Migrating Bitcoin to post quantum standards could “easily” take 5 to 10 years, according to Jameson Lopp, a Bitcoin Core developer and co founder of custody company Casa.

He tied the timeline to the scale of a Bitcoin protocol upgrade and the need for broad agreement.

Lopp said quantum computers do not pose a near term quantum computing threat to Bitcoin. However, he said the work and the fund migration would still take years.

Lopp agreed with Adam Back, CEO of Blockstream, on the near term timeline. Both pointed to continued monitoring rather than urgency.

Bitcoin post quantum migration still needs years of coordinated changes

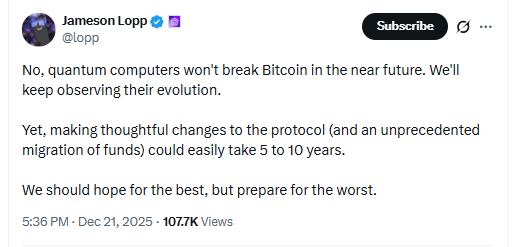

In an X post, Jameson Lopp wrote:

“Quantum computers won’t break Bitcoin in the near future.”

He said the community will keep watching how quantum systems evolve.

He also described the scale of the required move.

“Making thoughtful changes to the protocol and an unprecedented migration of funds could easily take 5 to 10 years,”

Lopp wrote.

Lopp added:

“We should hope for the best, but prepare for the worst.”

He linked the post quantum migration timeline to how slowly a decentralized network reaches agreement.

In a separate post, Lopp said a Bitcoin protocol upgrade differs from a centralized software update. Centralized firms can ship a change and enforce it through product control.

Bitcoin relies on distributed consensus. Many independent operators run nodes, wallets, and services. That structure creates what Lopp described as a collective action problem.

The ongoing quantum computing threat debate has also exposed a split in the community. Some Bitcoin maximalists urge caution on protocol changes. Meanwhile, some venture capital voices describe the threat as closer.

Quantum computing threat debate pulls in Rochard, Mow, and BIP 360

Bitcoin maximalist Pierre Rochard said:

“Quantum resistance solutions are affordable enough to be financed by non profits and VCs.”

He framed funding as achievable for post quantum defenses.

Rochard also described the attack cost. He said a quantum attack would be so expensive that the government would need to “subsidize it as a collective action problem.”

Samson Mow, a Bitcoin investor and CEO of wallet company and advocacy group JAN3, questioned the practical ability of quantum systems to break Bitcoin.

“In reality, quantum computers can’t factor the number 21 not 21 million 21, without heavy customization to the algorithm,”

Mow said.

Even with that pushback, some market participants link the narrative to price risk.

They describe impact from the threat, or perceived threat, tied to quantum readiness timelines.

Charles Edwards, founder of digital asset investment fund Capriole, said BTC could dip below $50,000 if the network is not quantum ready by 2028. He connected the timeline to protocol readiness.

Edwards also referenced a specific proposal. He cited Bitcoin Improvement Proposal BIP 360, which introduces a quantum ready signature scheme for BTC.

The proposal has become part of the broader post quantum migration discussion as the debate continues.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 22, 2025 • 🕓 Last updated: December 22, 2025