Back on January 11, 2024, the first-ever spot Bitcoin ETFs hit the market. Gary Gensler, the former SEC chair known for his tough stance on crypto, issued a last-minute warning about Bitcoin’s volatility, but not many people listened.

Record-breaking inflows

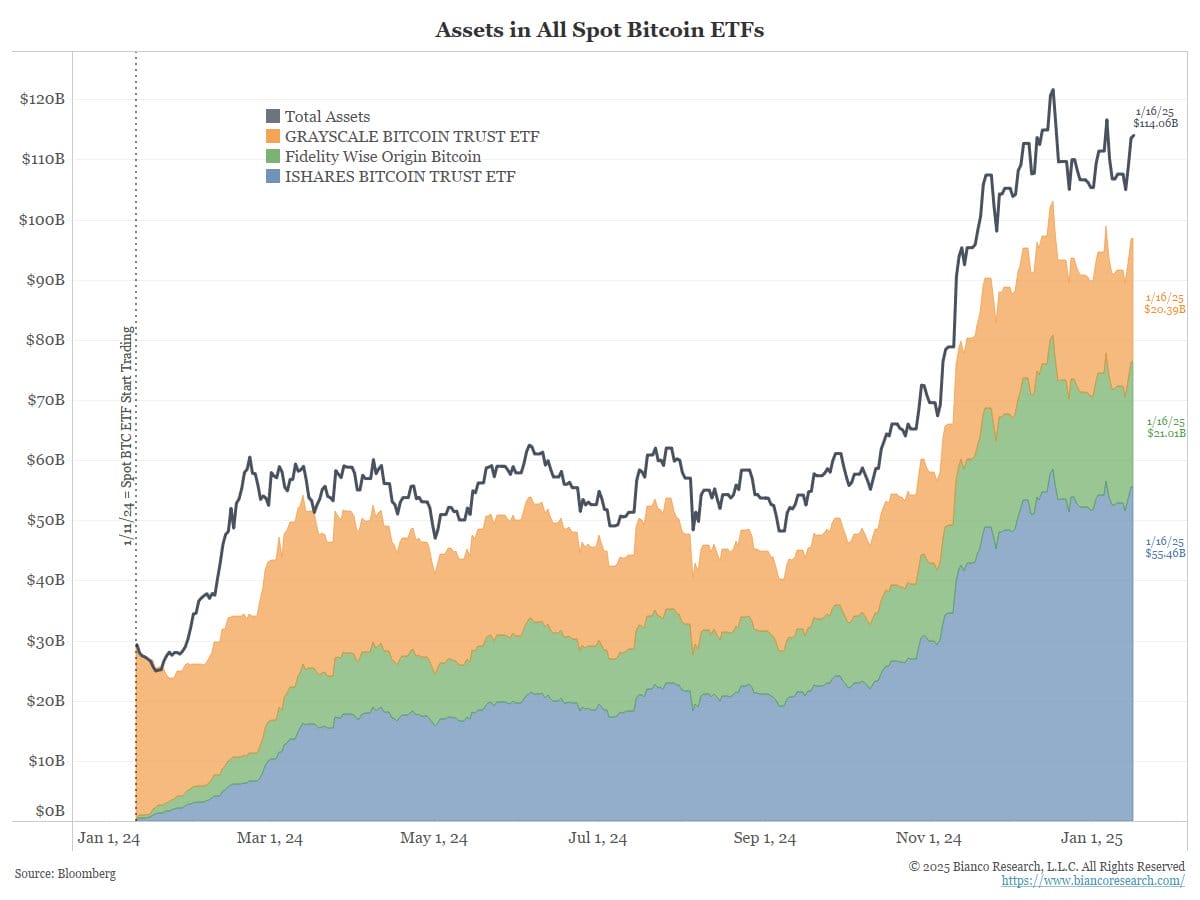

When these ETFs kicked off, they boasted $29 billion in assets, thanks largely to Grayscale’s GBTC conversion.

Fast forward to January 29, 2025, and that number has skyrocketed to $121 billion, but of course, it hasn’t been all that simple.

In September, total assets took a nosedive, dropping 26%, and analysts were starting to wonder if these funds were really going to attract traditional investors or if they were just a passing fad.

After that dip, things turned around dramatically. Investors poured nearly $40 billion back into the ETFs, with notable daily inflows of $987 million and $908 million reported on January 6 and 3 respectively.

The excitement peaked when Bitcoin crossed the psychological barrier of $100,000 in December, leading to a remarkable 16-day streak of inflows.

Who’s holding the bag?

A big chunk of the $121 billion is concentrated in just three funds: BlackRock’s IBIT with about $59.9 billion, Fidelity’s FBTC with around $22 billion, and Grayscale’s GBTC at roughly $21 billion.

Bloomberg analyst Eric Balchunas has dubbed these Bitcoin ETFs the most successful ETFs in history.

And why not? They’ve delivered returns of over 127% since launching, outperforming even ESG funds and matching gold ETFs in assets.

Institutional interest is mixed

Not everyone is convinced that institutional investors are fully on board. Analyst Jim Bianco pointed out that during a rough patch in September when outflows hit $1 billion, it seemed like these ETFs weren’t attracting the big players as expected.

1/8

Spot BTC ETFs update

tl:dr

* Inflows now outflows

* Holders have record losses

* Advisors <10% of holdings (boomers never came)

* Avg trade size now <$12k.It's not an adoption vehicle. Instead a small tourist tool and on-chain is returning to Tradfi.

See posts #4 and #8

— Jim Bianco (@biancoresearch) September 8, 2024

He noted that most buyers are retail investors, with only 9% of shares held by wealth advisors and 12% by hedge funds.

Despite these concerns, Balchunas claims that by September 2024, about 1,000 institutions had Bitcoin ETFs on their books, and this is a record number. He predicts that institutional interest in BlackRock’s IBIT will double this year.

As we look ahead, experts are optimistic about the future of Bitcoin ETFs. Many of them believe they’re quite important for expanding digital asset adoption and improving market transparency.

But let’s be real, just like any investment, there will be ups and downs, so time will tell how it performs in the long run.