Bitcoin smashed through its previous ATHs this week, hitting $118,800. Sounds like a party, right?

But where’s the crowd? The retail investors, the everyday people, the little guys who usually jump in when the hype’s hot, are nowhere to be seen.

It’s like throwing a wild bash and nobody shows up except the big shots. What’s going on here?

Eight months

Back in November 2024, right after Donald Trump snagged the US presidency, Bitcoin’s name was on everyone’s lips.

Google searches for “Bitcoin” skyrocketed, and retail investors flooded the market, pushing Bitcoin past $100,000 for the first time ever in early December.

That was the golden age of retail frenzy. Eight months ago. Not a really long time.

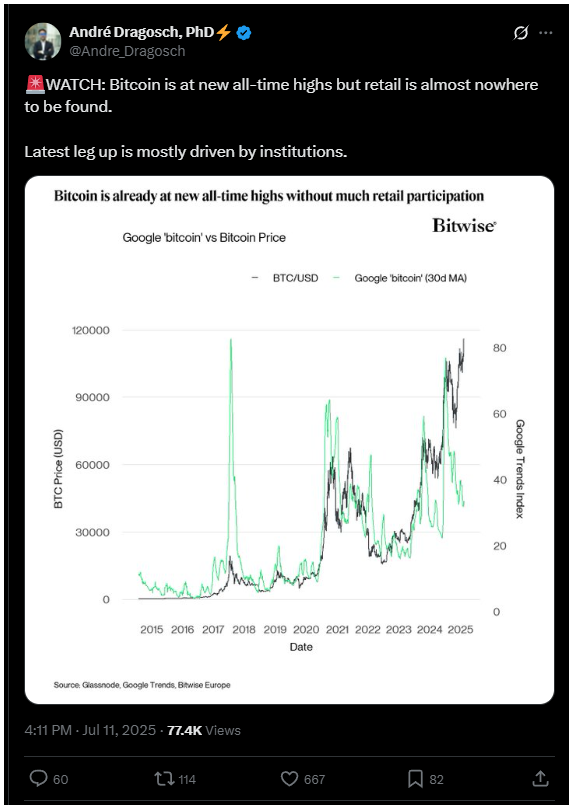

Fast forward to now. Bitcoin’s breaking records again, but Google search interest is down 60% compared to that Trump victory week. The average Joe just isn’t buzzing about Bitcoin like before.

André Dragosch, head of research at Bitwise, put it bluntly on X, and said there’s no real interes.

“Bitcoin is at new all-time highs but retail is almost nowhere to be found.”

According to him, this latest growth is mostly the handiwork of institutions, the big players with deep pockets, not the everyday investors.

Betting big

So why the cold shoulder from retail? Some Bitcoin fans think it’s because the price looks intimidating.

Lindsay Stamp, a Bitcoin commentator shared a lot of retail people see Bitcoin at $117k and think, ‘Nahhh, I missed the boat,’ and just walk away.

I think a lot of retail folks find out the price of one bitcoin is 117k and think nahhh I missed the boat and don’t even give it a second thought

— Lindsay Stamp (@lindsaystamp3) July 11, 2025

Cedric Youngelman, host of the Bitcoin Matrix podcast, threw in his two cents, wondering aloud, at what Bitcoin price do you think retail wakes up? His guess? Not anytime soon.

But another popular analyst Willy Woo says this rally isn’t done, and institutional demand is booming.

Spot Bitcoin ETFs are pulling in record inflows, over $1 billion on two consecutive days last week, totaling $2.72 billion over five days. That’s serious money, showing that while retail’s on the sidelines, the big fish are betting big.

Playground

If retail investors are quietly buying Bitcoin ETFs, the actual retail demand might be hiding under the radar.

Some experts suggest we rethink how we read onchain data because ETF shares held by retail clients could be the real story behind the scenes.

It’s clear that Bitcoin’s no longer the playground for the masses during every rally.

It’s become a high-stakes game dominated by institutions, with retail investors watching from the bleachers, hesitant to jump back in.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.