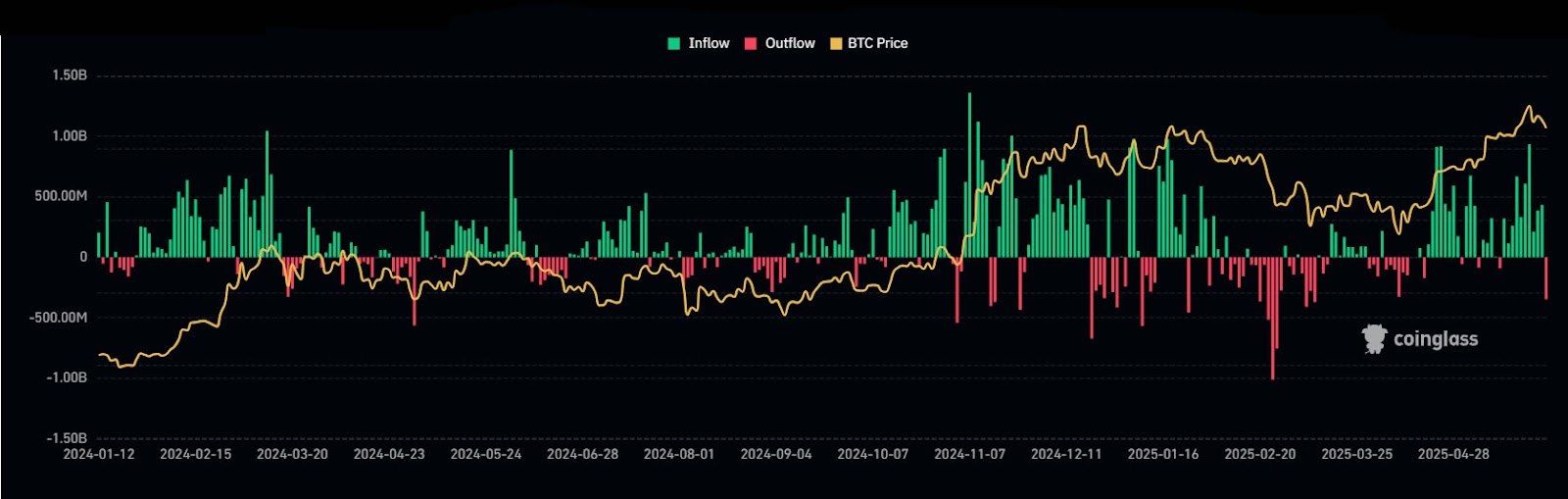

The Bitcoin ETF party has hit a stop sign, and it’s got that ’oh no’ vibe all over it. After a solid 10-day streak of money flowing in like it’s payday at the office, the US Bitcoin ETFs saw a collective $347 million slip out the door on May 29.

The kind of outflows that make you squint at your screen and say, what the heck just happened?

Fast money

Now, this isn’t just any small hiccup, unfortunately. Not the end of the world, of course, but it’s the first joint outflow day in over two weeks and the biggest single-day net outflow since March 11, when $396 million bailed.

Bitcoin itself took a dip, dropping more than 3.5% in a day, tumbling from a high of $108,850 to flirting with $105,000.

That’s like watching your favorite coffee machine break down right before your morning meeting, a total buzzkill.

Who’s losing the most? Fidelity’s Wise Origin Bitcoin Fund took the biggest hit, losing $166 million.

Grayscale’s Bitcoin Trust wasn’t far behind, bleeding $107.5 million.

Other players like Bitwise, Ark 21Shares, Invesco, Franklin Templeton, and VanEck also saw money flowing out, while CoinShares, WisdomTree, and Grayscale’s mini Bitcoin trust just stood there, doing the financial equivalent of shrugging.

Standing tall

But there’s one guy standing tall. BlackRock’s iShares Bitcoin Trust didn’t just avoid the chaos, it actually danced right through it with a $125 million net inflow.

They aren’t the biggest by accident, right? That’s 34 days in a row of people throwing cash at BlackRock’s fund like it’s the last donut in the box.

Over the past two weeks, BlackRock’s ETF has sucked in nearly $4 billion, pushing total inflows to $49 billion and assets under management past $70 billion. Talk about being the superstar everyone wants to sit next to!

Connected market

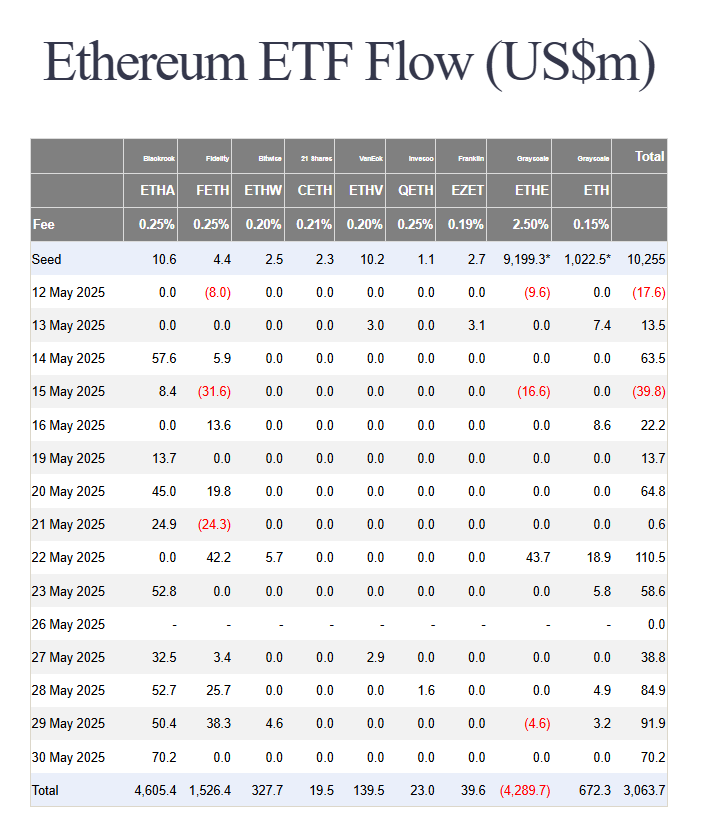

And it’s not just Bitcoin ETFs feeling the heat. Spot Ether ETFs are cruising along, with $92 million flowing in on the same day.

That’s 10 straight days of inflows, led by BlackRock’s iShares Ethereum Trust, which snagged over $50 million, bringing its total inflows since July 2024 to $4.5 billion.

It’s like Ether ETFs are that reliable coworker who always gets the job done while everyone else is scrambling and larping.

Oh, and here’s a nugget for the crypto nerds, the SEC just clarified that staking isn’t a securities-related activity.

ETF Store President Nate Geraci called it another hurdle cleared for staking in spot ETH ETFs. So, maybe the crypto world’s got a little more breathing room to grow.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.