlock financial potential, moving away from traditional bank-based models.

Larry Fink highlighted a pressing growth dilemma, affecting both emerging and established economies, and he explained that the International Monetary Fund and the World Bank were created 80 years ago, when banks primarily financed projects.

Today the capital markets have taken on this role, becoming the largest source of private-sector funding.

Investor Coalition

Reforms have led to significant investments in infrastructure in developing countries.

Yet, Fink stressed the need for new methods to unlock capital that differ from the traditional bank balance sheet approach.

To address this, Fink announced the creation of the Investor Coalition, which includes BlackRock, GIP, and KKR. This coalition will commit $25 billion to emerging economies in Asia.

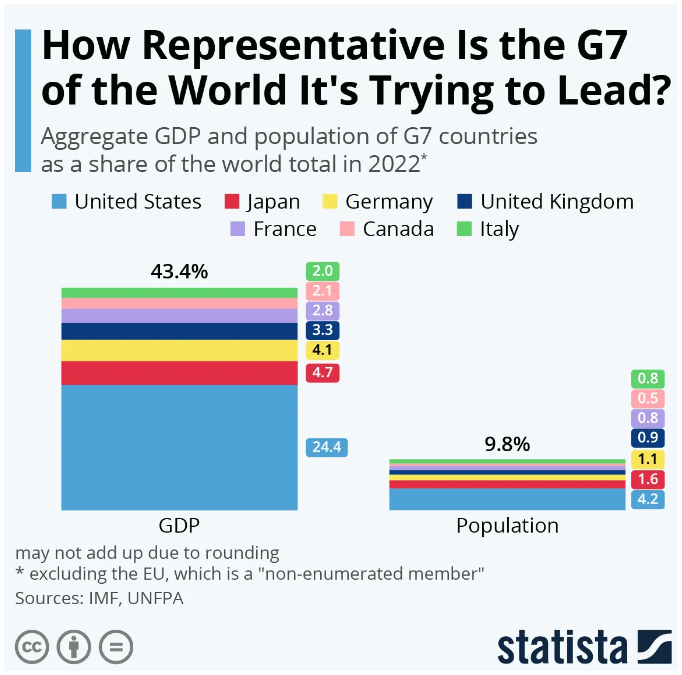

Fink also highlighted that the need for growth extends beyond emerging economies, as he mentioned that even major economic powers, including the G7, face the same growth dilemma.

With an average debt-to-GDP ratio of 129%, traditional methods like taxation and spending cuts are insufficient.

Have you heard about Bitcoin?

Likely due to these economic concerns, Bitcoin has gained attention as a potential safe haven.

Analysts at blockchain analytics firm Kaiko have noted that large institutional players, such as Franklin Templeton, Fidelity, and even BlackRock, are recognizing Bitcoin’s safe-haven qualities.

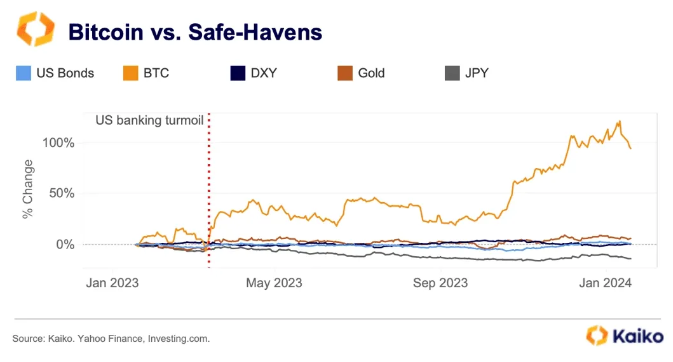

Kaiko’s analysis shows that Bitcoin’s 60-day correlation with the Nasdaq100 has decreased over the past year, averaging close to zero since June 2023, and this low correlation makes Bitcoin a pretty attractive safe haven, especially during financial crises.

For example, during last year’s US banking crisis, Bitcoin outperformed traditional assets like gold and US bonds.

The introduction of spot Bitcoin ETFs in the US has also seen strong demand, with over $15 billion in net inflows since January 2024.

These ETFs benefit from Bitcoin’s asymmetric returns and its reputation as a reliable asset during economic instability.