Imagine a heavyweight boxer in the ring, not throwing punches wildly but conserving energy, waiting for that perfect moment to strike.

That’s Bitcoin miners for you right now. After Bitcoin’s price dipped over 10% from its new ATH of $124K, the miners are changing the game with a smarter playbook.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Soaking up the supply

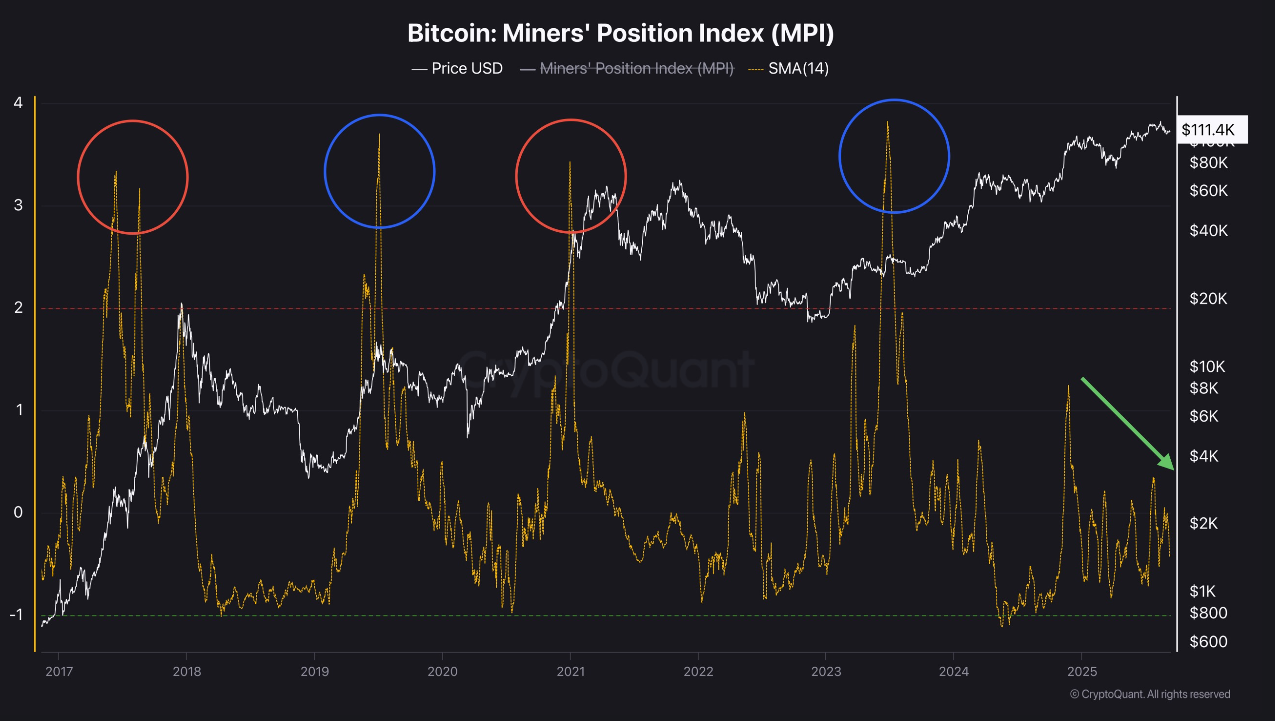

Fresh on-chain detective work, notably from CryptoQuant’s Avocado_onchain, shines a light on miners’ behavior through the Miners’ Position Index, the MPI.

This fancy metric tracks how much Bitcoin miners are sending to exchanges versus their usual flow.

Normally, high MPI signals a miner sell-off, like before a halving event or late in a bull market when miners unload coins to retail investors.

But this cycle? That sell-off party just isn’t happening.

Why? Two big reasons. First, spot Bitcoin ETFs have gotten the green light and are booming, holding about $144.3 billion worth of BTC, 6.5% of the total market cap.

That means big players outside mining might be ready to literally soak up supply, so miners aren’t feeling the pressure to sell.

Second, Bitcoin is being hoisted up as a strategic reserve asset by major economies, so miners are holding on for the long game, stacking coins instead of selling for quick cash.

The network is flexing muscles

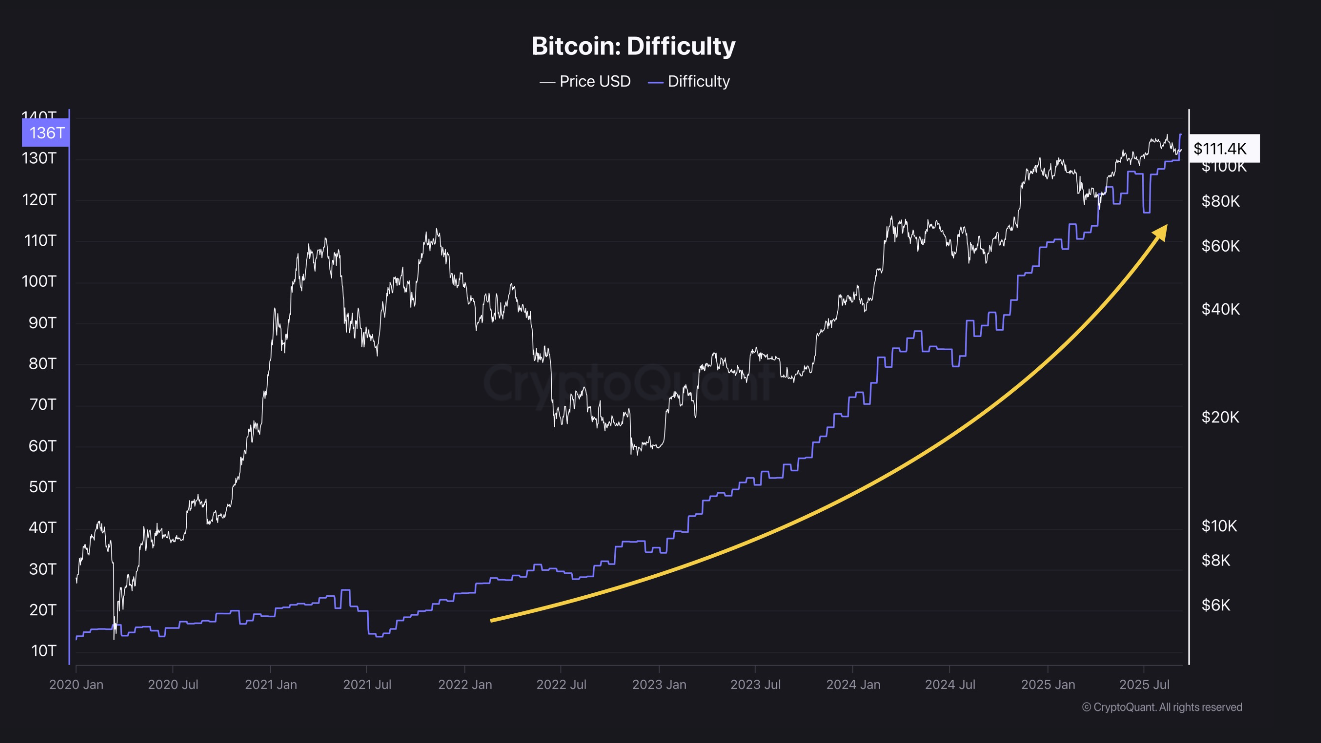

Adding to this already bullish picture, Bitcoin’s mining difficulty just blasted through a new all-time high, hitting around 134.7 trillion in September 2025.

It’s like the network is flexing muscles, welcoming more miners, tightening security, and making it tougher to mine blocks.

Higher difficulty means fewer new coins, which could throttle supply and juice prices if demand holds steady.

But miners face pressure too, costs are growing, and only the efficient players survive. That’s a sieve for the weak, leaving the pros in the ring.

Macro headwinds

Now, about the price game, opinions diverge. Some analysts say Bitcoin might slide below $100,000 (awkward, right?), while others, like Fundstrat’s Tom Lee, are shouting $200,000 by year-end (sounds better, right?).

In the time of writing, Bitcoin’s trading around $115,000. There’s caution and there’s excitement, but miners’ accumulation behavior gives the bulls some ammo, even if macro headwinds temper the mood.

So Bitcoin miners aren’t the desperate sellers they used to be. They’re holding strong, playing the long game, and likely, hopefully setting the stage for the next big wave.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 13, 2025 • 🕓 Last updated: September 13, 2025

✉️ Contact: [email protected]